The underneath is a right away excerpt of Marty’s Bent Factor #1228: “Deleveraging bitcoin before the world de-levers.” Sign up for the newsletter here.

The bitcoin marketplace is within the strategy of going via a super deleveraging match. The method began ultimate month when the Luna-Terra ponzi blew up spectacularly and was once compelled to liquidate roughly 80,000 bitcoin. The method sped up ultimate week when Celsius, 3 Arrows Capital, and Babel Finance proved to be overextended in unique high-yield token tasks that crashed onerous and, with regards to Babel, lending to these overextending in those tasks.

Each and every entity’s failure introduced with it a wave of bitcoin promote orders that drove the cost underneath $18,000 over the weekend. As of at this time, the cost of bitcoin has recovered, recently sitting above $20,000, then again rumors are swirling that there are lots of extra corporations suffering in the back of the scenes that may deliver with them extra huge promote orders as those entities search liquidity to hide their tasks. We will see if those rumors materialize into fact.

Whether or not they do or do not, this mass deleveraging is wholesome for a couple of causes. First, it reduces the quantity of interconnected chance all over the bitcoin marketplace. 2nd, the epic blow ups — particularly Celsius, which lured folks into their lure of an organization through promising yields on bitcoin that had been attained through taking insane dangers throughout DeFi protocols, lending and bitcoin mining — are offering a brand new wave of early adopters with the onerous lesson of trusting your valuable sats with centralized 3rd events who take undue chance together with your bitcoin. This lesson has been taught repeatedly all over the years: Mt. Gox, Mintpal, QuadrigaCX, BitConnect, OneCoin. Celsius can now be added to this record. Finally, the fast and violent deleveraging is appearing that bitcoin is a in reality loose marketplace. If you’re taking undue dangers and the ones dangers come again to chew you within the ass, there is not any lender of ultimate lodge.

Because of the normalization of enjoying a long way out at the chance curve that the fiat gadget has introduced with it, many felt relaxed enjoying fiat video games with their bitcoin. They’re coming to seek out that bitcoin is a merciless mistress and if you do not deal with her proper through maintaining and securing your personal keys, you’re going to be burnt up with the tide when the seas get turbulent. Over the years, as extra folks be told this lesson, the marketplace will have to self-correct and folks will have to go for merchandise that permit them to have keep an eye on of a key or keys inside of a quorum when interacting with 3rd events in the event that they make a decision to interact with them within the first position. Bitcoin is a wonderfully scarce asset that are meant to building up in buying energy over longer timeframes, so selecting up pennies to doubtlessly lose fortunes will change into extra clearly silly as time strikes ahead.

The associated fee drop is surely somewhat jarring, however it is not anything new. Merely par for the process a wonderfully scarce asset going via its early monetization section throughout which we people try to perceive the dynamics of the community and the way we will be able to engage with it.

Now here is the place issues get fascinating. Bitcoin is having a large cleaning match at a time when it’s changing into abundantly transparent that the fiat financial gadget is set to be completely steamrolled through the compounding mistakes which were made through coverage makers over the process many years. It in reality does really feel like “that is the large one.” Central bankers the world over appear an increasing number of nervous and, extra importantly, their fresh coverage adjustments are seeming to be wholly useless. The Federal Reserve’s fee hikes might in truth be making inflation possibilities worse as a hastily expanding federal finances fee ends up in vital will increase in the price of capital, which is most effective making it more difficult for power corporations to spend money on the infrastructure had to start quelling the supply-side factor this is inflicting costs to skyrocket.

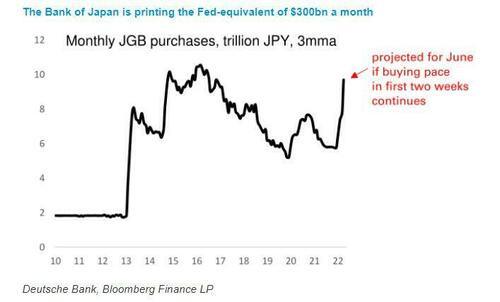

As we said last week, the Fed failing to tame inflation after making probably the most maximum competitive fee will increase within the ultimate thirty years may just result in a cave in in self assurance that would liberate the hyperinflation hounds. Remaining week, we warned in regards to the Financial institution of Japan dropping keep an eye on of its yield curve keep an eye on efforts. Because the calendar has grew to become and worth will increase around the globe appear much less prone to decelerate any time quickly, the location in Japan is changing into extra dire because the Eastern 10-year govt bond fails to carry the 0.25% fee the Financial institution of Japan has been focused on. Japan’s debt-to-GDP ratio is so excessive that it’s actually inconceivable for them to boost charges at the side of Western economies. In the event that they did, they’d bankrupt the rustic within the procedure. So as a substitute of overt default, it sort of feels that Japan is opting for the direction of hyperinflation as they’re going to be compelled to print unattainable quantities of yen to take a look at to keep an eye on charges.

Like we mentioned ultimate week, if the Financial institution of Japan loses keep an eye on and hyperinflation breaks out around the nation, it’s going to be recreation over for the remainder of the sector’s advanced economies who’ve pursued equivalent insurance policies, which contains the Fed, the Ecu Central Financial institution, the Financial institution of Canada, the Financial institution of England and plenty of others. A Japan-like blow up is the tip state of each unmarried central financial institution who launched into QE4eva.

With this in thoughts, your Uncle Marty is envisioning a state of affairs that would doubtlessly play out over the process this summer season and into the early fall that can supply a trail to “decoupling” for bitcoin.

There is no strategy to inform if a considerably de-levered and fairly affordable bitcoin will be the asset that people and bigger capital allocators flip to as the sector is going to shit, in spite of everything bringing to fruition the “protected haven” narrative. It is onerous to disclaim that the prerequisites for a decoupling to in truth occur will likely be riper than they ever had been. Stay a watch out in this as we get nearer to October and November 2022.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)