That is an opinion editorial by way of Captain Sidd, a finance creator and explorer of Bitcoin tradition.

During the last two years, the subject of inflation went mainstream. As a substitute of a sluggish and stable 2% inflation charge within the U.S., we’ve observed 10%-plus annualized inflation in items which can be crucial to our survival, like food and effort.

Over that very same time frame, the cost of bitcoin crowned a parabolic rally at an trade charge of round $70,000, flatlined, after which often misplaced worth towards the greenback to the place we’re nowadays, round $20,000 in keeping with bitcoin.

From this point of view, bitcoin might appear to have failed as a hedge towards value inflation thus far. On the other hand, bitcoin is an excessively small asset at the global level, in large part neglected by way of many of the global’s inhabitants thus far.

As a substitute of inspecting bitcoin, allow us to have a look at the U.S. greenback. The U.S. greenback is the arena’s reserve forex, issued by way of the country with the arena’s maximum tough and complicated army.

The greenback, greater than bitcoin, has a tale to inform about inflation and find out how to live on it.

Taking A Vital Glance At The Greenback

Except you’re employed in finance, you might imagine of the costs of products as one-sided: you may have bread, and it’s priced in bucks. If the cost of bread is going up, it will have to be on account of some exchange within the inputs to that bread or a call of the corporate that sells it. I’d wager most of the people by no means consider how the converting value of bread may contain a transformation within the greenback fairly than the bread itself.

Markets, and costs, are expressed in pairs. In the event you’ve ever traded cryptocurrencies, you could remember the fact that markets are displayed in phrases corresponding to BTC/USD, BTC/EUR, ETH/BTC and so forth. You’ll be able to additionally business the inverse of any of those, however typically the extra liquid asset is the denominator. In different phrases, the extra liquid asset denominates the marketplace.

In on a regular basis transactions, we simply name this dating a value. If the BTC/USD marketplace displays us one bitcoin is the same as 20,000 bucks, we simply say the cost of bitcoin is $20,000. Identical is going for the whole lot you purchase at any retailer, even supposing the pricing mechanisms for ultimate items like vehicles and snacks are extra advanced and not more clear than a forex.

Simplifying a marketplace pair like bread for bucks down to a cost obscures the position of the denominating forex in that value. We disregard that bucks are part of the bread for bucks transaction, so when the cost of bread strikes, we simplest search for adjustments within the manufacturing of bread. It will lie to us.

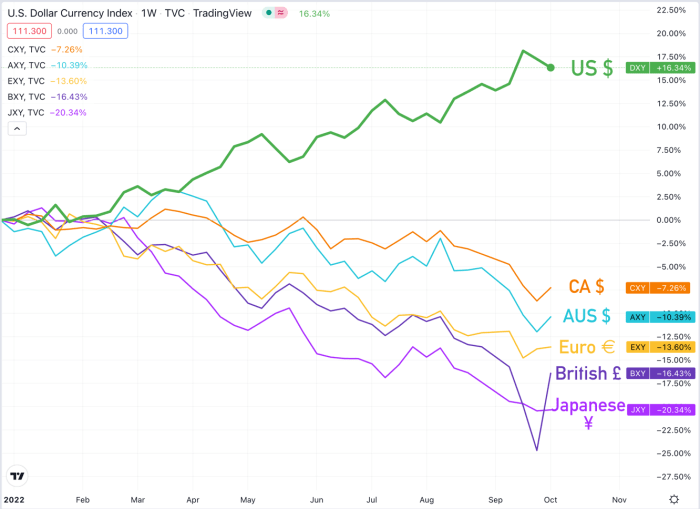

Let’s have a look at currencies towards every different. In the previous few weeks, we noticed many fiat currencies falling towards the greenback in tandem. Are all of those nations every taking movements which can be debasing their currencies in exactly the similar manner towards the greenback, or is the Federal Reserve accountable? For the reason that the Fed has often raised charges this yr, the greenback seems to be to be the wrongdoer within the strikes of those different currencies.

When costs for items are all emerging in combination towards the greenback, as is the case nowadays, it’s extra productive to take a look at the availability and insist of the greenback than at how items and services and products are produced.

Let’s have a look at the Federal Reserve and the U.S. greenback for instance of the results a central financial institution has on its economic system by way of controlling the availability in their financial unit.

The Fiat Curler Coaster

The Federal Reserve holds immense energy over our day-to-day lives thru its regulate of the provision of U.S. bucks and credit score. Underneath the gold usual previous to 1971, a hard and fast provide of gold and a promise to redeem bucks for gold at a hard and fast charge held the printing of latest bucks in test. Now that this restrict is long gone, the Federal Reserve is unfastened to print as many bucks because it needs.

The Fed’s playbook since 1971 is each genius and diabolical, relying in your ethics and what kind of their strikes get advantages your pockets. The playbook resembles a curler coaster experience.

First, the ascent. The Fed makes use of its gear to flood the economic system with reasonable credit score. Companies and folks take out loans to enlarge operations, purchase property and reside a excellent existence. If a trade proprietor resists taking over debt, they possibility being burnt up by way of competition who use loans to enlarge and take marketplace proportion. There’s a prisoner’s catch 22 situation right here, so everybody rushes into debt lest they be left at the back of. GDP grows often, signaling sure coverage effects to quantity crunchers in Federal Reserve workplaces.

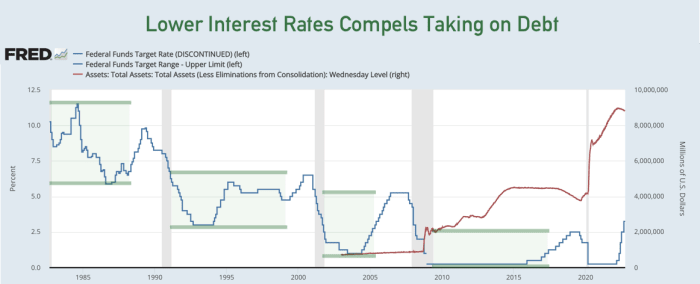

The Fed lowers charges after which helps to keep them low right through growth instances, inflicting unsustainable debt to accumulate amongst folks and companies. Grey bars point out recessions. Supply: Federal Reserve FRED

Within the growth duration between 1982 and 1990, we noticed rates of interest come down from ranges some distance above 10% to vary between 6% and 11.5%. Within the growth between 1991 and 2001 charges oscillated between 3% and six%. From 2001 to 2008 charges went as little as 1%, steadily hiking from 2004-2006 the place they leveled off at 5.5%. After 2009 and till the COVID-19 crash, charges sat round 0% till mountaineering to two.5% started in 2016. Every duration saved charges typically less than the ultimate duration, stimulating companies and folks to tackle debt.

2nd, the crest. Because the Fed makes an attempt to take away liquidity from the marketplace to mood expansion, they make additional debt financing extra expensive. This steadily slows shopper and trade buying, which lowers revenues and makes servicing present debt harder. It should take years, however someday an acute solvency disaster seems when crucial entities or companies can not provider their present debt any more. That is when the autumn starts: recession.

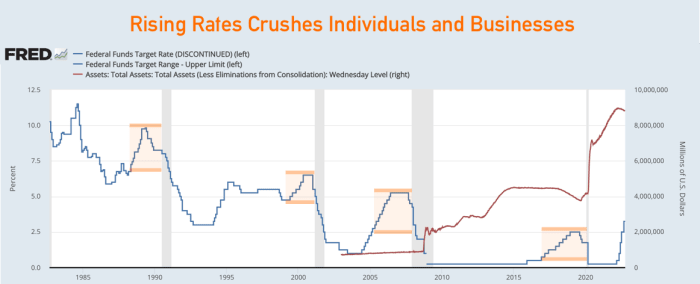

When the Fed hikes charges, they cause a cascading deleveraging tournament, every worse than the ultimate. This leads into recessions, represented by way of grey bars. Supply: Federal Reserve FRED

The autumn is marked by way of monetary tightening changing into a complete blown recession. Going into the 1990 recession was once an acute oil value surprise on account of Iraq’s invasion of Kuwait, and an ongoing savings and loan crisis without delay suffering from emerging rates of interest within the previous few years. The bursting of the dotcom bubble within the yr 2000, simply because the Federal Reserve raised rates of interest, drove all the economic system into recession. The housing bubble that advanced over the 2000s due to low rates of interest ran out of steam and taken the economic system to recession in 2008 after a couple of years of charge hikes collided with dangerous mortgages. Mountain climbing charges from 0% to round 2.5% from 2016 to 2019 reasons banks to prevent lending to one another within the crucial in a single day repo marketplace, placing the monetary machine in danger in 2019.

On account of all of the debt taken on right through the growth instances mixed with the emerging price of capital from upper rates of interest, a solvency disaster creates a pointy and painful fall in costs. This typically happens first in monetary property as companies liquidate what they may be able to to steer clear of defaulting on debt. To halt the autumn and prevent a “contagion” tournament the place one establishment failing brings down others, the Fed once more steps in to flood the economic system with reasonable credit score. This credit score fills the gaping hollow that asset costs have been about to drop thru. We see the Fed shedding rates of interest in a while ahead of all aforementioned recessions, as acute credit score crises rear their unsightly heads.

Publish-2008, interventions to save lots of the established order expanded past rate of interest manipulation to direct bailouts (“quantitative easing”) and authorities fiscal intervention within the type of stimulus tests and well-liked unemployment aid issued without delay to voters in 2020.

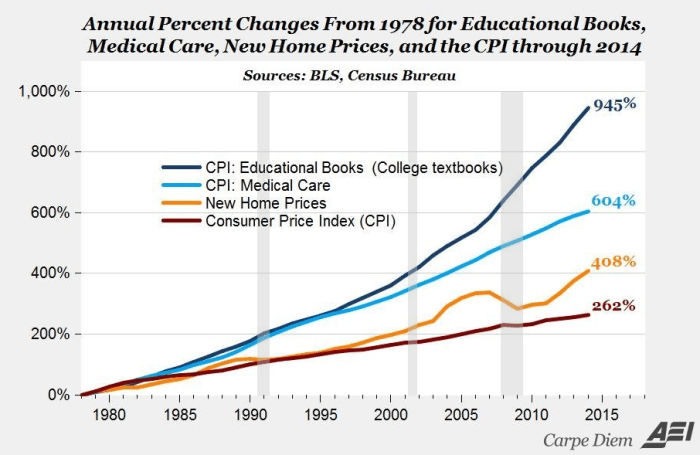

Following those crashes, we’re again firstly of our curler coaster. On the other hand, all isn’t the similar as ahead of. Costs across the economic system stabilize at a higher level than ahead of the curler coaster experience started, and inflation continues unabated.

Costs proceed marching upwards, in spite of recessions. Supply: AEI, edited by way of writer

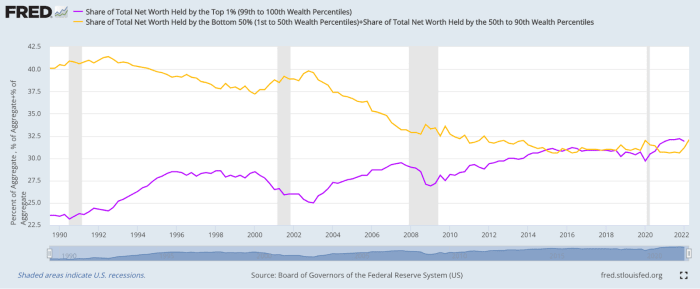

Maximum disturbingly, every drop at the curler coaster drives a reallocation of wealth from productive employees and marketers to unproductive homeowners and the politically liked. The ones establishments that make themselves politically necessary take pleasure in direct bailouts by way of the Federal Reserve and authorities, as we noticed within the 2008 and 2020 recessions. Unproductive homeowners and politically attached folks begin to refill the 1%. Their companies overtake different companies, irrespective of the ease to the client.

Wealth concentrates right through the growth, in brief redistributes right through a deleveraging, after which continues to accumulate a number of the 1% beginning at an excellent upper degree. Supply: Federal Reserve FRED

Fed coverage ahead of, right through and after every recession is constant. Every recession is essentially a liquidity disaster — stemming from centralized control of the greenback — no longer an exterior act of battle, God or company. The Fed’s acts don’t mood present trade cycles; they devise them. This perpetuates a financial machine that encourages well-liked habit to debt, widens the wealth hole and crushes other folks into poverty and dependence thru stable value inflation.

This cycle may be politically self-perpetuating. Since crashes are led to by way of a deleveraging of the debt taken on right through instances of low rates of interest, the federal government can sign that the greed of firms and the wealthy created the disaster. In fact, it’s artificially low rates of interest that create an atmosphere the place all companies will have to change into indebted as a way to stand a possibility towards their competition. On the other hand, many citizens are lulled into believing that capitalism and the unfastened marketplace is the issue. Those citizens willingly surrender extra energy to the federal government and central financial institution, resulting in even worse crises.

Nowadays’s Disaster Of Inflation

Because the early 1980s, in spite of the continuing flood of capital from constantly declining rates of interest, reported inflation in The usa has settled around 2% annually. Despite the fact that you disagree that The usa effectively exported inflation to creating nations thru international utilization of the greenback or that CPI numbers used to file inflation are inherently flawed, you can not forget about the inflation hitting The usa over the last two years.

Taking a look thru our greenback financial coverage lens, we see that the principle wrongdoer for this inflation isn’t undying company greed or a Eu power disaster that simplest started within the spring of 2022. The primary wrongdoer is obviously the unparalleled flood of greenbacks and credit score that entered the marketplace in 2020, which started coursing throughout the economic system in earnest starting with the well-liked lifting of the COVID-19 panic in 2021.

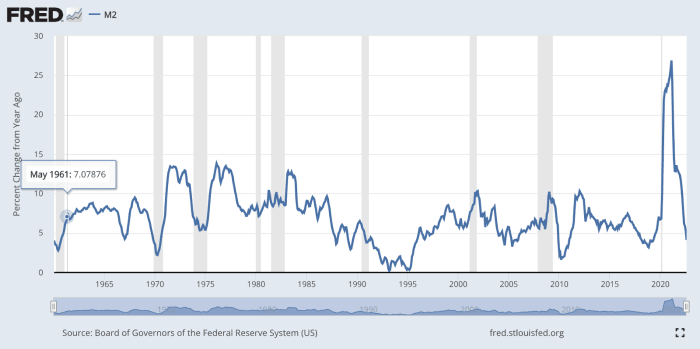

The entire provide of greenbacks higher by way of 40% in simply two years; 2020 and 2021. Supply: Federal Reserve FRED

Inside months, top inflation become a subject of outrage a number of the inhabitants. This pressured the Federal Reserve to the following section in their curler coaster: elevating charges.

Simply 8 months after the Federal Reserve started elevating charges aggressively to curb inflation, cracks are starting to display. Monetary pundits are pointing to indicators of approaching monetary calamity thru increasing credit-default swap spreads on authorities bonds in addition to main world banks corresponding to Deutsche Financial institution and Credit Suisse.

In September, the Financial institution of England introduced “transient” purchases of its authorities’s bonds as a way to “repair marketplace functioning and cut back any dangers from contagion to credit score prerequisites for UK families and companies,” (BoE). Purchasing bonds is an inflationary transfer — finished in an atmosphere of already top inflation.

With many fiat currencies heading for the drain and that worth flowing into the greenback, our greatest disaster but is brewing. During the last 50 years every deleveraging tournament has grown in severity, from one sector to the entire monetary machine and now to complete nations and their currencies.

In gentle of the oncoming disaster, what’s going to governments do to lengthen the inherently damaged financial machine that advantages the politically attached?

Dealing With Disaster

Every fall of the fiat curler coaster necessitates new gear to stay the machine intact.

In 2008, rates of interest hit 0 for the primary time and extra quantitative easing was once had to stay the monetary machine afloat.

In 2020, the Fed once more put rates of interest to 0 and signaled a coverage of “unlimited QE” simply to quell panic and flight from the machine. Along shutdowns mandated by way of authorities businesses, direct stimulus tests to each American in addition to higher unemployment and housing help have been important to stave off a large deleveraging that threatened to take down the monetary and financial machine.

All of those earlier crises got here at a time of reasonably tame inflation. The impending disaster could also be markedly other, since top inflation will make it tough for governments and their central banks to print the forex important to steer clear of well-liked financial cave in. Governments might flip to controls as a way to arrange inflation and dissent whilst conserving the present monetary machine. Those controls, doubtlessly enacted the use of a CBDC — or government-operated checking account — may entail governments:

Cash printing and worth inflation wish to proceed to stay the present machine operational, and controls will arrive because the political solution to them. What can on a regular basis voters hang which is able to keep worth right through financial growth whilst additionally ultimate proof against censorship and seizure by way of governments in search of to regulate the way you transact?

What Bitcoin Used to be Constructed For

Bitcoin was once no longer constructed to be a hedge towards the wider marketplace — finally, right through a deleveraging led to by way of central banks tightening credit score prerequisites, all approach of property might be offered off as a way to provider money owed. The place bitcoin shines is in conserving worth around the arbitrary central financial institution financial coverage cycles, and in its energy to withstand controls.

The costs of actual items take time to replicate newly revealed forex, whilst Bitcoin soaks up newly revealed cash straight away. Whilst the cash printers have been on from spring of 2020 throughout the finish of 2021, Bitcoin rocketed from round $5,000 to just about $70,000.

As a substitute of taking a look at bitcoin from the all time top to its present value, let’s have a look at bitcoin’s expansion in greenback phrases from its earlier cycle lows, after the large deleveraging of the COVID disaster in March 2020. Despite the fact that we think an investor scaled in from the time bitcoin trended between $5,000 and $10,000 in 2020, it returned 200%-400% thus far. The S&P 500 returned round 30% over that point.

On best of natural appreciation towards items and services and products, Bitcoin gives safety and privateness which can be merely unrivaled in every other financial excellent. As a purely virtual forex, you’ll be able to retailer bitcoin with just your brain. This permits dissidents and refugees to evade and break out oppressive governments hell bent on confiscating or controlling how they transact. The Bitcoin community’s decentralized community of nodes and validators helps to keep the machine operating predictably for all customers, with minimum possibility of presidency or company interference to modify the ones regulations.

Bitcoin’s talent to seize worth from an expansionary financial machine whilst additionally evading oppressive authorities controls makes it the very best instrument for shielding hard earned financial savings over the longer term right through this second in historical past.

The U.S. greenback machine manufactures a trade cycle that reallocates wealth from productive enterprises to political allies. Connections are extra precious than benefit in a global the place authorities investment — by means of central banks — is almost limitless. Will you stay using that painful curler coaster, or be part of the answer?

This can be a visitor publish by way of Captain Sidd. Critiques expressed are fully their very own and don’t essentially replicate the ones of BTC Inc or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)