Sign up for Our Telegram channel to stick up-to-the-minute on breaking information protection

Even though the vast majority of the endure marketplace is already most probably at the back of Bitcoin, it’s going to nonetheless see extra struggling within the close to long term.

Philip Swift, a well known on-chain analyst whose information supply, LookIntoBitcoin, analyzes a number of of probably the most well known Bitcoin marketplace signs, has come to quite a lot of conclusions, together with this one.

Swift, who co-founded buying and selling platform Decentrader with analyst Filbfilb, thinks that regardless of the prevailing value drive, Bitcoin will quickly escape of its most up-to-date macro downturn. Swift supplied new insights into what the knowledge is appearing professionals and what investors will have to take note of in a brand new interview with Cointelegraph.

How lengthy will the typical hodler wish to wait till the tide turns and Bitcoin comes storming again from two-year lows?

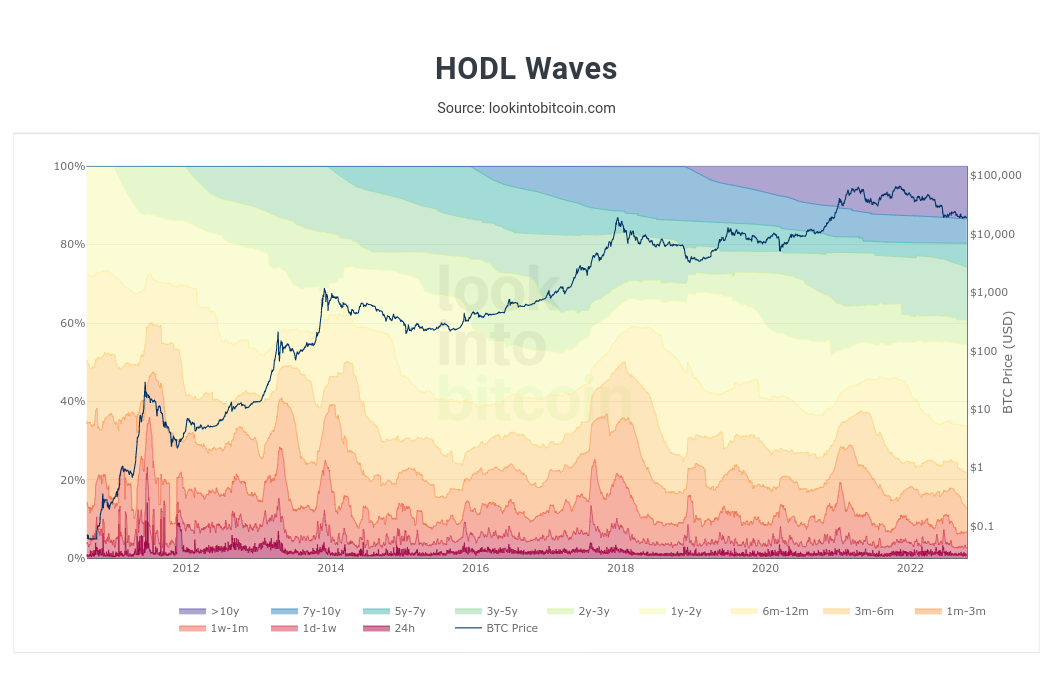

You’ve identified that some on-chain metrics corresponding to HODL Waves and RHODL Ratio are hinting at a BTC backside. May just you enlarge in this? Are you assured that historical past will repeat this cycle?

Philip Swift (PS): I consider we are actually on the level of extreme alternative for Bitcoin. There are a large number of key metrics on LookIntoBitcoin that point out we’re at main cycle lows.

We’re seeing the proportion of long-term holders top (1yr HODL Wave), which in most cases occurs within the depths of endure marketplace as those long-term holders don’t wish to take benefit till value strikes upper.

This has the impact of limiting to be had delivery available in the market, which is able to purpose value to extend when call for does in the end sit back in.

Bitcoin HODL Waves chart. Supply: LookIntoBitcoin

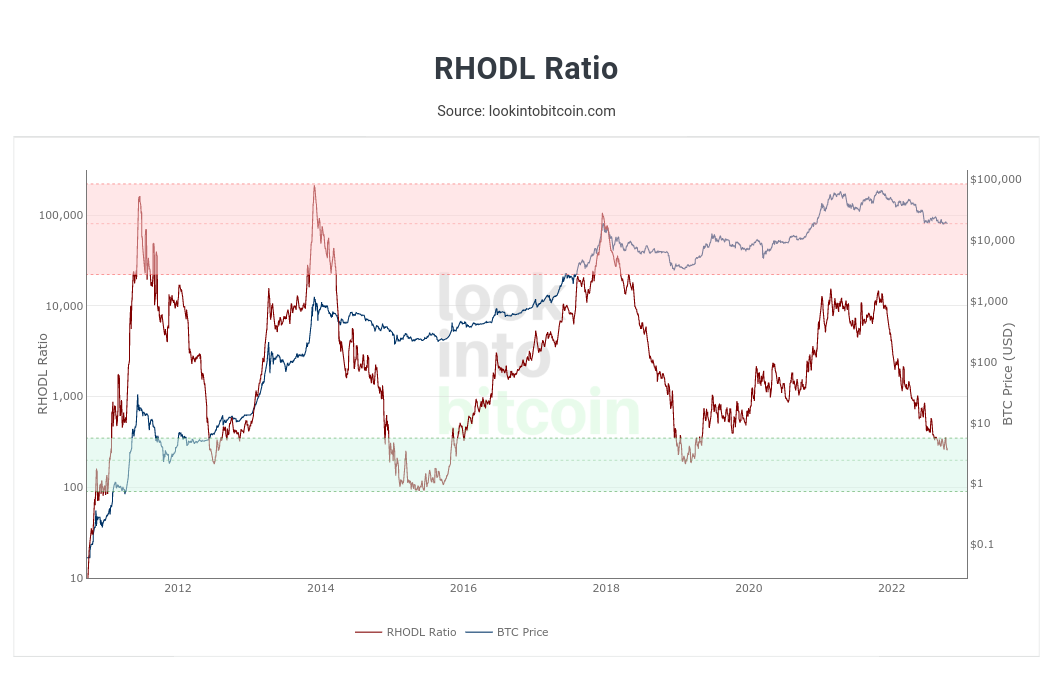

We also are seeing metrics like RHODL Ratio dip into their accumulation zones, which displays the level to which euphoria has now been tired from the marketplace. This elimination of sure sentiment is vital for a backside vary to shape for BTC.

RHODL Ratio is highlighting that the fee foundation of latest Bitcoin purchases is considerably less than costs paid 1–2 years in the past when the marketplace used to be obviously euphoric and anticipating +$100okay for Bitcoin. So it is in a position to let us know when the marketplace has reset in preparation for the following cycle to begin.

Bitcoin RHODL ratio chart. Supply: LookIntoBitcoin

How is that this endure marketplace other from earlier BTC cycles? Is there any silver lining?

PS: I used to be round for the 2018/19 endure marketplace and it in reality feels lovely equivalent. The entire vacationers have left and also you simply have the dedicated passionate crypto other folks last within the house. Those other folks will receive advantages probably the most within the subsequent bull run — so long as they don’t pass loopy buying and selling with leverage.

On the subject of silver linings, I’ve a pair! First, we’re in reality an even manner during the marketplace cycle, and most probably via the vast majority of this endure marketplace already. The chart under displays Bitcoin efficiency each and every cycle for the reason that halvening, and we’re already across the capitulation issues of the former two cycles.

Bitcoin bull marketplace comparability chart. Supply: Philip Swift/ Decentrader

2nd, the macro context could be very other now. Whilst it’s been painful for bulls to look Bitcoin and crypto so closely correlated to suffering conventional markets, I consider we’re quickly going to look a bid on Bitcoin as self belief in (main) governments crosses downwards past some degree of no go back.

I consider this insecurity in governments and their currencies will create a hurry against non-public “laborious” property, with Bitcoin being a big beneficiary of that pattern in 2023.

What different key on-chain metrics would you additionally counsel to keep watch over to identify the ground?

PS: Be cautious of Twitter personalities appearing Bitcoin on-chain charts minimize through unique/ bizarre variables. Such information very infrequently provides any authentic worth to the tale proven through the most important key metrics and those personalities do exactly it so that you could take hold of consideration somewhat than if truth be told looking to assist other folks.

Two metrics which might be specifically helpful within the present marketplace prerequisites:

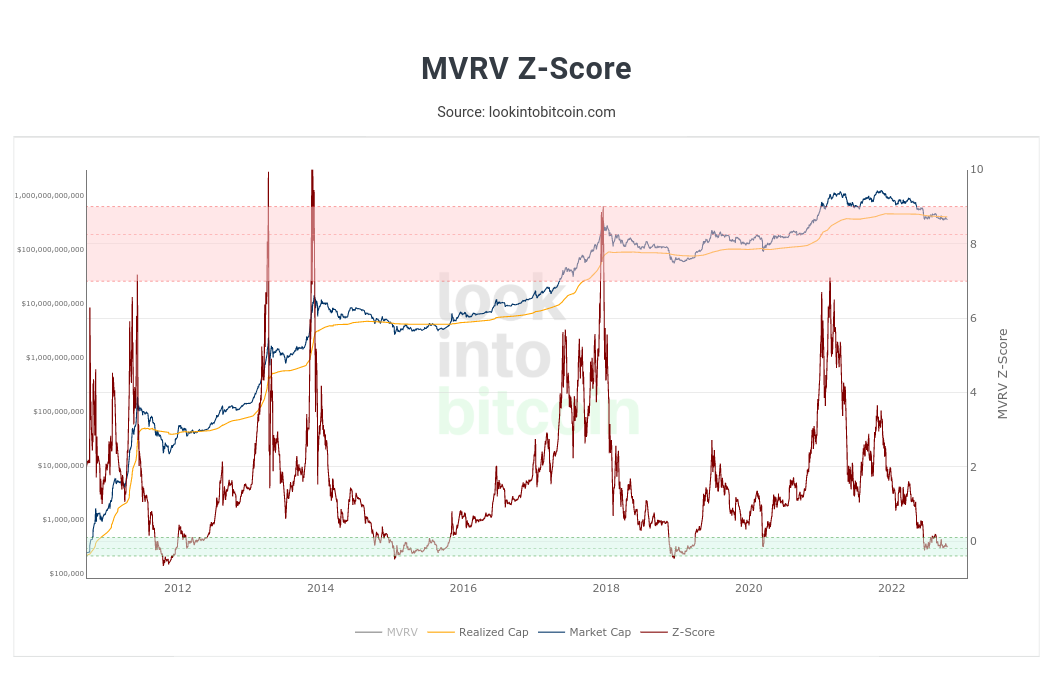

The MVRV Z-Ranking is a very powerful and broadly used metric for Bitcoin. It displays the extremes of Bitcoin value shifting above or under its learned value. Discovered value is the typical price foundation of all Bitcoin bought. So it may be considered an approximate break-even stage for the marketplace. Value simplest ever dips under that stage in excessive endure marketplace prerequisites.

When it does, the indicator in this chart dips into the golf green “accumulation” zone. We’re lately in that zone, which means that those could also be excellent ranges for the strategic long-term investor to amass extra Bitcoin.

Bitcoin MVRV Z-Ranking chart. Supply: LookIntoBitcoin

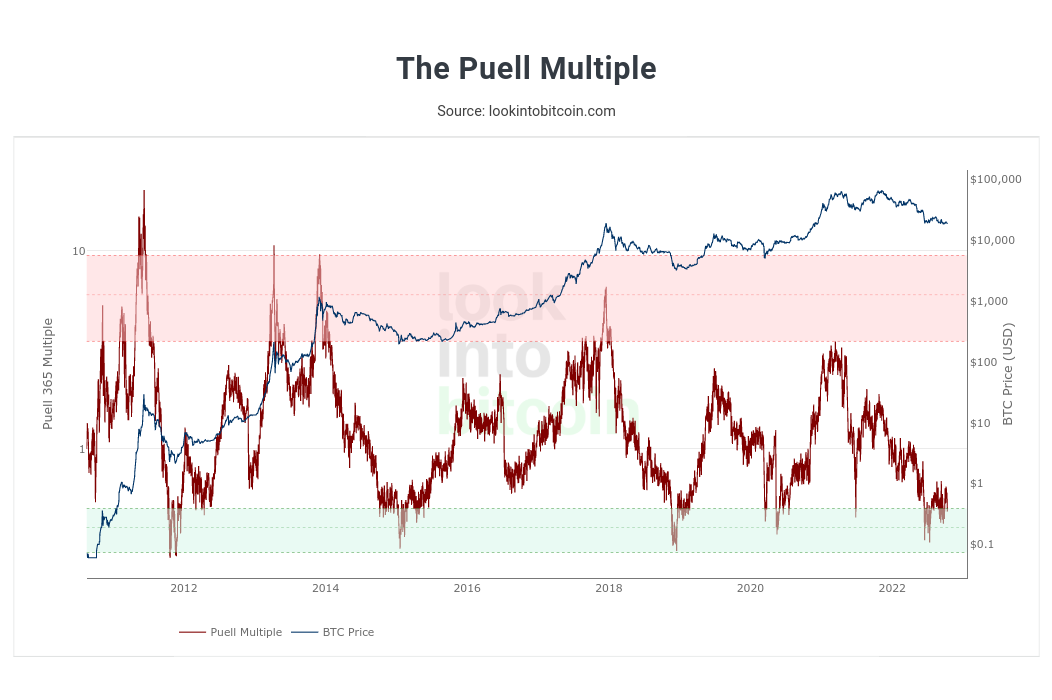

The Puell A couple of Seems to be at miner revenues as opposed to their historic norms. When the indicator dips into the golf green accumulation band, adore it is now, it displays many miners are underneath important pressure. This ceaselessly happens at main cycle lows for Bitcoin. This indicator suggests we’re with reference to a big cycle low for Bitcoin if now we have now not already bottomed.

Bitcoin Puell A couple of chart. Supply: LookIntoBitcoin

Your fellow analyst Filbfilb expects BTC to opposite direction in Q1 2023. Do you settle?

PS: Sure, I do. I feel conventional markets most probably have slightly extra downturn going into early 2023. At worst, I see crypto having a tricky time till then, so most probably some other 2–Three months max. However I feel the vast majority of worry will quickly transfer towards governments and their currencies — rightly so. Due to this fact I do be expecting non-public property like Bitcoin to outperform in 2023 and marvel most of the doomers who’re announcing Bitcoin has failed and goes to 0.

October is a traditionally dangerous month for shares — now not such a lot for Bitcoin. How lengthy do you are expecting BTC to be in lockstep with risk-on property and what is going to be the catalyst?

PS: Bitcoin has been an invaluable forward-looking menace indicator for the markets all the way through a lot of 2022. What’s going to exchange in 2023 is that marketplace members will recognize [that] many of the menace in reality lies with governments, now not with historically outlined “menace” property. In consequence, I be expecting a story shift that can receive advantages Bitcoin subsequent 12 months.

The movements of the UK’s executive round their mini-budget two weeks in the past had been a key turning level for that attainable narrative shift. Markets confirmed they had been ready to turn their disapproval of deficient coverage and incompetence. I be expecting that pattern to boost up now not just for the U.Okay. however in different international locations additionally.

Are you stunned at Ethereum’s deficient efficiency post-Merge? Are you bullish on ETH long run with its supply-burning mechanisms?

PS: ETH had a powerful temporary narrative with the Merge, but it surely used to be throughout the context of a world endure marketplace. So it’s not unexpected that its value efficiency has been lackluster. In the long run, the full marketplace prerequisites ruled, which used to be to be anticipated.

Longer term, despite the fact that, Ethereum is ready as much as do exceptionally neatly. This is a important element of Web3, which is rising exponentially. So I’m very bullish on Ethereum over the following couple of years.

What’s the perfect jurisdiction for a Bitcoin/ crypto dealer these days?

PS: Someplace this is low-tax and crypto-friendly. I in my opinion suppose Singapore is excellent and there’s a rising crypto scene right here, which is excellent a laugh too. I’ve pals who’re in Bali, which additionally sounds nice and is extra inexpensive.

The rest you want to upload?

PS: Face up to any temptation to surrender crypto close to the ground of the endure marketplace. Simply be affected person and use some excellent equipment to assist organize your feelings.

Comparable

Tamadoge – Play to Earn Meme Coin

- Earn TAMA in Battles With Doge Pets

- Most Provide of two Bn, Token Burn

- Now Indexed on OKX, Bitmart, LBank, MEXC, Uniswap

- Extremely Uncommon NFTs on OpenSea

Sign up for Our Telegram channel to stick up-to-the-minute on breaking information protection

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)