BTC shrugs off Genesis with 9% achieve. HBAR sees a upward thrust in TVL. AXS good points however promoting may include token release. MATIC governance disappoints.

BTC

The Bitcoin value prolonged a up to date rally to check the $23,000 degree. The sector’s biggest cryptocurrency by way of marketplace cap was once upper by way of 9% for the week.

The bullish transfer in BTC got here in spite of the bankruptcy of the Genesis crypto lending platform. The corporate is the newest sufferer of the FTX change cave in and bumped into issues after having $175 million locked up in FTX.

Genesis first bumped into issues of the cave in of any other crypto company, 3 Arrows Capital, which went bust in June closing yr. The corporate was once owed $1.2bn by way of 3 Arrows, which were introduced down by way of the failure of the Terra stablecoin and LUNA.

Previous this month, Genesis mentioned it was once slicing 30% of its team of workers, and is alleged to owe collectors $3.five billion. A kind of is the Gemini platform, owned by way of the Winklevoss twins, which had partnered with Genesis at the Earn staking protocol.

Some 340,000 Earn customers had been not able to achieve get right of entry to to their finances because the FTX cave in in November when Genesis was once pressured to halt withdrawals. Gemini has since been stuck up in a high-profile spat with its mother or father corporate, Virtual Forex Team. DCG additionally owns the Coin Table information platform and satirically, it broke the inside track tale that ended in the loss of life of FTX and the worries at its mother or father company.

Bitcoin will now glance to check the $25,250 degree which marked the low in Would possibly for the crypto marketplace.

HBAR

Hedera (HBAR) fixed a 30% rally this week as traders take pastime within the good contracts platform. The venture was once laborious hit within the 2021 endure marketplace with a value drop from $0.50 to $0.044. Hedera is aiming to be a disruptor within the good contracts house however there may be already stiff pageant from the likes of Avalanche, Fantom, and Ethereum.

Hedera stands on a platform of offering good contracts which can be “smarter” with speeds of as much as 10x more than its opponents. The venture may be taking a look to diversify into different spaces. Non-fungible tokens are an pastime for Hedera and a venture insider just lately talked of the inside track that tech large LG is rolling out its new tv era which can combine the HBAR NFT market. The TVs would additionally permit customers to show their NFT assortment. That would ultimately spice up HBAR because of the massive marketplace succeed in that LG has in the house equipment international.

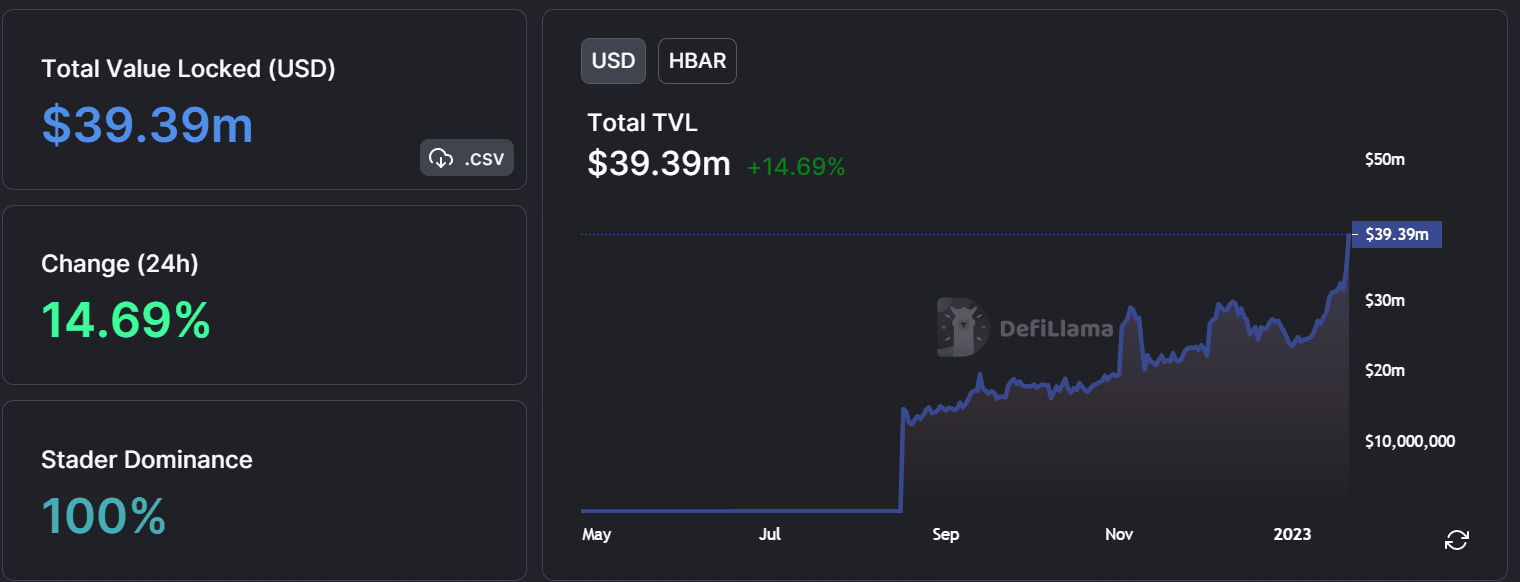

Hedera was once boosted this week by way of on-chain metrics as Santiment reported a big build up in buying and selling quantity. The Hedera community’s on-chain metrics, reminiscent of transactions according to 2nd and overall worth, had been emerging, along its Overall Worth Locked. Over 40 million transactions had been processed on Hedera, at a mean of 469.7 transactions according to 2nd (TPS) and a most of 6,856 TPS.

The TVL has now grown to $39 million, which is up sharply from Would possibly 2022, in keeping with DefILlama.

Hedera these days trades at $0.07 after this week’s value rally and has resistance across the $0.0840 degree.

AXS

Axie Infinity (AXS) was once any other robust performer this week, with the play-to-earn venture seeing a 40% bounce in its token.

Then again, there are worries of attainable promoting power forward of a token release. The approaching token release will free up 4.89 million new tokens, representing 1.8% of the asset’s 270 million overall provide, in keeping with Token Unlocks.

Hartmann Capital, Felix Hartmann, mentioned: “Traditionally groups have stored up bulletins for unlocks. I feel the marketplace has turn into so reflexive that folks purchase in anticipation of release information. The investment price is at round +0.03% that means beginning to see an imbalance with extra longs than shorts.”

The Axie Infinity platform may be suffering as user numbers proceed to say no within the blockchain sport. The P2E sport had as regards to 100,000 day by day are living gamers and 432,000 during the last month. It is a heavy decline from the two.Three million gamers recorded on the venture’s top in overdue 2021. Believe in Axie Infinity was once harm when the Ronin Community, which hosted the sport, was once hacked for $600 million.

The cost of AXS these days trades at $12 after a three-week rally within the token.

MATIC

Polygon (MATIC) didn’t sign up for the week’s bullish rally after issues over a difficult fork.

There have been issues concerning the decentralization of Polygon’s community after it was once mentioned that most effective 13 other people finished the new improve. The platform effectively finished the laborious fork closing Tuesday, growing a brand new Polygon blockchain that builders hope will see sooner transactions and restricted gasoline charge spikes.

Whilst the improve was once hailed as a technical development, governance was once wondered. In December, Polygon’s Governance Workforce put forth the preliminary laborious fork proposal. Then again, most effective the community’s 100 validators have been invited to take part within the vote, with most effective 15 vote casting and 13 approving the transfer.

In all, simply 15 validators forged their votes. 13 of them signed directly to Polygon’s plan, known as 87% in want. A supply accustomed to the topic advised Decrypt that a variety of Polygon validators haven’t even Regardless of the unfavourable sentiment, there was once excellent information for Polygon within the pattern for Layer 2 utilization. Polygon, Optimism, and Arbitrum have all noticed higher day by day consumer task up by way of 30%, 180%, and 40%, respectively.

MATIC has been discovering resistance on the $1.00 degree and these days trades beneath it.

Disclaimer: data contained herein is supplied with out taking into consideration your individual cases, subsequently must now not be construed as monetary recommendation, funding advice or an be offering of, or solicitation for, any transactions in cryptocurrencies.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)