After surging to as top as $20.9k, Bitcoin has nowadays noticed a slight decline again into the low $20ok ranges because of cash in taking from non permanent holders.

Bitcoin Quick-Time period Holder SOPR Has Been Increased Over The Previous Two Days

As identified by means of an analyst in a CryptoQuant post, the non permanent holders appear to be the use of the newest worth upward push for cash in taking.

The related indicator this is the “Spent Output Profit Ratio” (SOPR), which tells us whether or not the common investor is promoting Bitcoin at a cash in or at a loss at this time.

When the worth of this metric is bigger than 1, it method the entire marketplace is knowing some quantity of cash in recently. Alternatively, values under the brink recommend the holders as a complete are promoting at a loss

Naturally, values of the SOPR precisely equivalent to at least one recommend that the traders are simply breaking even on their promoting nowadays.

Now, there’s a cohort within the Bitcoin marketplace known as the “short-term holders” (STHs), which incorporates all traders who’ve been preserving their cash since not up to 155 days in the past.

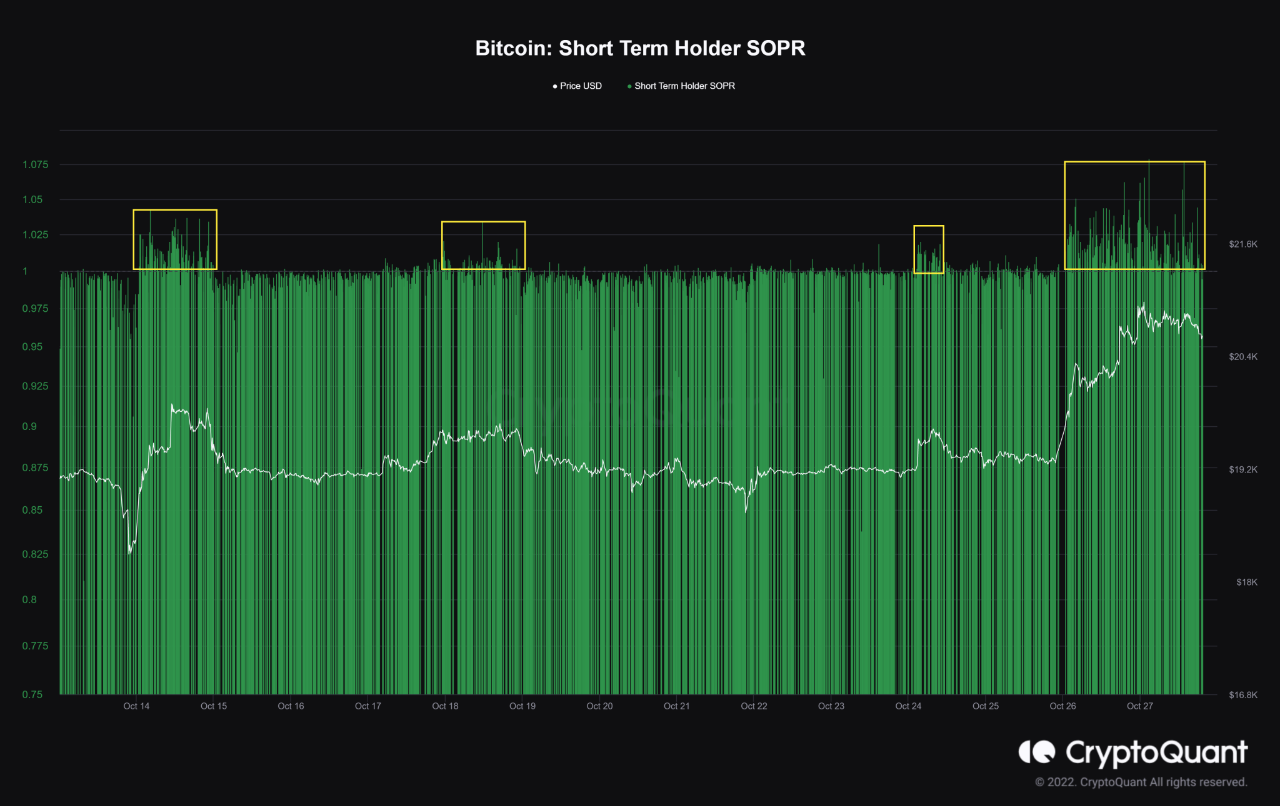

Here’s a chart that displays the fad within the BTC SOPR particularly for this holder team during the last couple of weeks:

The price of the metric turns out to have spiked up in contemporary days | Supply: CryptoQuant

As you’ll see within the above graph, the Bitcoin STH SOPR has been increased above the 1 degree throughout the remaining two days or so.

This upward push has coincided with the BTC worth after all surging up after shifting sideways round $19ok for a protracted whilst. This means that those traders are the use of this chance to reap some income.

Such profit-taking is in most cases bearish for the cost of the crypto, and because the chart presentations, there have been 3 cases of this sort of pattern throughout the previous two weeks. All of the ones cash in realization sprees from the STHs led to the associated fee going back off after a non permanent upward push.

This time as smartly the BTC worth has long past down from its top of $20.9k to as little as under $20.1k. sooner than retracing again up some to the present degree.

BTC Value

On the time of writing, Bitcoin’s price floats round $20.5k, up 8% within the remaining seven days. During the last month, the crypto has won 7% in worth.

Underneath is a chart that displays the fad in the cost of the coin during the last 5 days.

Looks as if the worth of the crypto has long past down during the last couple of days | Supply: BTCUSD on TradingView

Featured symbol from Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)