On-chain knowledge displays each the Bitcoin leverage ratio and the futures open hobby has spiked up just lately, an indication that can turn into bearish for the crypto’s value.

Bitcoin Estimated Leverage Ratio And Open Hobby Surge Up

As identified via an analyst in a CryptoQuant, the BTC futures marketplace turns out to were heating up all through the previous day.

To know the leverage ratio, two different metrics wish to be appeared to start with. They’re the “open hobby” and the “derivatives alternate reserve.”

The open interest is a hallmark that measures the overall quantity of contracts these days open at the Bitcoin futures marketplace. The metric contains each brief and lengthy positions.

The opposite indicator, the derivatives alternate reserve, tells us in regards to the general choice of cash these days provide within the wallets of all derivatives exchanges.

Now, the previous metric divided via the latter provides us the “estimated leverage ratio.” What this indicator indicates is the typical quantity of leverage utilized by customers on derivatives exchanges.

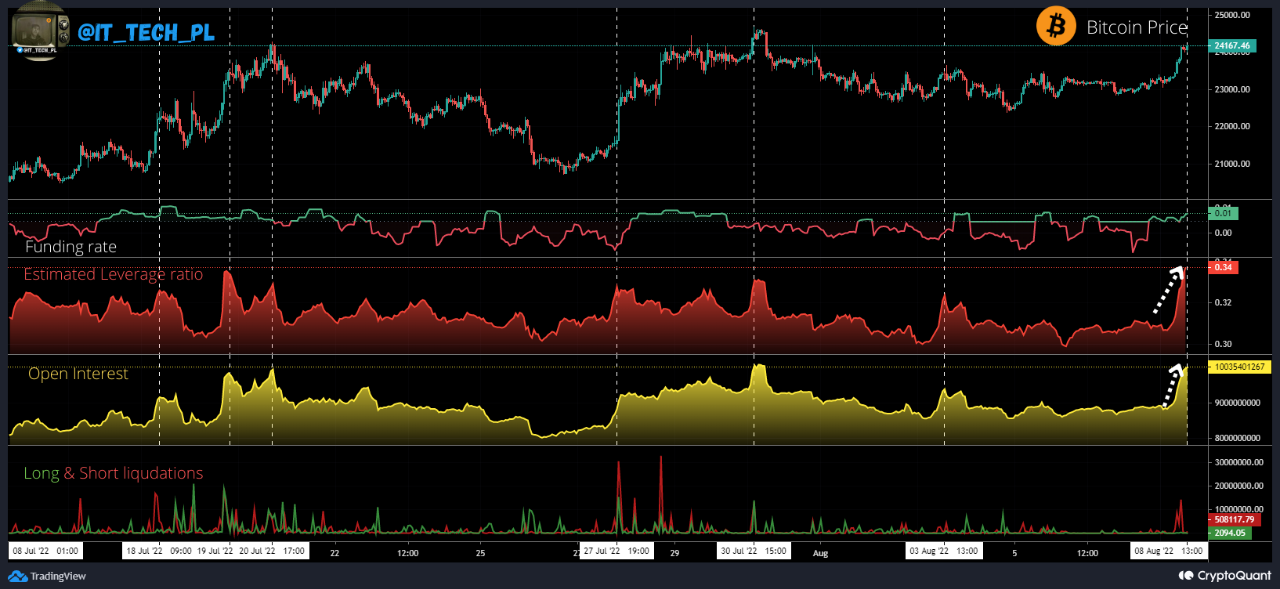

Here’s a chart that displays the fad within the Bitcoin leverage ratio, in addition to the open hobby, over the last month:

The worth of the 2 metrics has sharply risen just lately | Supply: CryptoQuant

As you’ll be able to see within the above graph, each the Bitcoin leverage ratio and the open hobby have spiked up all through the closing 24 hours as the price of the coin has additionally seen a surge.

Which means presently now not most effective is the typical leverage very top, but additionally the overall choice of positions are moderately giant.

The chart additionally contains knowledge for the funding rate, any other indicator that tells us in regards to the ratio between lengthy and brief positions. It seems like these days its price is certain, suggesting that longs are extra dominant.

Traditionally, this type of setup has in most cases result in upper volatility out there. This is because a top leverage approach any value transfer will result in a super choice of liquidations, which can additional magnify the transfer in query.

This stretched value transfer in flip ends up in extra liquidations. When liquidations cascade in combination on this manner, the development is known as a “squeeze.”

Since there are extra lengthy positions out there presently and the leverage is top, an extended squeeze may occur. If it does happen, the most recent bullish momentum for Bitcoin is also bogged down.

BTC Value

On the time of writing, Bitcoin’s value floats round $23.9k, up 3% up to now week.

Looks as if the price of the crypto has spiked up all through the closing day | Supply: BTCUSD on TradingView

Featured symbol from Natarajan sethuramalingam on Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)