Sign up for Our Telegram channel to stick up to the moment on breaking information protection

As some of the fastest-growing industries on the earth, the cryptocurrency sector has skilled large recognition prior to now two years. This surprising expansion used to be all because of the bull marketplace in 2021, which no longer most effective controlled to create an enormous group for the sphere but in addition noticed an exponential upward push within the worth of a number of tasks.

Whilst blockchain as a collective sector would possibly nonetheless be in its infancy, it has nonetheless situated itself as an asset elegance with a lot doable. This infact will also be observed extra it seems that now, as even sure nations have moved to legalise BTC, the front-runner cryptocurrency as their criminal gentle.

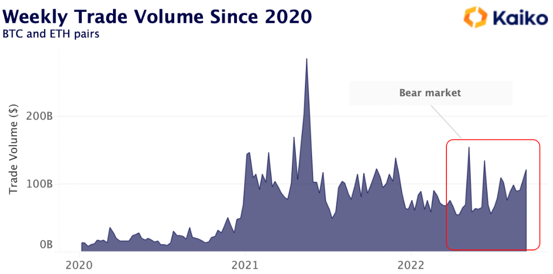

On the other hand, issues had been moderately tough for the making an investment citizenry those previous couple of months. For the reason that marketplace crash tokens and comparable property throughout the business have suffered very much, each with regards to worth and engagement. Tasks and ecosystems that after recorded thousands and thousands of greenbacks value of business quantity on a daily basis had been going through liquidity problems because of a lower in passion and participation from traders.

Regardless of all this, there definitely had been some winners and losers. Whilst an enormous collection of organisations struggled to maintain their trade and no longer pass bankrupt, some had been taking part in the sources earned right through the bull run, which lets them often construct their infrastructure now.

Firms like Coinbase needed to lay off staff to chop prices, whilst main tasks like Celsius confronted critical liquidity crunches. Total, it were a fiasco for some organizations that had prior to now been doing exceptionally neatly. The surprising marketplace crash no longer most effective introduced down the price of cryptocurrencies but in addition impacted main firms whilst doing so.

Traders, too, are but to get a transparent thought of the place the markets would possibly transfer within the upcoming days and feature been skeptical relating to parking their price range just lately. Even supposing, this hasn’t been the case for some of the aforementioned winners.

Exchanges and their main function within the business

As an rising sector, the participation of traders in cryptocurrencies is but to be mainstream. Actually, a learn about mentioned that over 98% of the folk didn’t even grab the fundamentals of those virtual property. Because of this, the one simple publicity that traders have as part of the blockchain business is thru exchanges.

Whilst consciousness of them being property with doable will also be got thru mainstream media platforms, it’s only thru cryptocurrency exchanges that those plenty can in reality turn into part of the business. Thus, exchanges play a significant function throughout the sector and affect the cost actions of cryptocurrencies on a significant stage.

One such main change that has traditionally been an enormous a part of the blockchain business is Binance. As some of the greatest exchanges on the earth, the traits or movements inside of its platform are scrutinized through traders and monetary analysts. One such example has just lately been recorded, the place the change has singularly been buying and selling reverse to the quantity pattern.

Binance resists business quantity pattern

Industry quantity is a superb indicator of a protracted undergo marketplace. As investors make the most of volatility right through an preliminary worth droop, business quantity normally surges. Merely put, Buying and selling quantity is the overall collection of stocks of safety traded right through a given duration. Traders frequently use buying and selling quantity to verify a pattern’s lifestyles or continuation or pattern reversal. It usually supplies traders with a sign to go into the marketplace.

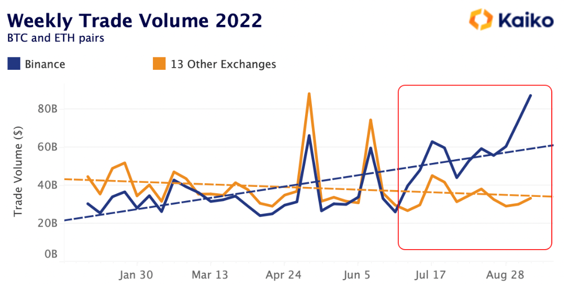

When taking a look on the mixed quantity for BTC and ETH pairs throughout 14 main exchanges, it’s going to be famous that there hasn’t been any roughly expanding business volumes. On the other hand, many a time, such aggregated information could be a bit deceptive. When keeping apart Binance from different exchanges, it may be spotted that there was a robust disbalance between the 13 different exchanges and the aforementioned one.

This exceeding quantity in Binance would possibly partially be because of it eliminating charges on BTC/ETH pairs previous this yr. Thus, if most effective bearing in mind the quantity traded on Binance, it issues out that the marketplace is also in for some other crash. This upper call for which places Binance on an entire other spectrum than its festival is because of the no buying and selling price function, which sadly many smaller exchanges can not manage to pay for to do.

What’s Binance?

Based in 2017, Binance is the largest change on the earth with regards to buying and selling quantity, which is clear from the guidelines above. It used to be based through ChangPeng Zhao, additionally popularly referred to as CZ. The present CEO used to be a developer who created a number of high-frequency buying and selling tool.

To start with based totally in China, the corporate needed to relocate its headquarters following China’s ban on cryptocurrency buying and selling and comparable actions. It’s registered within the Cayman Islands and used to be already utilized by over 28.6 million customers again in 2021. Binance has two variations of its change providing too. One is for catering to its buyer base in the USA referred to as Binance US, whilst the opposite is a model this is to be had to different nations it operates in.

How this may increasingly impact the marketplace on an entire

A number of sides decide the long run actions of the marketplace. Whilst this won’t be certain some kind of fast flip of occasions with regards to the business’s worth, the statistic does depict the shift of customers from different exchanges to Binance. This straightforward exchange may doubtlessly have a long-term impact.

If most effective bearing in mind Binance’s quantity, the marketplace would possibly most likely see a drop in worth someday quickly. Nevertheless it can’t be speculated with accuracy since part of the trade going to a sole entity might not be unnatural. The type of expansion and believe Binance has constructed through the years might be the case for the next collection of traders flocking to it.

It definitely hasn’t impacted the cryptocurrency marketplace but, as costs nonetheless appear to be on the ranges they’ve been buying and selling for a number of months. On the time of writing, BTC, the highest cryptocurrency, is buying and selling at round $19,000 with a marketplace cap of greater than $360 billion.

Learn Extra

Tamadoge – Play to Earn Meme Coin

- Earn TAMA in Battles With Doge Pets

- Capped Provide of two Bn, Token Burn

- Presale Raised $19 Million in Below Two Months

- Upcoming ICO on OKX Trade

Sign up for Our Telegram channel to stick up to the moment on breaking information protection

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)