Bitcoin has been slowing down on its bullish momentum after crossing the barrier at $22,000 and $23,000. The cryptocurrency nonetheless holds a few of its beneficial properties from closing week however could be poised for a re-test of decrease ranges.

On the time of writing, BTC’s value trades at $22,900 with a 2% loss within the closing 24 hours and an 8% benefit during the last week.

This Bitcoin Undergo Marketplace May No longer Be Like 2020

Crypto marketplace individuals appear to be in pursuit of a snappy and chronic uptrend, like the only noticed in 2020. At the moment, BTC’s value drop to a low of $3,000 after which started an ascend to its present all-time highs.

Alternatively, buying and selling company QCP Capital believes the cost of Bitcoin and different huge cryptocurrencies may see extra sideways motion and problem force prior to reclaiming misplaced territory. This value motion could be extra just like the 2018 undergo marketplace.

The company believes BTC’s value will get advantages all through Q3, 2022. Right through this era, the cryptocurrency may try to reclaim upper ranges, however with a possible to damage above crucial resistance spaces capped by means of greater promoting force from the Bitcoin mining sector and crypto corporations struggling because of the bearish development.

BTC’s value motion may proceed to perform on unsure grounds with “uneven strikes” with another narrative between bullish and bearish with a crucial resistance at $28,700 to the upside and important toughen at $10,000 to the disadvantage.

The latter suits the 85% crash that BTC’s value skilled all through the 2018 undergo marketplace.

Crypto Restoration Will Be Sluggish However Spells Lengthy-Time period Bullishness

In 2017 when the cost of Bitcoin reached its earlier all-time top at $20,000, the crypto marketplace adopted with a large rally. Through 2018, the field entered a multi-year undergo marketplace with the cost of primary cryptocurrencies shedding over 80% in their worth taking down buying and selling liquidity with it.

QCP Capital believes the field has entered a brand new age of extra adulthood and resilience. The present problem promoting force has noticed top liquidity in a strong setting with much less volatility throughout huge cryptocurrencies.

As well as, institutional passion in Bitcoin and Ethereum has been continual regardless of the disadvantage value motion. Actually, QCP data an build up in “each buying and selling and investments” from those entities.

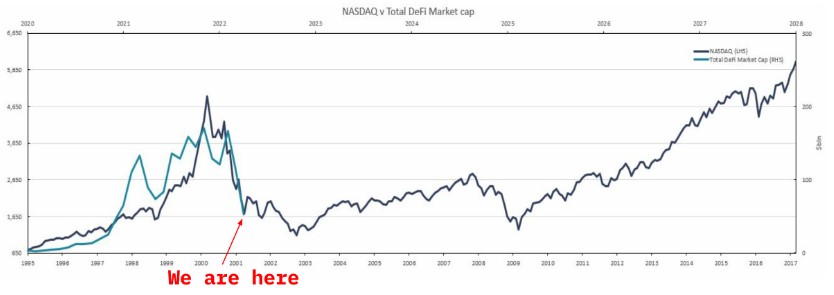

In the long run, this resilience within the face of top inflation and a hawkish Federal Reserve will translate into a large rally. The buying and selling company when put next the prospective expansion of the crypto ecosystem, for the decentralized finance sector, with the Nasdaq 100.

As noticed beneath, the crypto sector has been following the preliminary years of the Index and may development decrease over the approaching years prior to it after all reaches international adoption. Over the following decade that implies:

(…) that the long run might be a crypto-dominated one. The similar manner each corporate on the planet nowadays is, to some extent, an web corporate. We imagine in a 5-10 years from now, each corporate might be, come what may, a crypto corporate.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)