The under is an excerpt from a up to date version of Bitcoin Mag Professional, Bitcoin Mag’s top class markets e-newsletter. To be some of the first to obtain those insights and different on-chain bitcoin marketplace research directly in your inbox, subscribe now.

Bitcoin And The S&P 500

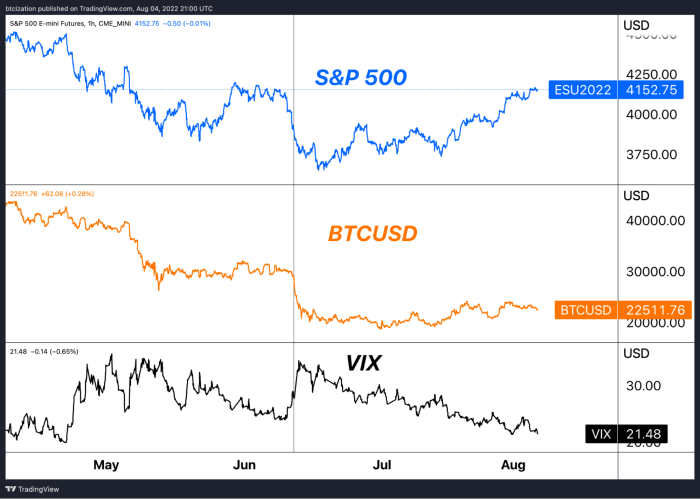

In our newest per thirty days record, which centered broadly at the evolving macroeconomic surroundings, we highlighted the robust correlation between bitcoin and equities over the process 2020, whilst additionally relating to bitcoin as a quasi-24/7/365, inverse VIX (these days). Usually, because of this when equities are bidding, bitcoin has gotten a boost as neatly; and when equities are promoting off (most likely along a upward thrust within the VIX), bitcoin would face drawback power as neatly.

Marketplace contributors must recall that following the implosion of LUNA/UST, bitcoin was once consolidating across the $30,000 for almost a month sooner than fairness marketplace volatility greater as shares took a brand new leg decrease, which pulled bitcoin down with out key enhance.

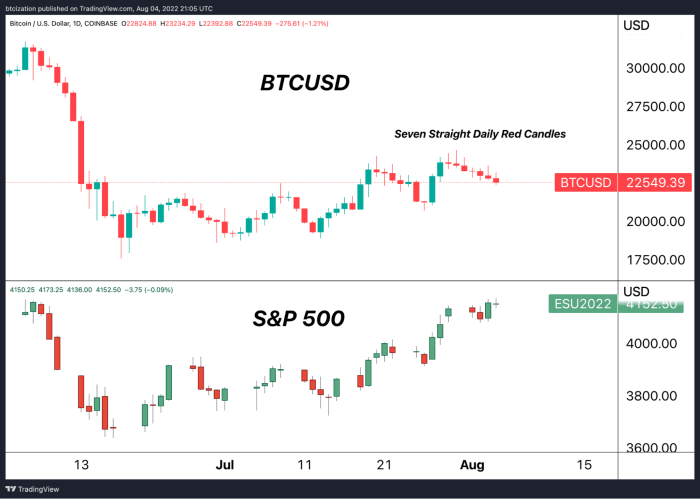

So what sticks out within the present development? Neatly, each markets have exogenous variables that may impact value and ancient learned correlations. As equities proceed to bid, on account of passive flows and a squeeze of overdue bearish positioning, bitcoin’s value motion has began to meaningfully flip over, with its spinoff marketplace brief squeeze in large part going on already.

Bitcoin particularly is in the middle of its 7th crimson day-to-day candle in a row (decrease remaining value than opening).

For the reason that equities had been in a broader uptrend, the underperformance over the quick time period is relating to for bulls, as one must ask themselves the place bitcoin will business if/when fairness markets flip decrease and/or legacy marketplace volatility considerably will increase.

Whilst this factor is targeted much less on long-term basics and extra on momentary value motion, this aligns with our broader marketplace thesis that possibility property haven’t bottomed, as coated in our July Per thirty days Document. Macro laws all on the present second, and given bitcoin’s nonetheless nascent position as an insignificant pond amid a world ocean of general property, learned correlations and relative underperformance are anticipated and remarkable, respectively.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)