A quant has identified some similarities between the present and summer season 2020 Bitcoin markets thru on-chain knowledge.

Bitcoin Change Provide Surprise Ratio Has All of a sudden Risen Not too long ago

As defined through an analyst in a CryptoQuant post, there appear to be some similarities between the present marketplace pattern and that right through the summer season of 2020.

The “exchange supply” is a trademark that measures the whole quantity of Bitcoin provide on wallets of all exchanges.

This provide is generally assumed to be the marketing provide of the crypto as buyers usually switch their cash to exchanges for promoting functions.

The provision in chilly wallets of buyers, then again, is most probably being held for accumulation, and is not going to be offered.

The ratio between this investor pockets provide and the trade reserve is known as the “trade provide surprise ratio.”

When the price of this metric is going up, it way the provision on exchanges is shedding and buyers are filling up their chilly wallets.

Comparable Studying | Bitcoin Futures Basis Nears One-Year Lows, How Will This Affect BTC?

Then again, a downtrend suggests a push to promote from dealers as they deposit their Bitcoin to centralized exchanges.

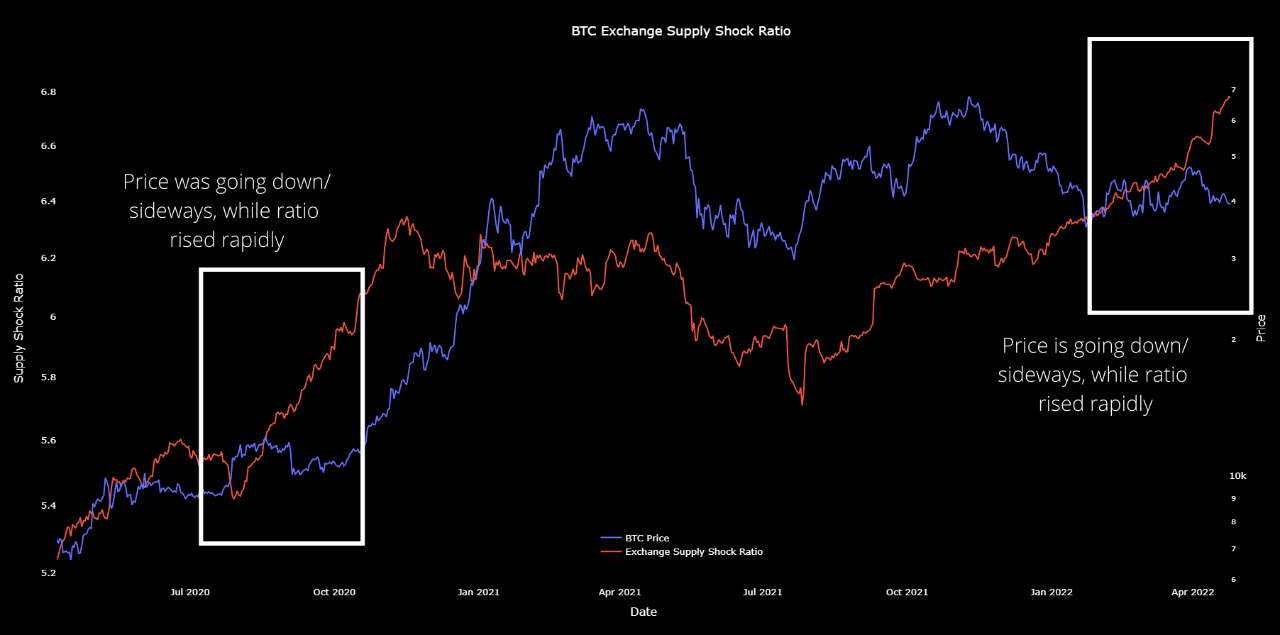

Now, here’s a chart that presentations the fashion within the BTC trade provide surprise ratio over the last couple of years:

The worth of the indicator turns out to had been on the upward push just lately | Supply: CryptoQuant

Within the above graph, the quant has marked the related developments of similarity between the Bitcoin markets of summer season of 2020 and of at the moment.

It seems like right through each the classes, the fee used to be trending down or shifting sideways, whilst the trade provide surprise ratio were impulsively going up.

Comparable Studying | Institutional Investors Bearish On Bitcoin, Ethereum. Here’s What They’re Buying

In spite of the suffering worth these days, buyers have confirmed call for for the crypto as they’ve been impulsively amassing just lately (very similar to again then).

What adopted a couple of months after the summer season of 2020 used to be the beginning of a brand new Bitcoin bull run because of the ensuing “provide surprise.”

The BTC worth is heavily tied to the stock market recently, and the analyst believes it’s conceivable that when it decouples, a an identical surprise may well be there this time as smartly.

BTC Value

On the time of writing, Bitcoin’s price is buying and selling round $39.8k, down 7% up to now week. During the last month, the crypto has misplaced 15% in worth.

The underneath chart presentations the fashion in the cost of the coin over the last 5 days.

The cost of the crypto appears to be like to be regularly hiking again up after the plunge down a couple of days in the past | Supply: BTCUSD on TradingView

Featured symbol from Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)