by means of Braiins

by means of Braiins

The underneath is an instantaneous excerpt of Marty’s Bent Issue #1194: “Rising energy price, difficulty, and their effect on mining profitability.“ Sign up for the newsletter here.

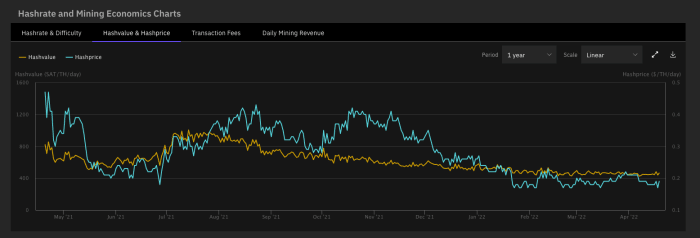

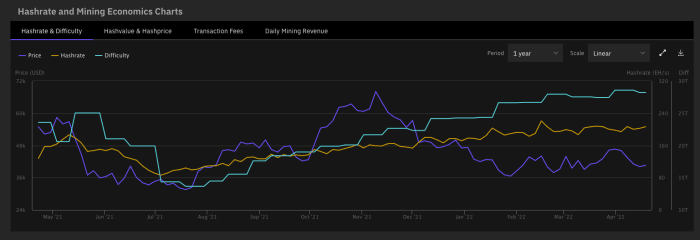

Here is one thing to pay shut consideration to within the coming months: the economics of the bitcoin mining business. With the bitcoin worth staying in a decent worth vary for the primary three-and-a-half months of the yr as hash fee and issue have risen persistently (for probably the most section) along surging power costs, your Uncle Marty has his antennae perked for indicators of combat within the mining international. The present marketplace prerequisites are definitely hanging a pressure on many miners this present day. Specifically those that do not need (or suppose they have got) mounted electrical energy costs which can be slightly low in comparison to the remainder of the marketplace.

As power costs upward push and miners who made purchases some time in the past start to get ASICs delivered and try to reap payback as briefly as conceivable by means of plugging mentioned ASICs in as briefly as conceivable, riding hash fee and issue up within the procedure, the marketplace prerequisites are getting very tight available in the market for lots of operators. If the cost of bitcoin stays locked within the vary that it’s been buying and selling in for the closing 4 months, miners proceed to plug in additional ASICs as they get delivered and effort costs proceed to upward push, lets see numerous blow americaavailable in the market that lead to a few consolidation amongst gamers.

What is going to be maximum attention-grabbing to look is how energy acquire agreements (PPAs) dangle up beneath those prerequisites. Many miners that leverage the grid to mine most often interact in PPAs with a hard and fast worth of electrical energy over a specified time period to fasten in part of their running expenditures (opex). If uncooked power enter costs proceed to climb on the tempo that they have got over the past yr, the application corporations that signed the ones PPAs are an increasing number of incentivized to determine tactics to get out of the ones PPAs in order that they are able to build up their margins and proceed to function in an excessive marketplace. Does upstream worth power power the palms of utilities corporations to the purpose the place they’re compelled to renegotiate their PPAs mid-contract? If this is the case, what number of miners who baked in mounted electrical energy prices get burnt up because of an sudden upward push in opex that makes them unprofitable? Time will inform.

Stay your eyes at the courting between power costs, hash fee, issue, and the bitcoin worth because the calendar turns. It’s possible you’ll understand a host of other people getting stuck with their pants down.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)