Not too long ago on an episode of the “Orange Tablet Addicts” podcast, I used to be speaking to a monetary consultant and requested the query, “What did the position of a monetary planner appear to be pre-1971?” The usage of the historical past of markets, law and fiscal advising, right here I read about how over the past 100 years, governments brought about financial dysfunction whilst additionally making a marketplace for monetary planners. I additionally recommend what the position of a monetary planner will appear to be in a valid cash setting.

To grasp the historical past of economic advising, we should get started with a short lived historical past of markets as we all know them. There have been some early markets that popped up in Europe beginning with Antwerp in the 1400s. The port of Antwerp discovered itself between the Germans, who traded furs and rye, and the Italians who introduced gemstones from the A long way East. Innkeepers within the town would supply safe haven, whilst additionally serving to vacationers alternate items with one every other. Through the years, they started to create alternate charges and via the 16th century, they have been buying and selling extra in promissory notes moderately than exchanging items. Then, in Amsterdam in 1602, The Dutch East Buying and selling Corporate become the first publicly traded company via providing an IPO to “all citizens of those lands” inviting all Dutchmen the facility to take a position.

In 1792, stockbrokers met on Wall Boulevard to create the Buttonwood Settlement for the marketing of shares and bonds, which might ultimately develop into the New York Stock Exchange. Charles Dow created the Dow Jones Industrial Average in 1896. Then in 1923, Henry Barnum Deficient launched the pre-version of the S&P (it become Same old & Deficient’s post-merger with Same old Statistics in 1941), adopted via MFS Massachusetts Investors Trust introducing the start of the trendy mutual fund in 1924. Whilst those United States markets have been maturing, they remained virtually utterly unregulated till the inventory marketplace crash of 1929.

Within the 1920s, if a person sought after to shop for inventory in an organization they’d move in particular person to a stockbroker for the acquisition. It was once quite easy, particular person A needs to shop for inventory in corporate B, in order that they move to dealer C to make it occur. Whilst data traveled a lot slower again then, sadly, it traveled even slower to most people. People who have been nearer to data and the newspaper’s printing press have been in a position to behave sooner on positive information. The issue was once that particular person D invested with data that particular person A knew a lot previous. This panorama of making an investment would exchange significantly within the coming decade based on the inventory marketplace crash. So that you can save you every other crash, Congress handed the Securities Act, which President Franklin D. Roosevelt signed in 1933. It was once the primary time the government handed law to keep watch over the country’s inventory markets. The government supposed the legislation to give protection to traders, create transparency of companies and their funds, and save you misrepresentations and fraud.

Following the signing of the Securities Act will be the introduction of the SEC (Securities and Trade Fee), the NASD (Nationwide Affiliation of Securities Sellers), and persisted law over the approaching a long time. In 1952, economist Harry Markowitz would create “the root for contemporary portfolio concept” with the purpose of optimizing a shopper’s investments. In 1958, John Keeble and Richard Felder based the Financial Services Corporation. Over the following 10 years, they’d develop their industry to doing round 300 monetary plans a month. It was once in 1966, that Keeble discovered on the subject of insurance coverage and investments, it’s the buyer’s wishes that pressure gross sales. In not up to 50 years after the primary piece of law, the U.S. would see the introduction of commissions, companies, societies, faculties and new funding methods and tax incentives as a right away result of federal regulations. The introduction of latest regulations, theories and techniques laid the framework for most people’s want for a monetary consultant.

On June 19, 1969, a person named Loren Dunton began the Society for Financial Counseling Ethics. This society known people who have been legally and ethically serving to the general public with monetary suggest. Six months later, Dunton met with 12 different males in Chicago on December 12, 1969. The gang of attendees principally had a background in mutual finances and insurance coverage and was once assembly in the middle of a nasty financial system. They have been in search of to seek out sure answers to navigate the brand new financial scenario. Out of this amassing got here the World Affiliation of Monetary Making plans, which might create the Faculty for Monetary Making plans (CFP). Inside of 4 years, the school launched a five-course curriculum and graduated their top notch with the CFP designation. This certification continues lately during the Qualified Monetary Planner Board of Requirements. The assembly of the “Chicago 13” now receives a public consensus as to the beginning of economic making plans as a certified apply.

All this to mention, heading into the 1970s the paperwork in monetary making plans was once already thicker than dust and the occupation itself was once necessitating extra skillability. Are you able to begin to see the place this development is main? At this level, the USA was once on the height of the Vietnam Conflict and was once spending more cash to fund the struggle than the federal government may justify via what was once within the gold reserves. Then, in August of 1971, President Richard Nixon landed the overall blow to the gold usual via deciding it might now not peg the U.S. buck to gold.

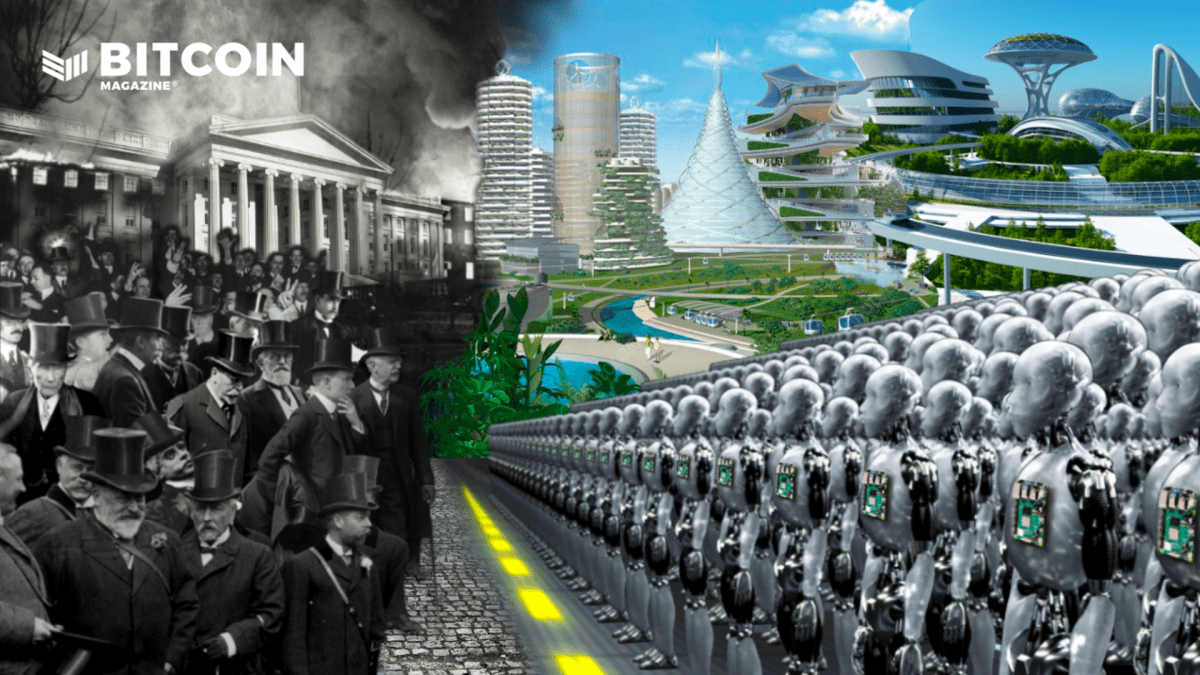

The monetary making plans business was once now off to the races. In 1974, the velocity of inflation was once 12.3%, up from 5.6% in 1969. The USA printing press was once printing cash sooner than ever, and the U.S. buck was once now not a protected instrument to retailer one’s wealth. The extra inflation raged, the extra there was once a necessity for monetary advisors. What is extra, the rise in law handed, the extra advanced the activity of economic making plans become. So, because of inflation, the general public wanted monetary planners and as the box was once turning into extra multifaceted, they may now not do the activity on their very own. Whether or not deliberately or by chance, the federal government created an issue (inflation and sophisticated markets) whilst additionally growing an business (monetary making plans).

At first phases of economic making plans, the position appeared other than it does lately. Buyers centered much less on shares and extra on actual property, restricted partnerships and annuities. Past that, monetary planners did extra tax making plans than the rest. Inflation, taxes and rates of interest have been top, so those investments served as the most efficient aid. The inventory marketplace carried out so poorly for one of these lengthy time frame that traders sought after little to do with it. As the USA was the 1980s, families discovered their want for a monetary planner as a result of new tax regulations, the 401(okay) and a inventory marketplace that in spite of everything started to take off once more.

So does Bitcoin repair this? The solution is sure. A significant reason why gold failed as cash is as a result of it’s arduous to custody safely and it’s tough to divide. The answer this is maximum not unusual is to make use of a financial institution to retailer the gold after which use financial institution certificate to turn how a lot gold one celebration is shifting to every other. Through the years, those certificate become what we all know now because the buck invoice. So when Franklin D. Roosevelt signed Executive Order 6102 that, “all people are required to ship on or prior to Would possibly 1, 1933, all gold coin, gold bullion, and gold certificate now owned via them to a Federal Reserve Financial institution, department or company, or to any member financial institution of the Federal Reserve Device,” the one prison selection for the USA electorate was once to deal in bucks.

This legislation gave the federal government the aptitude to print as a lot cash because it sought after with rarely any responsibility; the Nixon Surprise ultimately uncovered this drawback. Bitcoin solves this via its mounted provide, simple and protected self-custody and talent to ship huge or small increments between two events; it excels within the spaces the place gold failed. With Bitcoin, most people can use foreign money as a shop of price as soon as once more.

Must monetary planners be apprehensive about Bitcoin working them into chapter 11? Within the Bitcoin Mag article, “The Role Of A Financial Advisor In A Hyperbitcoinized World,” Trent Dudenhoeffer mentioned that monetary planners is not going to get run out in their jobs, however that the evolution of cash will redefine their duties. This modification might be a right away results of the motivation style converting as a result of Bitcoin will repair the cash. The will for monetary planners will lower because the want to outpace inflation decreases. When folks want much less time with a monetary consultant, the assembly turns into a extra all-encompassing technique consultation that can best happen each and every two or 3 years.

Additionally, in Dudenhoeffer’s article, he makes the case that monetary advisors would be the ones to onboard numerous folks to Bitcoin at some point. This reaction will principally be since the consultant is the gatekeeper to many of the consumer’s belongings. He brings up those particular eventualities that monetary planners will help purchasers within the Bitcoin age: Does it make sense for purchasers to take out a loan the usage of a portion in their Bitcoin as collateral, will the customer want assist with multisignature setup, which cellular and desktop wallets will higher serve the customer’s wishes and whether or not or now not purchasers will have to take part in peer-to-peer lending protocols to earn further yield. Thankfully, the break of day of this age is also nearer than we predict with new merchandise at Watchdog Capital, Swan Bitcoin’s “Swan Marketing consultant,” and plenty of others which can be coming to the marketplace.

Undoubtedly, many fiscal advisors are already within the industry for altruistic causes and search to assist those that are coming to them for steering. Sadly, purple tape or unfavorable incentives from the federal government or their company workplace frequently stay the ones CFPs from serving their purchasers smartly. The hope for the ones advisors will have to be that at some point, they’d be capable of tackle fewer purchasers in an effort to maximize the care and a focus they offer every person. As noticed during the ultimate 50-plus years of economic making plans historical past, monetary planners learn how to regulate to the marketplace’s calls for and purchasers will all the time want assist with fundamental monetary duties like budgeting, taxes, well being care and long-term making plans. In lately’s making an investment, advisors should construct portfolios to overcome the price of inflation or they don’t seem to be protective the buying energy of the investor. Alternatively, when purchasers grasp bitcoin, they are going to best make investments if it could beat the appreciation of bitcoin’s buying energy. A Bitcoin usual will utterly turn funding methods on their head. The way forward for monetary making plans lies within the arms of those that adapt to the approaching financial revolution to raised help their purchasers.

It is a visitor submit via Brian. Reviews expressed are solely their very own and don’t essentially mirror the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)