Many traders are uneasy since Bitcoin worth has fallen via round 70% since its height in November 2021. Within the interim, marketplace sentiment is at an rock bottom because of analysts’ expectancies of a big recession. That is particularly transparent from the decline within the fairness markets as measured via the S&P 500 and Nasdaq 100 indices, which has a large have an effect on on how other folks spend money on BTC on regulated markets.

Bitcoin Funding Cars Have Taken A Beating

When looking on the Grayscale Bitcoin Consider, the percentage value has considerably diminished from its height of more or less $56 to $11.94. On the identical time, the percentage values of 3iQ CoinShares Bitcoin ETF and Goal Bitcoin Canadian ETF each fell sharply.

The Grayscale Bitcoin Consider (GBTC) has fallen deeply to $11.94 since its height. Supply: TradingView

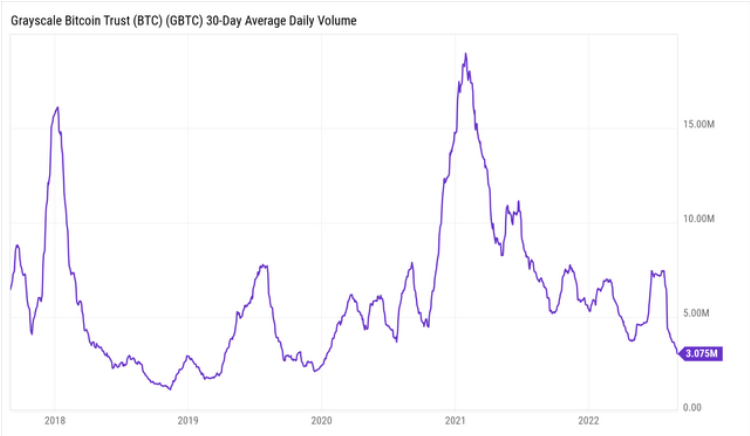

In spite of the stocks’ vital bargain, GBTC’s day by day buying and selling quantity has tremendously diminished to three.075M. It means that institutional traders could be skeptical about Bitcoin-related monetary merchandise at the regulated marketplace or they could simply imagine that the undergo marketplace isn’t but over.

The day by day buying and selling quantity of GBTC has sharply dropped to three.075M in spite of the beneficiant bargain of the stocks. Supply: YCharts

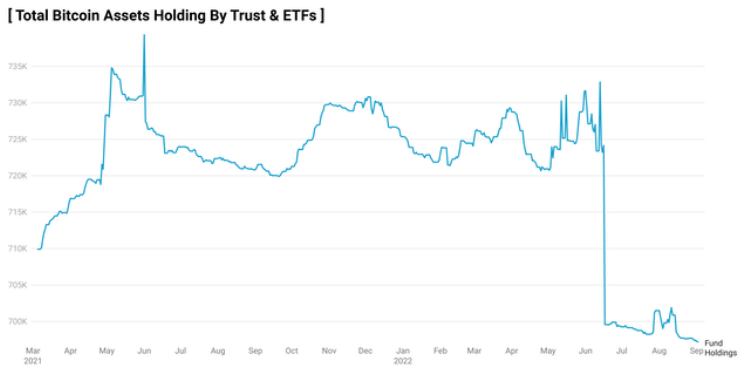

Moreover, given the present marketplace stipulations, positive trusts and ETFs are steadily promoting off their holdings. As an example, since achieving its prime in February 2022, the entire quantity of BTC held via the Grayscale Bitcoin Consider has diminished.Additionally, for the reason that marketplace peaked in Might 2021, the entire collection of Bitcoins held via quite a lot of trusts and ETFs has sharply diminished.

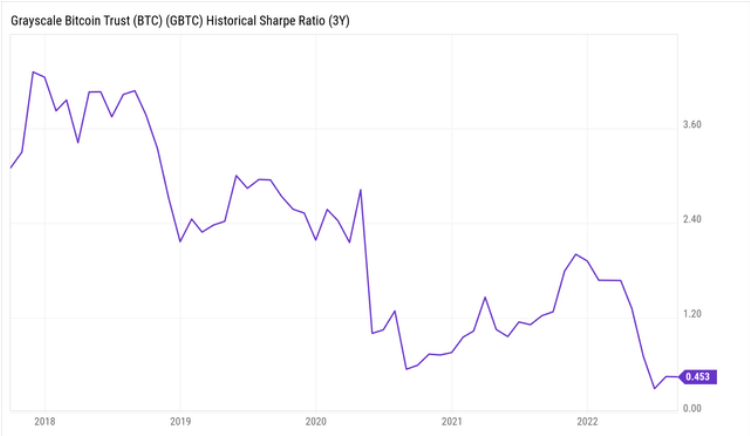

The Sharpe ratio signifies that GBTC is a foul asset with an excessively low risk-adjusted efficiency on the subject of go back on funding. In truth, the Sharpe ratio has just lately dropped to 0.453 after declining through the years. It means that whilst GBTC’s volatility is moderately prime, the projected go back on funding is moderately modest.

Loss After Loss

The present pioneer crypto funding cars in regulated markets, together with trusts and ETFs, have to some degree displayed the pessimistic sign. In spite of the numerous bargain at which GBTC has been bought, the day by day buying and selling quantity is often declining, and a number of other trusts and ETFs, equivalent to Grayscale Bitcoin Consider, were prompt to promote their BTC holdings.

The entire collection of BTC held via trusts & ETFs has plummeted since Might 2021. Supply: CryptoQuant

The present Bitcoin funding equipment in regulated markets equivalent to trusts and ETFs have proven the bearish sign to a definite extent. Even though GBTC has been traded at a considerable loss, the day by day buying and selling quantity helps to keep reducing and a few trusts and ETFs together with Grayscale Bitcoin Consider were inspired to divest their Bitcoin holdings.

Sharpe ratio tells us that GBTC is a deficient asset with an excessively low risk-adjusted efficiency. Supply: YCharts

For the reason that stocks of GBTC bought or purchased via institutional traders are reported quarterly, many contemporary trades can have no longer been indexed but. On the other hand, those above figures may just give us some clues of what is also in fact going down with Bitcoin at the back of the scenes.

Shops can handiest remember {that a} native backside has been reached after it has already befell, like relating to institutional traders who bought GBTC in past due June simply previous to the July upward thrust.

Maximum significantly, the Sharpe ratio displays that GBTC’s go back on funding is moderately low and that this asset seems to be slightly dangerous. Subsequently, presently, traders could be in a position to start hedging in opposition to the emerging unfavorable drawback threat of bitcoin.

Featured symbol from Unsplash, charts from TradingView.com, Ycharts, and Cryptoquant

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)