On-chain information displays Bitcoin traders had been chickening out massive quantities from exchanges as mistrust round them has grown just lately.

FTX Debacle Leads To Extra Bitcoin Traders Distrusting Exchanges

As identified by means of an analyst in a CryptoQuant post, traders who’ve change into afraid to carry on exchanges are sending their BTC to private wallets.

There are a few related signs right here; the primary is the “Energetic Receiving Addresses,” which tells us the whole choice of wallet addresses that had been energetic as receivers all over a selected time frame.

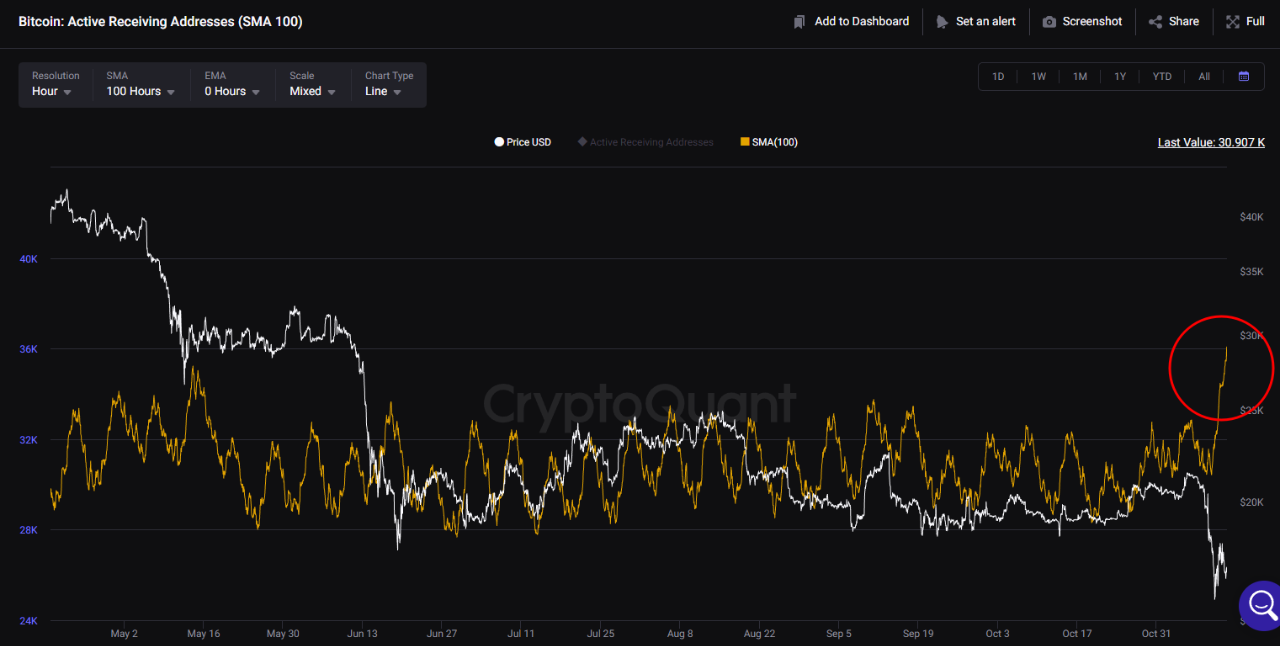

The beneath chart displays the fad within the 100-day easy transferring moderate price of this Bitcoin indicator over the past six months:

The 100-day SMA price of the metric turns out to have spiked up in contemporary days | Supply: CryptoQuant

As you’ll be able to see within the above graph, the worth of the Bitcoin Energetic Receiving Addresses has been very top in the previous few days.

Which means traders had been sending cash to numerous particular person wallets for the reason that crash because of the FTX debacle.

The opposite indicator of pastime is the “all exchanges reserve,” which measures the whole quantity of BTC these days sitting within the wallets of all centralized exchanges.

Here’s a chart that displays the fad on this Bitcoin metric:

Looks as if the worth of the metric has been happening just lately | Supply: CryptoQuant

From the graph, it’s obvious that the Bitcoin trade reserves were following an general downwards trajectory for greater than a 12 months now, however the metric has plunged particularly exhausting in contemporary days.

This plummet within the indicator has additionally coincided with the cave in of FTX. Generally, the trade reserves spike up all over main crashes as traders switch their cash to exchanges for dumping.

The new pattern within the metric has obviously, then again, no longer adopted this trend. The trade reserve happening, mixed with the truth that numerous wallets are energetic presently, suggests particular person traders are taking the cash out to their private wallets.

This displays that the FTX disaster has as soon as once more made Bitcoin holders cautious about conserving their cash within the custody of centralized exchanges, as they’re who prefer to withdraw them to particular person wallets.

BTC Value

On the time of writing, Bitcoin’s value floats round $16.5k, down 20% within the ultimate seven days. Over the last month, the crypto has misplaced 15% in price.

BTC has been transferring sideways in the previous few days | Supply: BTCUSD on TradingView

Featured symbol from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)