Bitcoin used to be upper through 8% however continues to be now not charging above $20ok. Binance Coin rallied on 0 charges. QNT and CVX up 40% however nonetheless a long way from highs.

BTC

The Bitcoin worth discovered reinforce to transport above $20,000 this week however couldn’t stamp its authority above there.

BTC used to be nonetheless up virtually 8% at the week and that gave the coin some hope for a sustained rally.

The transfer upper in Bitcoin used to be boosted through information that the highest cryptocurrency trade, Binance, used to be introducing 0 buying and selling charges on Friday remaining week.

Binance CEO Changpeng Zhao stated customers had been looking to acquire VIP tiers by way of prime buying and selling volumes.

We will be able to exclude BTC buying and selling from VIP calculations. Take away all incentives to clean business. Announcement with main points coming in a while.

A wash business refers back to the phenomenon of a dealer who buys and sells an asset for the aim of inflating its worth.

With the new undergo marketplace, exchanges like Binance had been in the hunt for tactics of attracting and holding customers at the platform. The cost of BTC has struggled this 12 months because the Federal Reserve has ramped up its charge hike coverage and that has spurred a US buck rally above the 100 degree within the DXY index of world currencies.

Bitcoin used to be buying and selling across the $21,000 degree after a Sunday worth drop of two.6% with key resistance being on the $30,000 degree.

BNB

Binance Coin additionally rallied 7% because the marketplace reacted to the brand new price construction.

The cost of BNB used to be weighed down lately through information that the Securities and Change Fee used to be launching an investigation into the trade’s coin.

Binance introduced the BNB token with an ICO in July 2017 and that used to be performed throughout more than a few platforms. A Bloomberg record stated that no less than one resident of america participated within the ICO, which ended in SEC scrutiny. In 2020, Changpeng Zhao introduced adjustments to the Binance Coin white paper he stated would make sure that BNB would now not be labeled as a safety.

Mr. Zhao used to be additionally commenting at the regulatory image this week in mild of the new crypto marketplace troubles.

There must be clearer regulatory pointers on reserves for various kinds of companies within the crypto area. Extra regulatory pointers on this house would for sure assist.

“We’re seeing that numerous corporations are bancrupt, and numerous tasks have long gone beneath,” he stated. “However it’s a small quantity within the grand scheme of items.”

He additionally commented at the skill of Binance to assist suffering corporations, announcing, “We do take a look at wired property, firms which are bancrupt, and we’d love to assist them both with loans, minority investments, and even majority acquisitions. All of the ones issues are at the desk.”

He stated Binance has performed “slightly a couple of” offers and is taking a look at 50-100 offers.

“Everyone is aware of we have now the most important money reserves within the business,” he stated. “They’re speaking to us.”

The cost of BNB used to be buying and selling at $235 and has reinforce at that degree with resistance forward at $350.

CVX

Convex Finance used to be some of the giant gainers this week with a soar of over 40%.

The DeFi undertaking, which targets to optimize yields from the Curve Finance trade, rallied after greater than 27.four million tokens had been unlocked on the finish of June.

Regardless of some fears that a large block of CVX tokens becoming a member of the marketplace would depress costs, the loss of promoting gave investors self assurance to shop for. With the liberate date passing with out drama, customers had extra self assurance to deposit their tokens at the Convex protocol.

Consistent with Dune Analytics knowledge, round 42% of all CVX tokens from the new liberate had been relocked within the protocol up to now. The remainder tokens had been withdrawn or are looking ahead to their homeowners to make a decision whether or not to relock them. Buyers are satisfied to carry onto CVX at its present depressed ranges in hopes of a rebound.

The total value locked (TVL) at the Convex Finance chain has dropped from $20bn in overdue 2021 to simply $3.4bn now. A contemporary uptick from the lows at $2.94 will give traders hope that the ground is in position.

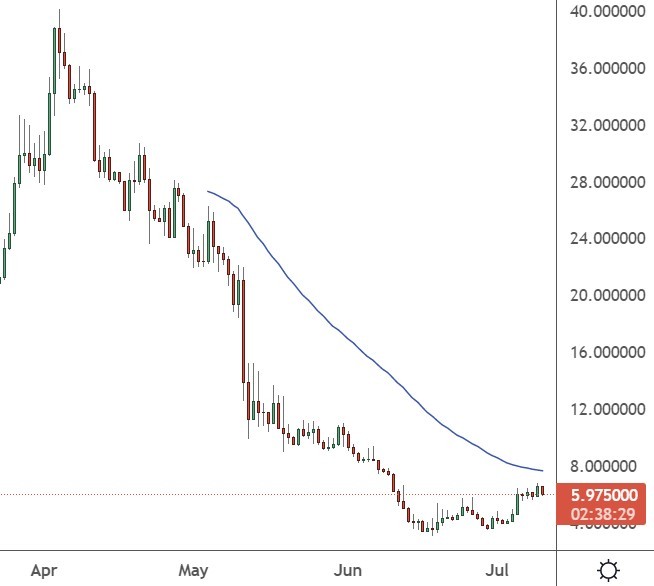

The cost of CVX rallied to business across the $6.00 degree however is some distance from the $40.00 highs.

QNT

Quant Finance used to be some other coin with a rally of over 40% this week.

Quant’s overledger platform is aimed toward banks and monetary establishments. A contemporary replace used to be the discharge of a beta section of Overledger Tokenise. Tokenise is Quant’s top class API for developing and deploying the following technology of tokens and virtual property onto the Ethereum, Polygon, and XDC mainnets.

The Quant device is alleged to be the primary OS to be constructed for blockchains, with the function to glue blockchains and networks on a world scale, with out affecting their interoperability.

Quant additionally provides blockchain interoperability answers to LACChain, which is a blockchain initiative in Latin The us and the Caribbean that targets to fortify monetary inclusion, sustainability, and efficiencies via digitization.

Quant additionally plans to release their very own Instrument-As-A-Carrier (SaaS) for endeavor and middleware packages. Those will supply answers to other industries with a focal point on sectors reminiscent of healthcare, provide chain, executive, and monetary products and services.

The cost of QNT now trades at $80 after a steep decline from the highs at $400.

Disclaimer: data contained herein is equipped with out making an allowance for your individual instances, due to this fact must now not be construed as monetary recommendation, funding advice or an be offering of, or solicitation for, any transactions in cryptocurrencies.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)