The beneath is a complete, unfastened excerpt from a contemporary version of Bitcoin Mag Professional, Bitcoin Mag’s top class markets e-newsletter. To be a number of the first to obtain those insights and different on-chain bitcoin marketplace research directly for your inbox, subscribe now.

Public Miner Equities As opposed to Bitcoin

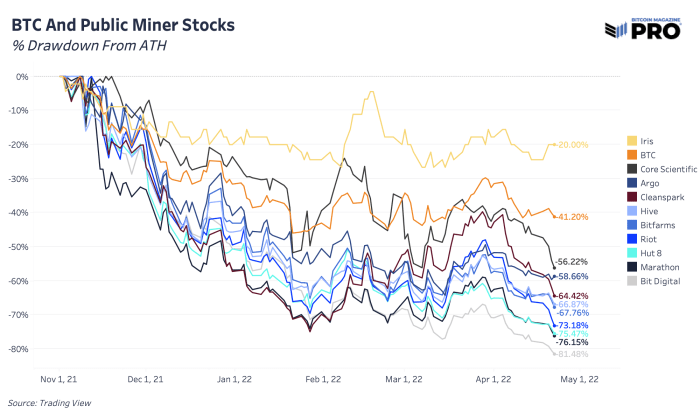

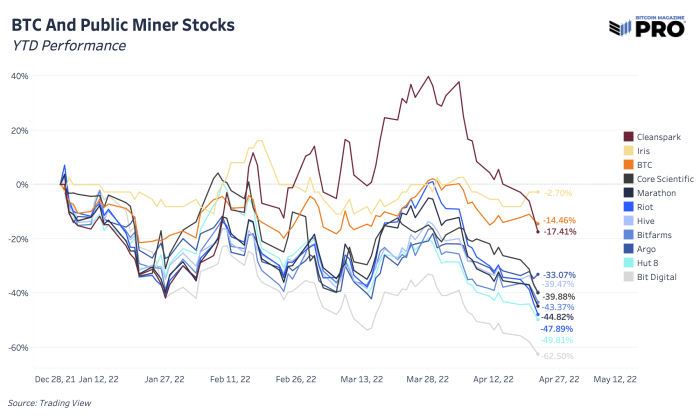

As for many risk-on belongings, together with bitcoin and public bitcoin mining equities, the drawdowns from all-time highs were considerable. As bitcoin has fallen 41.20% from its November all-time top, all of the bitcoin mining trade has carried out a lot worse, going through a mean drawdown of 64.10%. Public bitcoin miner shares have acted as further funding automobiles for oblique bitcoin publicity with alternative for outperforming bitcoin over the previous couple of years — no less than till the marketplace shifted in November 2021.

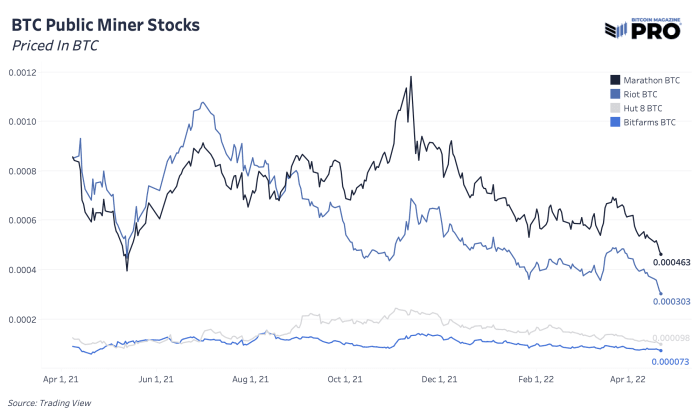

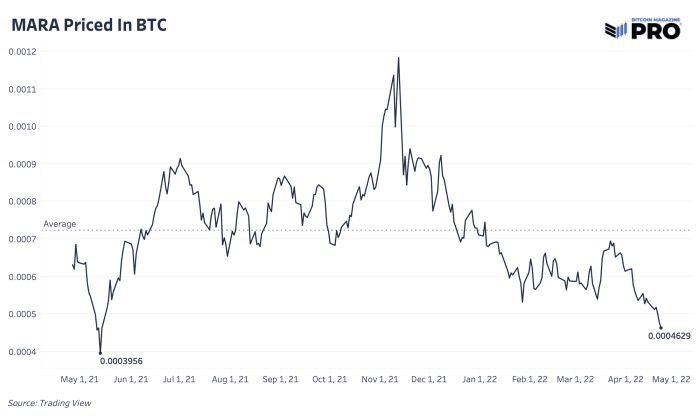

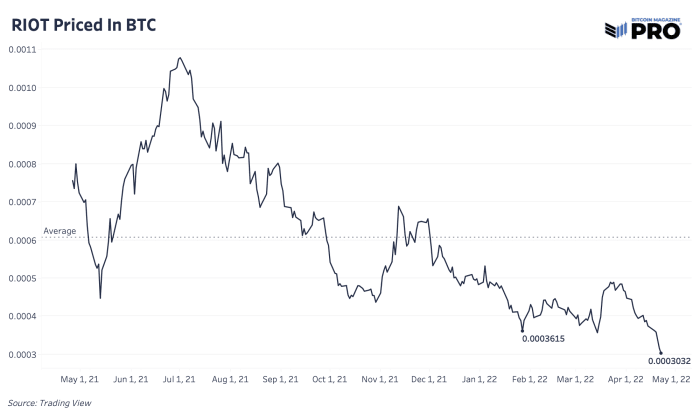

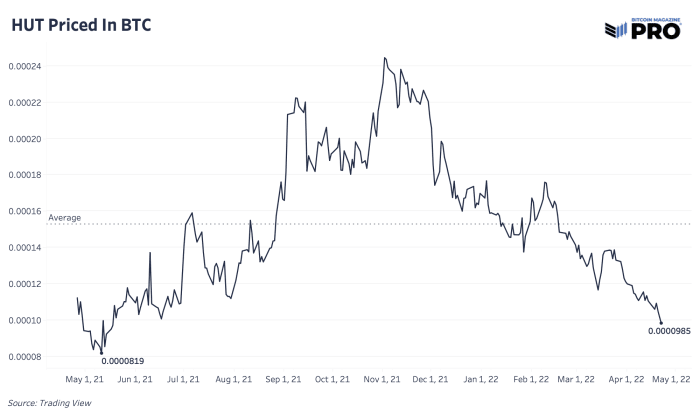

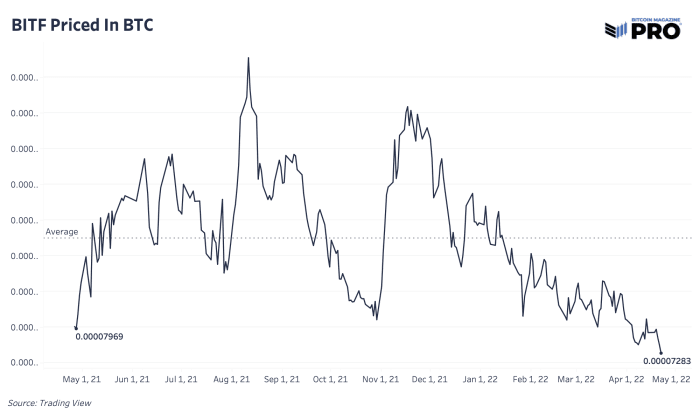

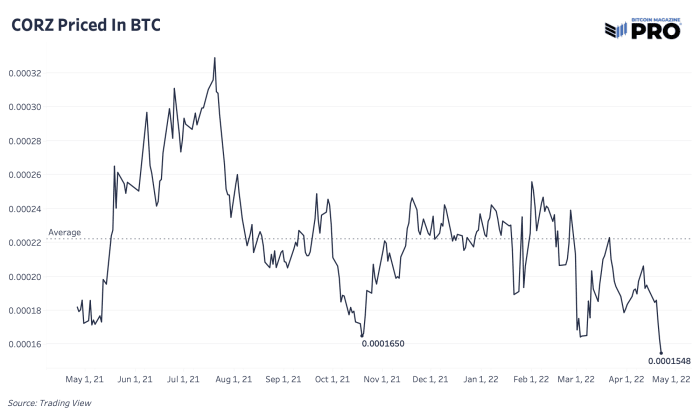

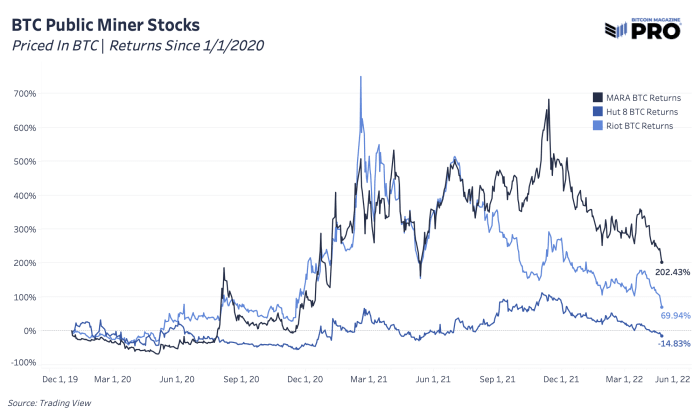

With the exception of pricing miners in USD phrases, how smartly do they carry out priced in bitcoin? The ones the use of bitcoin as a unit of account will naturally search for alternatives that may outpace bitcoin in an try to develop their general bitcoin place and proportion of a restricted provide. With the most recent drawdowns, bitcoin miners are beginning to glance moderately reasonable when priced in BTC phrases, as many of those shares are nearing or making new 12-month lows.

Even if our base case is that the wider equities marketplace (and most probably bitcoin) has extra problem to return this 12 months, particular person mining shares might be nearer to a backside than the remainder of the marketplace, with maximum down 60% to 70% already. Beneath are one of the most sensible public miners priced in BTC over the past 12 months, smartly beneath their annual averages.

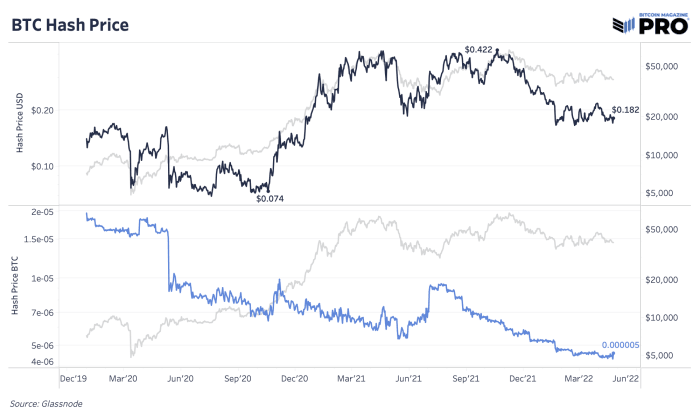

The efficiency decline relative to bitcoin is newer over the past six months. Make a choice miners have had sturdy outperformance relative to bitcoin since 2020 with bitcoin’s hash value emerging from $0.07 to $0.42 at its contemporary top. As value exploded and hash charge used to be lagging at the back of, miners were in a golden length making extra income in line with hash resulting in a length of upper income, upper profits and better marketplace valuations.

Since 2020, right here have been one of the miner fairness returns when priced in bitcoin around the most sensible marketplace capitalization miners. This hash value growth blended with emerging investor call for and hypothesis led Marathon and Revolt shares to outperform bitcoin via 202% and 70% respectively. Choosing and timing the precise miner inventory (or basket of miner shares) to outperform could also be a very powerful, which makes self-custody bitcoin the most efficient means for many.

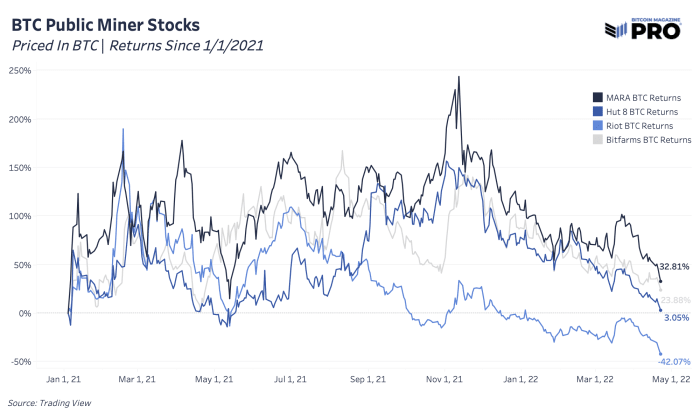

Since 2021, the ones returns and outperformance are extra muted (and even detrimental), appearing how tough it’s been for miners to outperform bitcoin with hash value peaking right through a broader macro pivot to a risk-off marketplace regime.

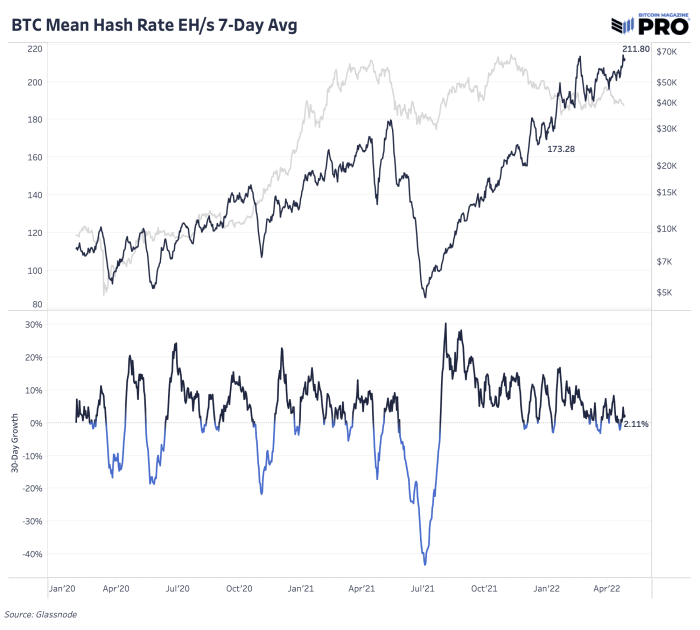

Hash value (miner income in line with terahash) now sits at round $0.182 and continues to fall from its upper momentary pattern as value stagnates and hash charge enlargement diverges, down 14.46% and up 22.23% year-to-date respectively. At a kind of annualized 66.69% enlargement charge nearly via April, that might put the entire hash charge with regards to 289 EH/s via the tip of the 12 months.

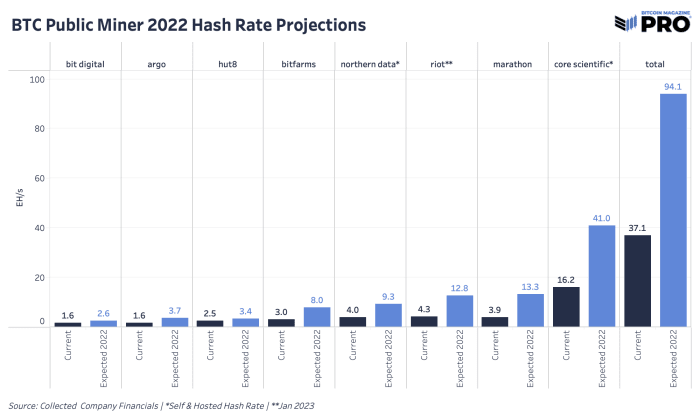

Even if this can be a large process to carry that a lot hash charge and gear on-line this 12 months amid ASICs provide chain delays, energy capability problems and emerging power prices, choose most sensible public miners are nonetheless making plans to develop their hash charge via 154% via 2022 — from 37.1 EH/s to 94.1 EH/s. This enlargement (desk beneath) contains all introduced 2022 plans throughout self-mined and hosted hash charge.

And not using a bullish value catalyst within the brief time period, be expecting the community’s hash charge growth to proceed; upper problem changes will proceed to push hash value decrease. Hash value is of course trending in opposition to 0 over bitcoin’s lifetime because the marginal value of manufacturing a bitcoin turns into extra aggressive through the years, however there shall be profitable classes the place value appreciation outpaces hash charge’s capability to develop within the brief time period.

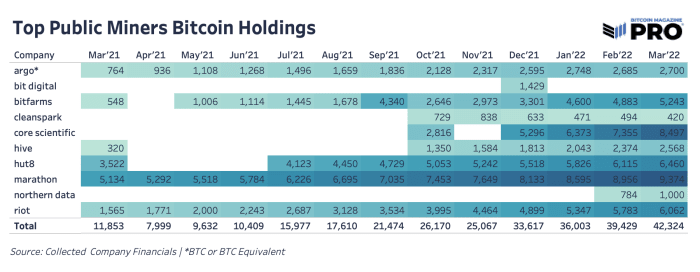

Regardless of the new fall in valuations, we’ve observed little exchange in public miners to curb their hash charge growth plans for 2022 and 2023 or downsize their BTC holdings. Reported bitcoin holdings grew 7.3% month-over-month in March, appearing indicators that bitcoin miners aren’t but going through primary capitulation or promoting power to opposite this new trade pattern of emerging bitcoin accumulation.

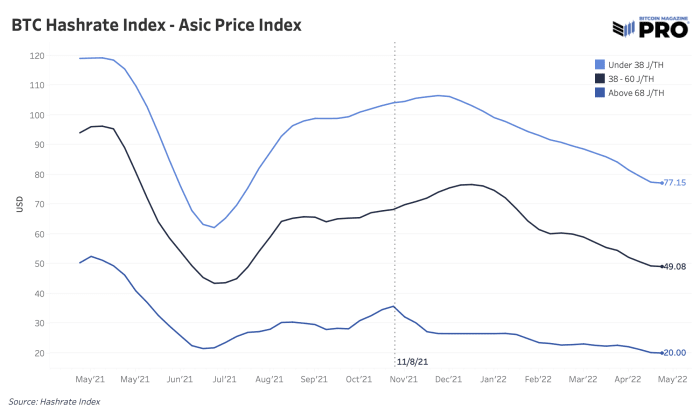

The rage of falling hash value will pressure weaker miners to unplug machines, to find extra environment friendly power resources and/or dump the ones machines or bitcoin holdings within the worst case. A few of the ones marketplace dynamics will also be tracked by means of a mining rig value index in USD with knowledge from Luxor and their Hashrate Index.

General, USD costs of ASICs throughout potency tiers were falling considerably after an area top in November 2021. This is able to make ASICs extra interesting at decrease costs for consumers however can even carry down asset values for holders of huge fleets. Like hash value, Hashrate Index is anticipating costs to proceed trending in opposition to post-China ban lows.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)