The under is an excerpt from a up to date version of Bitcoin Mag Professional, Bitcoin Mag’s top rate markets publication. To be some of the first to obtain those insights and different on-chain bitcoin marketplace research immediately on your inbox, subscribe now.

Bitcoin Endure Marketplace Rallies

Endure marketplace rallies, whether or not it’s equities or bitcoin, are a an identical cyclical transfer that’s performed out in markets time and time once more. They are able to be convincing and unstable as traders turn into too some distance situated in a single path.

We wish to spotlight the undergo marketplace rally case for bitcoin. As bitcoin has been intently following broader risk-on property this cycle, it’s most probably that continues because the marketplace heads decrease over the approaching months.

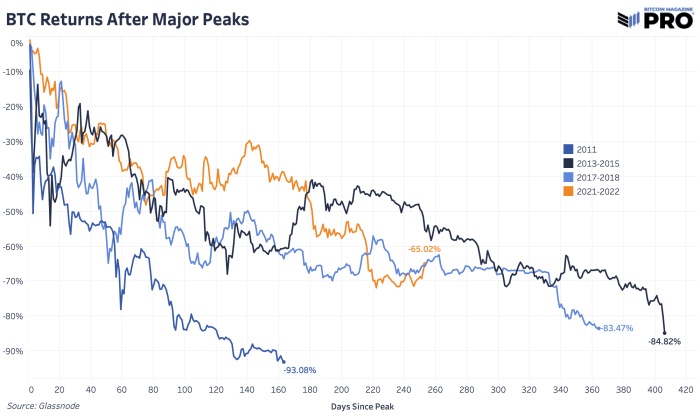

We have now bitcoin-specific undergo marketplace cycles. After the newest rally, bitcoin is down 65% from the all time prime in November, 253 days in. 2013 and 2017 cycles discovered a backside at 84.82% and 83.47% drawdowns, respectively, with each lasting with reference to round 400 days. Bitcoin’s newest rally isn’t out of the peculiar for the standard undergo marketplace rally transfer. Even a transfer to $30,000 is affordable.

In most cases, undergo marketplace cycles within the legacy international finish after a 20% transfer up from the lows so having a cycle that published new all-time highs turns out like a stretch. But, taking a look at this manner is compelling from a length of 435 days and drawdown of 70%, which might are compatible the concept that all-time prime drawdowns reduce over the years.

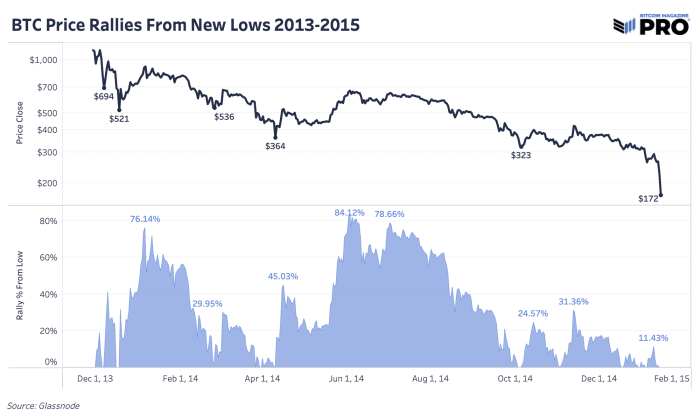

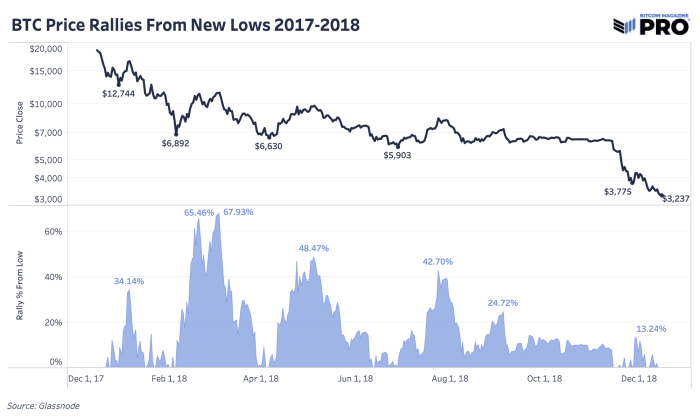

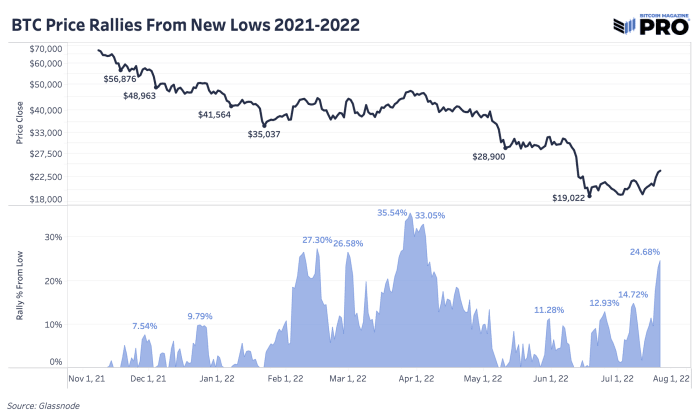

The opposite direction to have a look at the rallies is to peer how prime costs transfer off of recent lows. Underneath we’ve got the rally percentages from new lows throughout cycles. The use of day-to-day shut costs and now not absolute backside wick costs, the 2013-2015 cycle noticed rally positive factors of 84.12% at its absolute best whilst 2017-2018 noticed 67.93%. Within the present cycle we’ve observed a 35.54% rally transfer at its absolute best whilst the most recent transfer, on the time of writing, is round 26%.

Ultimate Observe

There’s a case to be made for the bitcoin backside being in amid the wave of pressured liquidations, capitulation-like habits and just about each and every mean-reversing cycle metric printing a excellent long-term alternative to amass. But, our analysis and research leads us to those questions:

How some distance will equities fall? Is a 23.55% drawdown from all-time prime within the S&P 500 Index the worst we see on this marketplace? Are financial and liquidity prerequisites getting higher to justify a reversal? Has there been a basic exchange or catalyst for bitcoin to signify it received’t observe broader marketplace strikes?

It’s imaginable that bitcoin has already front-runned that transfer and might be the asset to backside first, anyway. We’re satisfied that the much more likely case is that bitcoin will a minimum of revisit earlier lows and most probably make a brand new one.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)