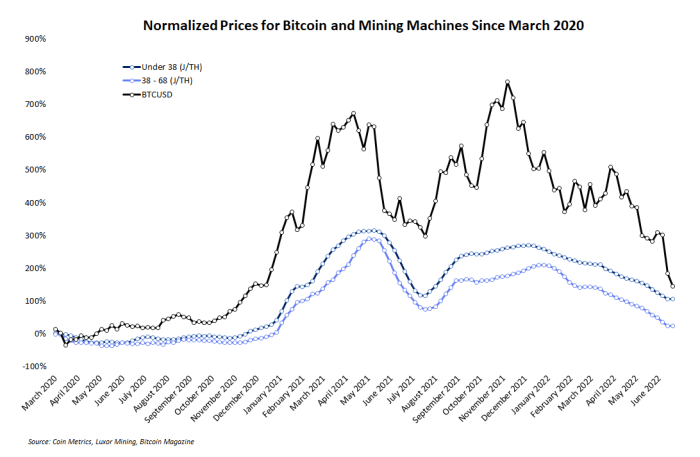

One explanation why miners steadily pay shut consideration to bitcoin’s worth is as a result of mining machines have a powerful sure correlation to its fluctuations. And as bitcoin’s dollar-denominated worth has dropped precipitously this month, mining {hardware} costs adopted.

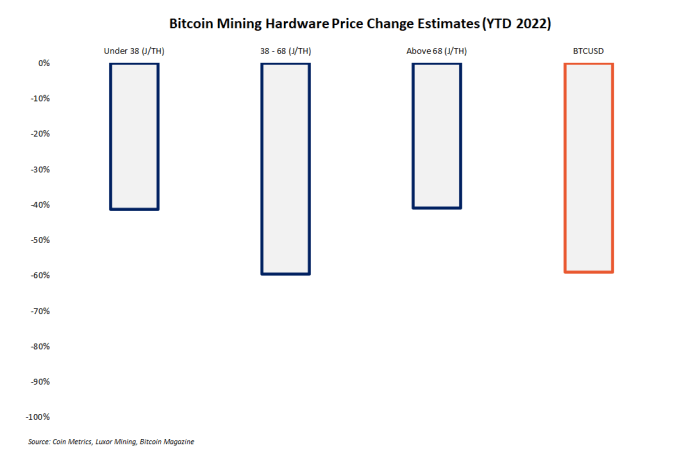

At its fresh lows, bitcoin was once buying and selling close to $17,000, a drop of over 60% 12 months to this point. Over the similar length, costs for the most productive mining machines fell via 41%, as detailed beneath.

Watching the connection between costs for bitcoin and bitcoin mining machines provides helpful perception into the mining sector’s response to bitcoin worth volatility and timing for collecting discounted {hardware}.

This newsletter overviews present marketplace pricing knowledge for bitcoin mining machines, its correlative courting to bitcoin itself, and discusses how and when miners may imagine enticing with the summer time {hardware} selloff as consumers.

Within The Newest Bitcoin Mining {Hardware} Pricing Information

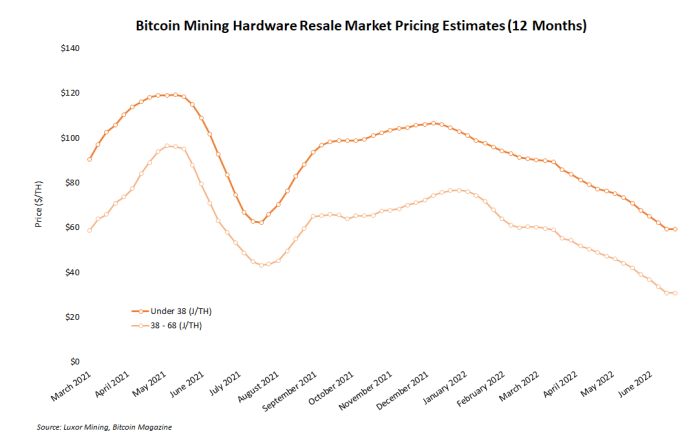

Probably the most- and least-efficient tranches of mining {hardware} have observed the smallest year-to-date worth declines, in keeping with marketplace knowledge curated via Luxor Mining. Machines with efficiencies above 38 joules according to terahash (J/TH) and beneath 68 J/TH have observed more or less 40% declines since January. Over the similar length, bitcoin has dropped more or less 60%.

Although fresh worth declines for bitcoin and a few mining machines were equivalent on a proportion foundation, the downward developments didn’t get started or development absolutely in sync with each and every different. The road chart beneath presentations two peaks in bitcoin’s worth all over April 2021 and November 2021. Readers will understand that costs for the mining machines (knowledge proven for the top-two potency tiers) didn’t height till more or less a month later in each circumstances.

Although gadget costs are carefully correlated to bitcoin’s worth, they nonetheless lag in the back of it. The next segment provides a short lived reason behind why, however potential consumers can steadily use fluctuations in bitcoin’s worth as a near-term indicator of the place gadget costs are more likely to.

Why Mining Device Costs Observe Bitcoin Value

Costs for bitcoin mining {hardware} are carefully correlated to bitcoin’s worth for 2 key causes.

For something, since hash price generally follows or lags in the back of bitcoin’s worth actions, the costs of bitcoin mining {hardware} — the supply of hash price — additionally lagging in the back of will have to be anticipated. The cause of that is simply defined: For instance, when bitcoin is in a sustained downward worth pattern, some miners which can be going through dwindling earnings make a selection to unplug or even liquidate their {hardware}, which introduces extra promote power at the mining {hardware} marketplace.

This similar state of affairs reverses all over bullish classes when miners – incentivized via mountain climbing mining earnings – acquire and deploy new machines. In fact, marketplace actions in each pattern (up or down) by no means occur this cleanly, however typically, this research explains the incentives that reason gadget costs to practice bitcoin’s worth.

Since hash price usually follows bitcoin’s worth, costs of bitcoin mining rigs additionally lagging in the back of will have to be anticipated.

Mining {hardware} costs additionally generally tend to lag bitcoin as a result of their fundamental serve as as “cash printers,” which makes their house owners, who’re inherently long-term bullish, reluctant to unexpectedly promote them. Between the operating costs, capital expenditures and total bullish ideology required to even get started mining, this sector of the Bitcoin economic system is all the time probably the most heavily-leveraged lengthy, via a vital margin. When the fee is going up, miners are keen to shop for extra hash price. But if the bitcoin worth begins to dip, miners with thin profit margins and poorly-planned operations — in spite of their bullish philosophies – are compelled to prevent hashing and steadily to liquidate their {hardware}. Briefly, the web cash printers are treasured, and no one is keen to promote theirs.

It is value noting that slight dips in bitcoin’s worth are normally inadequate power to section a miner from their machines. However sustained downward worth motion like miners have observed for the previous a number of weeks can in the end drive less-profitable miners to boost money via promoting {hardware}.

The place To Purchase Bitcoin Mining {Hardware}

The marketplace for mining {hardware} is now higher and extra subtle than at every other time in Bitcoin’s historical past thank you largely to many companies that experience constructed {hardware} marketplaces to provider retail miners. Many of those resale markets, on the other hand, also are steadily utilized by huge institutional consumers that aren’t operating without delay with producers, like Bitmain or MicroBT.

Probably the most main mining {hardware} markets are run via Kaboomracks, MiningStore, Upstream Information and Compass Mining. Different marketplaces exist, however the {hardware} marketplace is rife with scams. The consequences of bitcoin worth drops are already observed within the gadget market, with massive lots of decrease potency {hardware} being indexed via miners via Kaboomracks, for instance. The corporate even revealed a notice that its availability for accepting older machines like Antminer S9s is restricted, possibly to push back a possible deluge of miners taking a look to liquidate.

Mining swimming pools like Foundry and Luxor additionally be offering {hardware} brokerage services and products for severe miners. However past the corporate names indexed on this article, each potential purchaser will have to be abundantly wary ahead of sending any budget to someone posing as a vendor of {hardware}.

Retail miners (aka., the plebs) should buy without delay from producers, too. From time to time web page buys are limited or unavailable for small amounts (normally all over occasions of red-hot purchaser call for in a bull marketplace), which leaves simplest institutional consumers who’ve direct get admission to to the producer’s crew ready to position orders. However within the present marketplace, producers have steeply discounted dollar-denominated gadget costs, and their web page listings are considerable.

How Will Bitcoin Mining Device Costs Trade From Right here?

If bitcoin’s worth begins to opposite direction and rebound considerably, mining gadget costs will in the end practice. Additional selloffs may even drag {hardware} costs decrease. And in that state of affairs, precisely how low and for the way lengthy mining gadget costs will drop is inconceivable to are expecting.

Extra downward worth actions from bitcoin, on the other hand, are positive to additionally cause extra gadget provide at the resale marketplace as less-efficient mining operations will likely be compelled to liquidate some property. In both case, bitcoin’s worth will steadily act as a trademark for mining {hardware} costs, and typically, miners can plan their gadget purchases accordingly.

It is a visitor submit via Zack Voell. Critiques expressed are fully their very own and don’t essentially replicate the ones of BTC Inc or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)