ETH hits resistance at crucial worth degree. ETC provides over 180% in July. Optimism coin tops the week’s gainers. RVN flies from lows.

ETH

The cost of Ethereum was once upper this week however has dipped in the previous few days from resistance on the $1,700 degree.

This can be a essential crossroads for ETH as we will see at the worth chart. The $1,700-1,800 degree has marked the highest of a steep uptrend channel and we at the moment are trying out the Might lows of round $1,670. The associated fee motion this week may decide whether or not ETH can proceed upper or see a near-term correction.

There are fears that the coin may dip forward of the approaching Merge improve because of an airdrop. That is taking part in out within the futures marketplace with a backwardation tournament, the place the futures worth turns into not up to the spot worth. This is on account of a loss of decrease call for in futures buyers who possibly see the coin as priced in for now. Ethereum futures quarterly contracts, scheduled to run out in December 2022, now industry not up to the spot worth, and futures buyers clearly see a year-end dip.

On the other hand, there may be communicate of a possible chain cut up which might be bullish within the run-up to the Merge, in accordance to a few analysts. Roshun Patel, former VP of institutional lending at Genesis Buying and selling, mentioned that December Ether futures have flipped into backwardation because of Ethereum “fork odds,” which might urged buyers to shop for spot ETH forward of the Merge. The solution will play out over the following couple of months because the ETH chain heads nearer to the Merge.

In the meantime, the Global Financial Fund warned crypto traders, “there are others that would fail,” based on the hot Terra Luna cave in.

“Lets see additional selloffs, each in crypto belongings and in dangerous asset markets, like equities,” mentioned Tobias Adrian, director of financial and capital markets for the IMF. “There might be additional disasters of one of the coin choices—specifically, one of the algorithmic stablecoins which have been hit maximum exhausting, and there are others that would fail.”

ETC

Ethereum Vintage has persisted its advance and posted positive aspects of round 180% in July.

“ETC is being pushed via hypothesis that ETH miners will cross to ETC and probably, there might be any other exhausting fork benefitting them,” IntoTheBlock analysts mentioned. The transfer in ETC has been pushed via the improve to the Ethereum chain this is set to finish this fall. The transition from a proof-of-work (PoW) blockchain to a proof-of-stake (PoS) blockchain in Ethereum has observed miners transfer again to ETC.

Ethereum Vintage is the one actual chain that will probably be suitable with ASIC era, and miners that personal pricey rigs will need to stay the usage of that equipment.

“Ethereum’s mining community is made up of 2 sorts of {hardware}: ASICs and GPUs,” Messari’s Sami Kasab mentioned in a record. “The issue with ASICs is that they are able to’t be repurposed for various programs but even so mining ETH. Ethereum Vintage is the one different PoW coin that may be mined with an ETH ASIC, since its hashing set of rules is suitable with ETH’s set of rules.”

The cost of Ethereum Vintage has now risen to $36.50, and the fee motion is taking part in out in a vintage channel trend. The resistance on the $42-45 degree will decide whether or not ETC can proceed shifting upper.

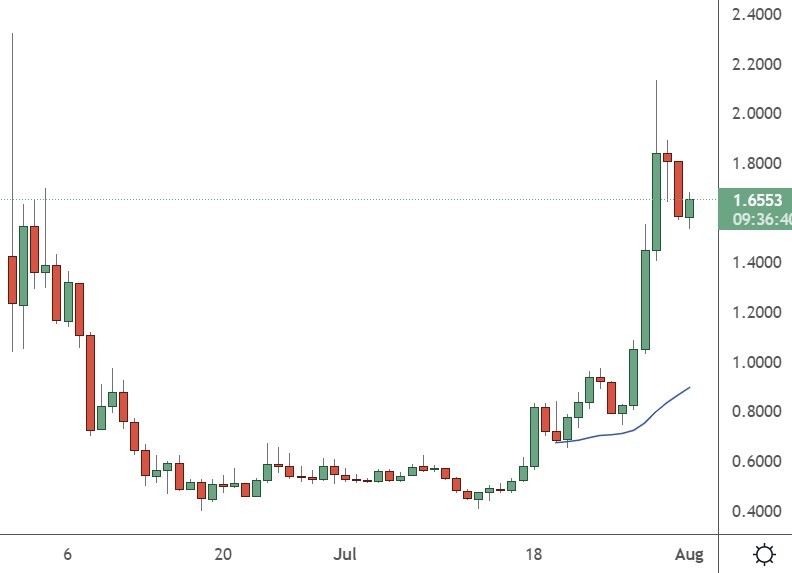

OP

Optimism was once the aptly named venture that supplied the largest positive aspects this week. The cost of the coin now trades at $1.65 after lows in July at $0.40.

The Optimism venture leans closely at the Ethereum blockchain and calls itself “a cheap and lightning-fast Ethereum L2 (Layer 2) blockchain.”

The venture supplies robust interoperability with Ethereum and the Ethereum Digital Device, and builders might need to construct apps in this blockchain after which switch them later to Ethereum.

Remaining month, the venture introduced the Optimism Collective: a “large-scale experiment in virtual democratic governance, with a venture of realigning the web with its constituents.” There’s recently a primary airdrop ongoing within the venture.

The marketplace cap for OP is $385 million, and the venture is ranked quantity 98 at the listing of cash.

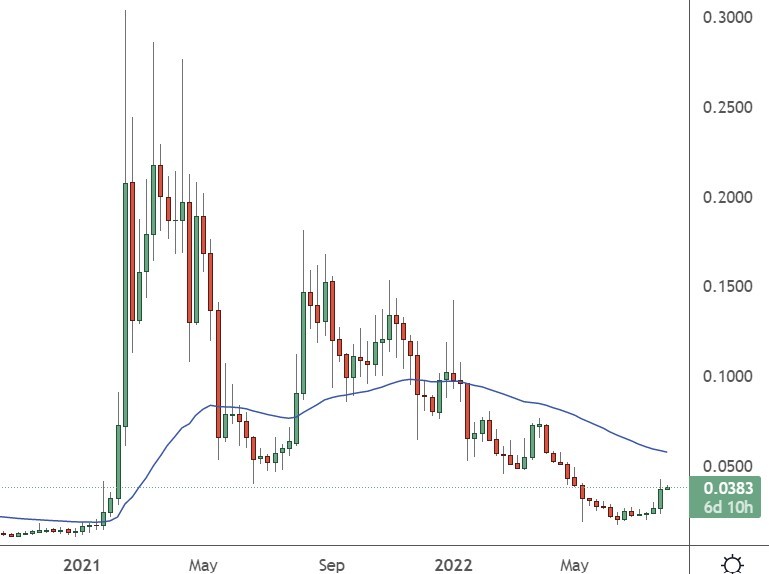

RVN

The cost of Ravencoin may be up round 150% from its low.

Ravencoin has moved again into the highest 100 cryptocurrencies and is a Bitcoin clone that seeks to unravel one of the issues of the unique BTC chain.

As an example, RVN has a quicker transaction time of one minute in comparison to over 10 mins in BTC. Whilst BTC has a restricted provide of 21 million, Ravencoin has over 11 billion, making it extra inexpensive than BTC with decrease transaction prices.

Ravencoin additionally we could customers mint tokens at the chain with the prospective to mint monetary belongings, leisure tickets, and reward playing cards or rewards.

A contemporary article mentioned the usage of NFTs or blockchain for sports activities tickets and said:

“…the NBA is having a look into NFT ‘price tag stubs’ to lovers once they redeem their tickets at a venue. Why? As a result of price tag stubs from memorable video games develop into large cash down the road, and recently, the NBA sees none of that. On the other hand, NFTs may also be programmed to funnel a share of all long term secondary gross sales to a given deal with, on this case, owned via the staff that issued the tickets. On this approach, lovers retain one thing that can turn out to head up in worth, and the NBA generates a brand new flow of passive earnings from secondary marketplace task. It’s a win-win.”

The cost of RVN now trades at $0.038 and remains to be a 10X transfer clear of its all-time highs set in early 2021.

Disclaimer: data contained herein is supplied with out bearing in mind your individual instances, due to this fact will have to now not be construed as monetary recommendation, funding advice or an be offering of, or solicitation for, any transactions in cryptocurrencies.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)