Embittered nocoiners like to cherry-pick moments when Bitcoin doesn’t reside as much as arbitrary expectancies. The comic story’s on them as Bitcoin grows ever more potent.

Mainstream economists, pundits, newshounds and others trapped in a fiat mindset by no means pass over the chance to dig a grave for Bitcoin. And Bitcoin provides a variety of such alternatives: the preferred web page 99bitcoins tracks “Bitcoin Obituaries,” a repository of greater than 400 proclamations of Bitcoin’s loss of life from mainstream information websites, politicians and buyers.

Each and every time the cost of bitcoin falls in the course of a disaster, it’s proclaimed a terrible failure. Final time we noticed that was once in March 2020, when bitcoin fell from $8,000 to round $4,900 in sooner or later. After all, it then recovered inside a month and went on to succeed in greater than $60,000 over the process the following 20 months, however unsurprisingly, the critics didn’t proclaim Bitcoin an enormous luck then.

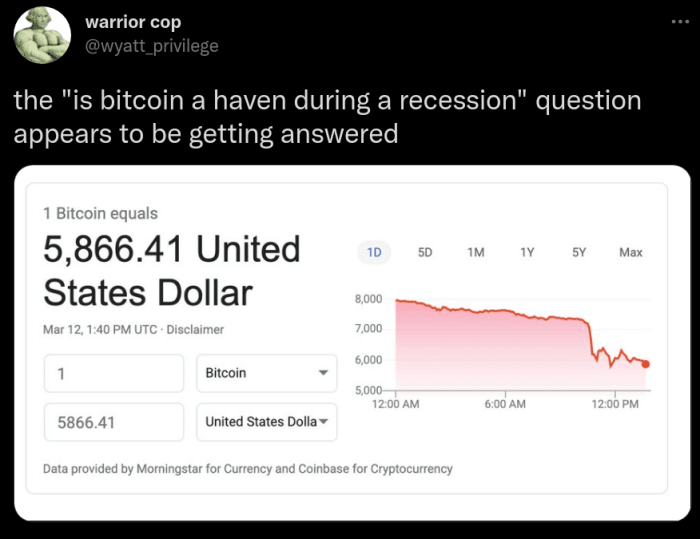

The newest fall in bitcoin’s value on the outset of the Russian-Ukrainian war was once no exception to the rule of thumb of nocoiners burying Bitcoin at each and every instance. We noticed a large number of tweets like the only underneath, accompanied by way of articles on mainstream media equivalent to CNBC’s “The Case For Bitcoin As ‘Digital Gold’ Is Falling Apart.”

(Source)

We will at all times cherry-pick moments like those, when a number of hours of value motion precisely fit our bias. I did the similar as soon as the associated fee traits of bitcoin and gold reversed:

That is simply to show that judging any asset with the eye span of a goldfish is ludicrous. Each and every one that takes themselves severely will have to imagine issues with a broader point of view, allowing for each the previous value efficiency and the longer term price proposition.

Bitcoin’s Price Proposition Doesn’t Are compatible In One Chart

(Source)

We’ve all observed the lifetime value chart: the quantity is going vastly up with some bumps at the street. However referring critics handiest to the associated fee historical past doesn’t generally paintings. They might rightly indicate the age-old adage that “previous efficiency isn’t any ensure of long run effects.”

Complete appreciation of Bitcoin takes no longer handiest value, but additionally value under consideration. Worth is only a present intersection of marketplace provide and insist, while price is wishes which might be fulfilled, personal tastes which might be met, targets which might be reached — all made conceivable due to a specific treasured just right, on this case bitcoin.

So what are the wishes that Bitcoin is helping satisfy?

Bitcoin has two an important enhancements over the present monetary gadget.

“Inflation is at all times and in every single place a financial phenomenon, within the sense that it’s and will also be produced handiest by way of a extra fast building up within the amount of cash than in output.” – Milton Friedman

First, Bitcoin prevents perpetual inflation. It was standard for a number of generations to shop for a can of soda for the same price of 5 cents. After the politicians severed the rest ties to gold in 1971, the associated fee enlargement has been rampant: the U.S. value degree has grown seven times over the last 50 years. And that’s simply in the US; the inflation has at all times been even more intense in different portions of the arena. As Milton Friedman identified, the purpose for the perpetual inflation is financial coverage. There’s no finish to fiat cash printing and no laborious prohibit on its issuance. Whilst fiat financial coverage is made up our minds by way of a small cabal of central bankers according to their subjective view of the financial system, Bitcoin’s financial coverage is about in stone: the issuance set of rules is run by way of the arena’s greatest collective tremendous laptop and enforced by way of hundreds of independently run nodes all over the international. This is the reason we will say that bitcoin’s issuance cap of 21 million is credible.

2nd, Bitcoin is proof against monetary censorship and has a top level of fault tolerance. Prior to now few weeks, we’ve observed a justifiable share of fiat failing as a competent medium of alternate. First in Canada, the place non violent protesters and their supporters had their financial institution accounts frozen, then in Ukraine and Russia, the place ATM withdrawals were limited, digital payments were suspended, and bank runs commenced. Bitcoin, however, isn’t topic to a specific jurisdiction of geographical infrastructure: when China expelled 50% of the global mining hash rate last year, bitcoin customers slightly spotted. Additionally, when a specific nation bans bitcoin, it nonetheless prospers underground, with customers buying and selling and transacting in a peer-to-peer type. When fiat fails as a medium of alternate, bitcoin becomes the best option to be had to atypical other folks.

As we will see in quite a lot of international locations over the arena — West and East alike — your financial savings, your running capital, your cash to feed the circle of relatives can turn out to be inaccessible in a single day, with none prior caution. This may end up in life-threatening scenarios. Enough money reserves can save you your circle of relatives from going in an instant hungry; a enough bitcoin stash let you get started anew in case your nation ceases to be a livable position.

Endurance Can pay Off

Whilst you perceive Bitcoin’s position on this planet of ever-more dysfunctional fiat currencies, the temporary dips and alleged failure to thrive in an acute disaster turn out to be laughable. Bitcoin proves treasured for many who know why and the right way to use it. Some would possibly want its long-term store-of-value houses, others would possibly use it to save lots of their lives when the arena round them falls aside. Those makes use of will not be intuitive to the ivory tower commenters with comfortable jobs and sponsored pension financial savings plans, however for others they turn out to be increasingly obtrusive.

As at all times, needless to say handiest bitcoin on your unique keep an eye on is in point of fact yours. Bitcoin saved on an alternate isn’t yours; use the best-in-class open-source hardware wallets to take care of your sovereignty within the antagonistic surroundings of lately.

This can be a visitor put up by way of Josef Tětek. Critiques expressed are fully their very own and don’t essentially mirror the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)