On-chain information presentations that Bitcoin “mid-term” holders were at the transfer throughout the previous day, suggesting that they could also be dumping lately.

Bitcoin 3-6 Months Age Band Displays Massive Spike In Spent Outputs

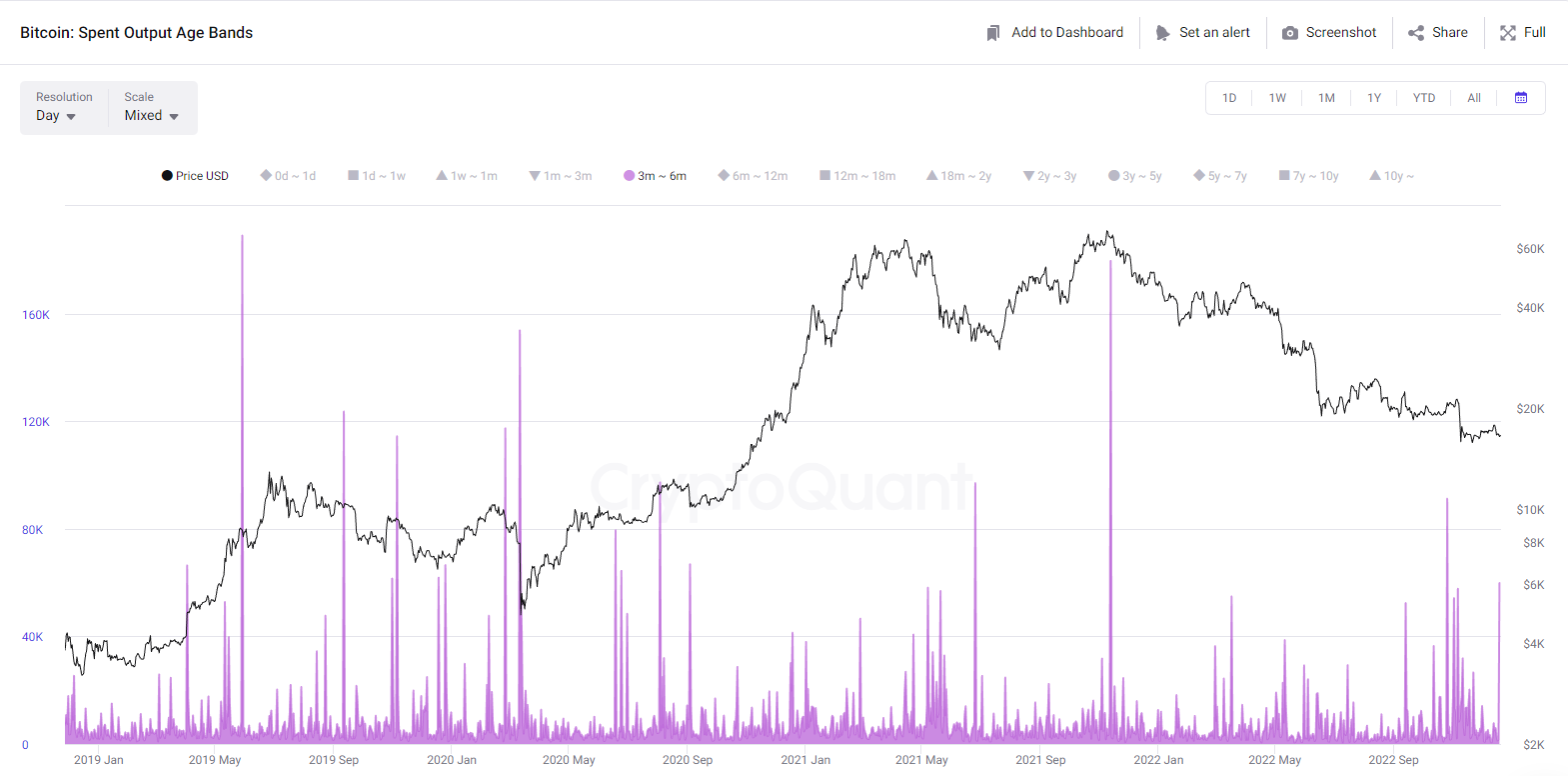

As identified by means of an analyst in a CryptoQuant post, an build up within the spent outputs for the 3-6 months workforce has led to large strikes for BTC sooner than. The related indicator here’s the “Spent Output Age Bands,” which tells us which age bands within the Bitcoin marketplace are transferring what number of cash at this time.

Those “age bands” are teams that outline levels between which the cash (or holders) falling into stated band final confirmed any motion or promoting. As an example, the “1m-3m” age band contains all tokens which were sitting dormant since a minimum of 1 month and at maximum Three months in the past. If holders belonging to this workforce shift their cash, then the transfer will display up as a spike at the spent outputs chart for the band.

Within the context of the present subject, the related age band is the “3m-6m” workforce. Here’s a chart that presentations the craze within the spent output metric for it throughout the previous couple of years:

The price of the metric turns out to have shot up throughout the final day | Supply: CryptoQuant

Because the above graph presentations, the spent output metric has recorded a big price for the 3m-6m Bitcoin age band lately. The holders belonging to this workforce are once in a while known as the “mid-term holders,” on account of the truth that their vary covers the boundary between the non permanent holder and the long-term holder cohorts.

From the chart, it’s obvious that in most cases every time this holder workforce has proven indicators of heavy dumping, the cost of BTC has noticed a steep decline in a while after. The newest crash following the collapse of FTX, too, was once preceded by means of a big motion from those traders.

After the present spike, Bitcoin has in truth already noticed a non permanent drop, because the underneath chart presentations. On the other hand, it’s unclear in this day and age whether or not this decline was once all there may be going to be. If previous examples are anything else to head by means of, Bitcoin normally observes a big transfer every time this development paperwork, which suggests the actual decline from the most recent spike could also be but to come back.

A better take a look at the fee development following the spike within the indicator | Supply: CryptoQuant

BTC Worth

On the time of writing, Bitcoin’s price floats round $16.8k, down 3% within the final week.

Seems like the worth of the crypto has been transferring sideways for the reason that plunge a couple of days again | Supply: BTCUSD on TradingView

Featured symbol from mana5280 on Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)