ETH outperformed BTC to the drawback with a 6% loss this week. USTC sees consumers for any other shot at steadiness. FTX founder corners crypto belongings.

ETH

The Ethereum value used to be -6% decrease this week because the coin nonetheless suffers from a BTC decoupling. Bitcoin shed virtually 4% with a transfer that dipped under $19ok after the failure of the 3AC hedge fund.

Ethereum will have a superb opportunity to erase the ones losses and catch up once more as soon as the marketplace’s liquidity problems cross. Every other issue within the ETH weak point has been a prolong within the venture’s merge.

There used to be certain information on that entrance with the Sepolia testnet set to run via its Merge trial this week, which is the second one ultimate testnet to trial sooner than the reputable Merge.

Etherscan mentioned that the Grey Glacier arduous fork used to be initiated on Thursday, which can prolong the trouble bomb through round 100 days, giving builders till mid-October to finish the venture’s Merge.

Developer Tim Beiko mentioned:

After years of labor to carry proof-of-stake to Ethereum, we at the moment are neatly into the overall trying out level: testnet deployments!

Ethereum trades at $1,100 after buyers bailed out on Merge replace delays however the coin may see a restoration sooner than that mid-October timeline. The venture’s founder had up to now said August for the V2.Zero enhancements, which come with velocity, power utilization and scalability.

USTC

The word “as soon as bitten, two times shy,” does no longer practice to buyers within the failed LUNA venture and its stablecoin, which proved to not be very solid.

The collapsed UST stablecoin used to be rebooted as USTC and has rallied over 70% this week as buyers hope for a go back to parity with america greenback. This is nonetheless a ways from the present value of $0.06 in spite of the marketplace cap surging from $200m to over $60m in a seven-day duration.

The venture’s rebranded LUNC token, which rose from the ashes of LUNA, may be seeing hypothesis, and buyers on Reddit are discussing the coin’s possibilities of going to $1 as soon as once more, in spite of these days buying and selling at $0.000128.

This is harking back to the meme coin dramas from ultimate 12 months and the similar predictions for the likes of Shiba Inu. LUNC isn’t SHIB with a tiny provide of cash when compared, however investor believe has been misplaced for the instant within the all-important Overall Worth Locked (TVL) metric.

FTX

The founding father of the FTX change, Sam Bankman-Fried has been very lively within the crypto downturn.

One analyst at Bankless requested the query: Does Sam Bankman-Fried Personal The whole thing Now?

The ill-fated 3 Arrows Capital used to be compelled into liquidation through a British Virgin Islands court docket after its fresh liquidity issues and ‘SBF’ used to be taking a look to take benefit.

His Alameda Ventures fund introduced a $500M mortgage package deal to avoid wasting Voyager, which used to be owed loans through the failed hedge fund. Every other company BlockFi used to be additionally in hassle because of an overcollateralized mortgage of $1B to 3AC and used to be given a $400M credit score line from FTX. The FTX change is competing with a virtual asset fund to obtain BlockFi.

Bankman-Fried additionally mentioned purchasing into distressed crypto miners subsequent.

“Once we consider the mining business, they do play a bit of little bit of function within the conceivable contagion unfold, to the level that there are miners that had been collateralizing borrows with their mining rigs,” Bankman-Fried instructed Bloomberg.

“There may come alongside a in reality compelling alternative for us — I indisputably don’t wish to cut price that chance.”

For FTX and the change marketplace, investors will proceed to keep watch over volumes so as to see if the hot endure marketplace has created longer-term injury. The change’s founder clearly believes that isn’t the case. There used to be additionally an SEC inquiry introduced into rival change Binance over its BNB coin and that might even have a bearing.

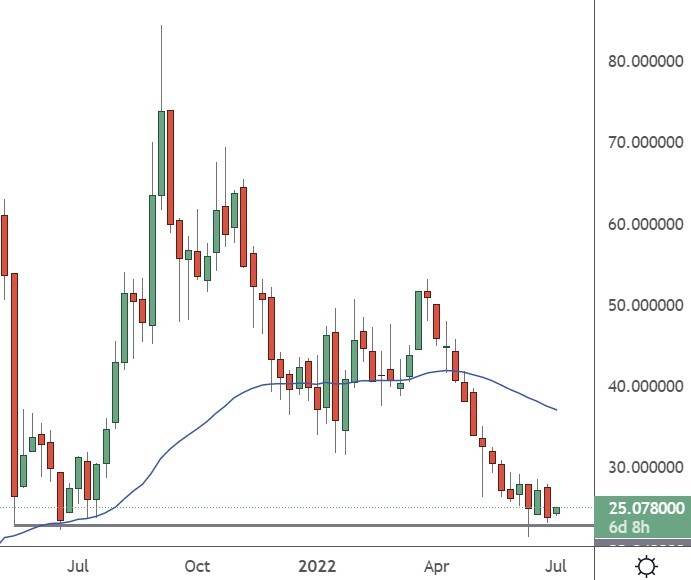

The cost of FTT has discovered give a boost to forward of the $24 ranges and now appears for a transfer upper.

DOT

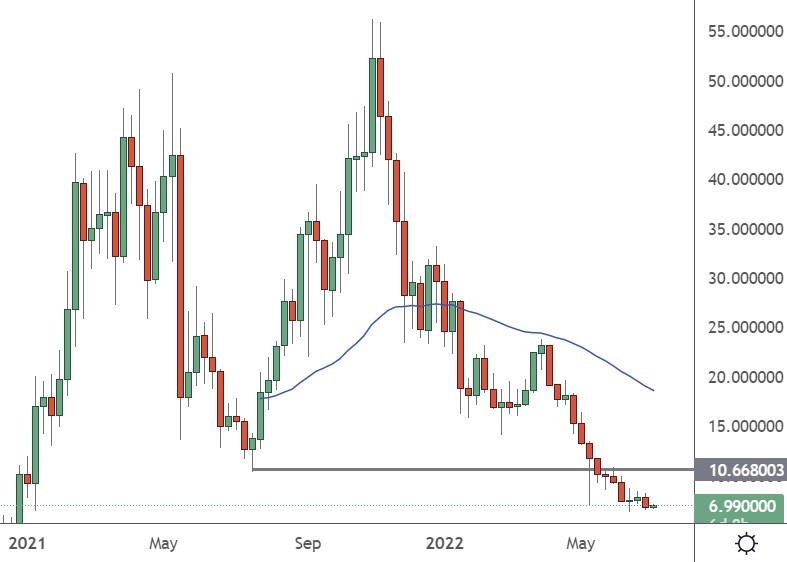

Polkadot has misplaced flooring to Dogecoin for a place within the most sensible ten cash through marketplace cap.

DOT had closed to inside $500m however has slipped to a $7 billion valuation towards the $nine billion of DOGE.

Polkadot’s woes are because of the downturn in decentralized finance (DeFi) tasks as deposits locked on chains have slumped. That may be a purchasing alternative in DOT because the venture can capitalize on a revival within the crypto lending and staking marketplace as soon as steadiness returns. The Polkadot TVL has slumped from $2.5m to $23,400 available in the market downturn. The coin isn’t a full-on DeFi venture however long run tendencies may supercharge the valuation.

Dogecoin is looking ahead to the closure of the Elon Musk Twitter bid which remains to be no longer sure. Buyers be expecting the coin to characteristic at the platform, in all probability for tipping or different small bills.

Polkadot introduced a brand new governance style this week with a shift within the “Layer 0” blockchain’s governance from a council and tech committee towards a extra decentralized and inclusive shape. The function is to support the decision-making procedure for the long run trail of the venture.

DOT used to be buying and selling at $7, which is some distance from the best-ever highs of $55.00 again in past due November.

Disclaimer: data contained herein is supplied with out bearing in mind your own instances, due to this fact must no longer be construed as monetary recommendation, funding advice or an be offering of, or solicitation for, any transactions in cryptocurrencies.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)