Given the higher price of digitalization, blockchain generation and the Crypto sector have discovered extra programs within the conventional finance sector. Cryptocurrencies have supplied new virtual cost techniques, broader monetary inclusion, and innovation. On the other hand, virtual belongings are extremely risky, posing a problem to their use as shops of price and way of cost.

This volatility resulted in the creation of stablecoins. Those virtual belongings have received extra traction through the years because of sooner remittance bills. However stablecoins have additionally confirmed risky throughout excessive marketplace prerequisites.

A record disclosed that the Hong Kong Central Financial institution is worried that stablecoins and virtual belongings would possibly negatively affect the fiat forex device.

The Hong Kong Financial Authority (HKMA) assessed the location. Of their findings, they seen that the instabilities of virtual belongings and asset-backed stablecoins may spill over to the standard finance device.

Main points Of HKMA’s Evaluate

The asset-backed stablecoins evaluate highlighted the chance of liquidity mismatch, which impacts their balance throughout sell-out (fire-sale) occasions. A hearth sale match is a time of economic value fluctuation when buyers should purchase stablecoins not up to the marketplace value.

In step with the Central financial institution of Hong Kong, the correlation of crypto belongings has rendered the crypto trade liable to systematic shocks. As well as, the higher publicity of economic establishments to crypto would possibly lead them to be liable to shut-down results from surprising adjustments in cryptocurrency costs.

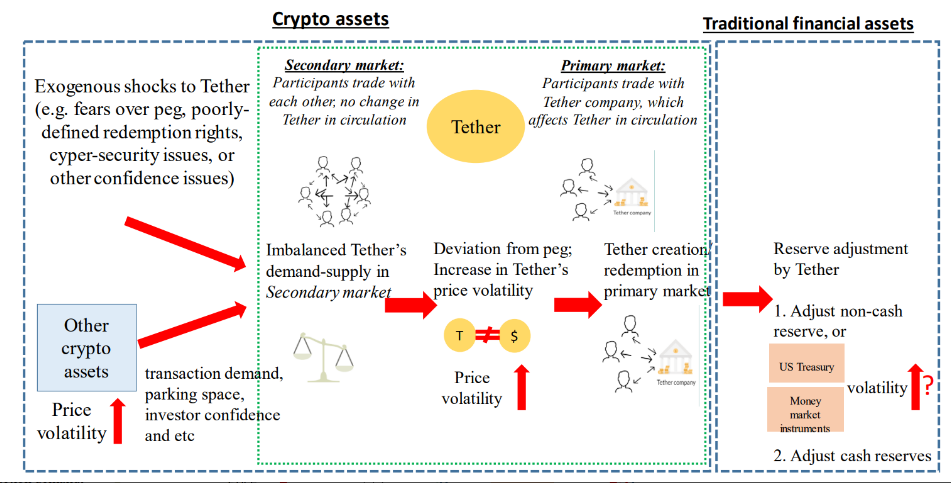

The HKMA defined additional with a flowchart, appearing the spillover results of crypto on conventional finance belongings. The flowchart means that the fee fluctuations of asset-backed stablecoins may cause opposite changes on stablecoins. The speculation steers the adjustment that the call for and provide of stablecoins could cause value volatility.

A Flowchart illustrates the transaction mechanism of Tether stablecoin and the spillover channel from crypto to conventional monetary belongings.

The HKMA studied the cave in of USD Terra (USDT), which led to a large value decline in Tether stablecoin. The Hong Kong financial institution steered the institutionalization of standard monetary disclosures to permit regulators to stay tabs at the liquidity prerequisites of crypto companies.

The HKMA additionally beneficial that regulators support the asset-backed stablecoins’ liquidity control by means of striking restrictions at the Composition of reserve belongings.

Hong Kong Welcomes Crypto ETF Choices

In the meantime, the Securities and Futures Fee (SFC) of Hong Kong gave feedback that toughen the HKMA’s suggestions. The fee steered that control corporations that need to be offering exchange-traded fund (ETFs) choices will have to have a just right monitor document of regulatory compliance.

In a brand new replace, the HKEX Crew launched a tweet welcoming the SFC’s announcement as permission to record ETFs with digital belongings. The change mentioned that the tips would facilitate the expansion of Hong Kong as Asia’s main ETF market.

The Hong Kong-based change remarked that list ETFs would make stronger Hong Kong’s position as a global finance heart.

Featured symbol from Pixabay, chart from TradingView.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)