Information from Santiment presentations those altcoins have observed increased whale process just lately, which can make them ones to look ahead to within the coming days.

Polygon (MATIC), Aave (AAVE), And Dydx (DYDX) See Larger Whale Transactions

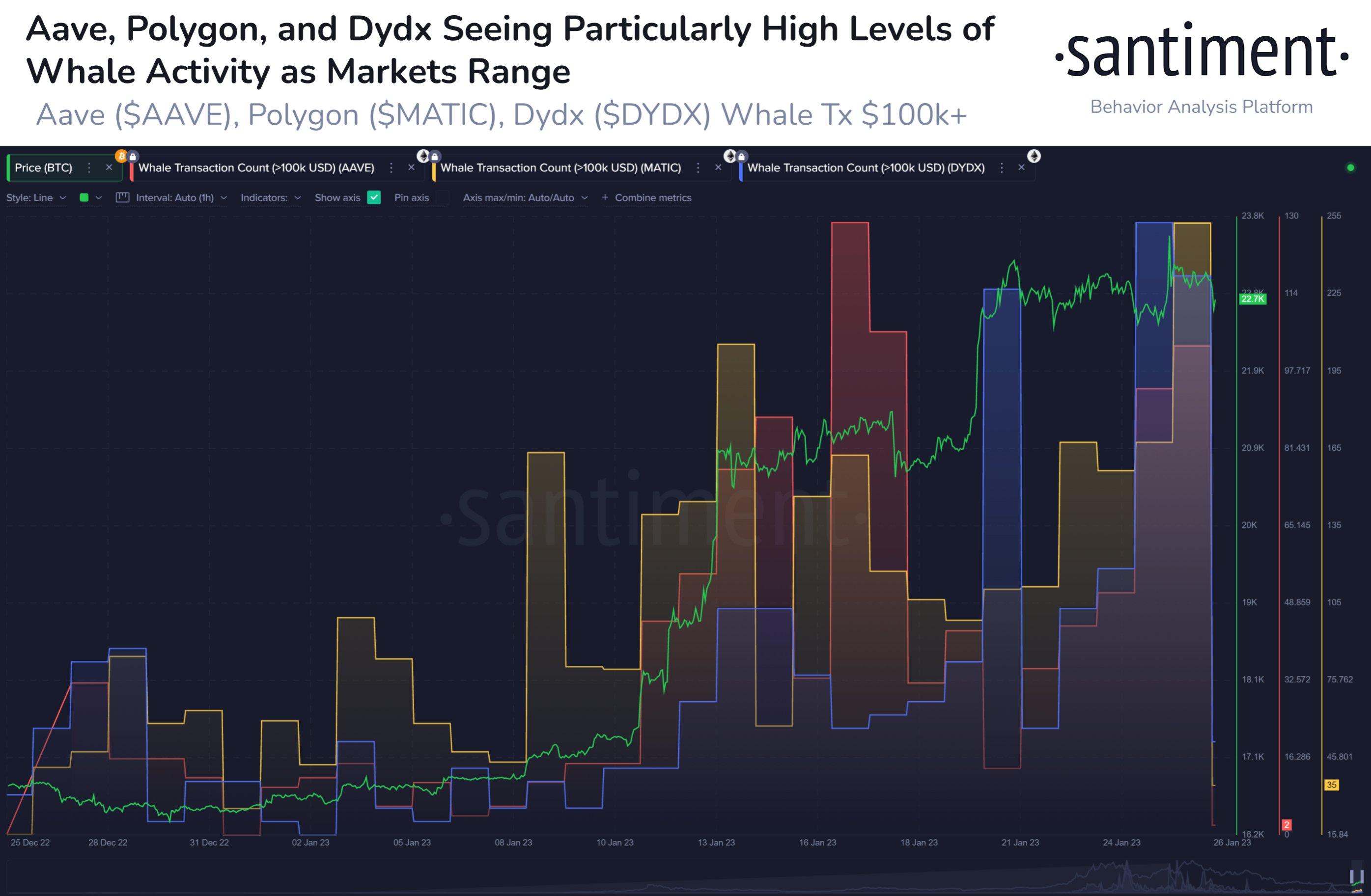

In line with knowledge from the on-chain analytics company Santiment, Polygon, Aave, and Dydx have all rallied together with prime whale process just lately. The related indicator here’s the “whale transaction rely,” which measures the entire choice of transfers that whales are making at this time.

Within the context of those altcoins, the situation for a transaction to rely as one coming from whales is that it will have to contain a motion of cash value no less than $100,000.

When the worth of this metric is prime for any coin, it method whales are making a lot of transactions of that individual crypto these days. This development suggests those humongous holders are actively buying and selling the precise coin nowadays.

Since whale transactions contain the motion of enormous scales of capital, a vital choice of them in combination can occasionally noticeably affect the marketplace. On account of this, the whale transaction rely being at sizeable values may end up in larger volatility in the cost of the crypto in query.

Now, here’s a chart that presentations the craze within the whale transaction rely for 3 other altcoins (Polygon, Aave, and Dydx) over the last month:

The values of all of the 3 metrics appear to have been prime in fresh days | Supply: Santiment on Twitter

As displayed within the above graph, Polygon, Aave, and Dydx have all seen some beautiful prime whale process all over the previous month. On this duration, those altcoins have additionally proven some vital rallies (AAVE has climbed 56%, MATIC 35%, and DYDX 94%).

Apparently, essentially the most vital spikes within the whale transaction rely for those cryptos got here when the marketplace used to be ranging (as can also be observed from the BTC worth curve within the above graph) between January 13 and January 18. Following this atypical burst of process, the rally (which had come to a short lived halt) resumed its momentum and the altcoins sharply larger of their price.

In the previous few days, the indicator’s values have once more been at identical (if now not outright upper) ranges as observed all over the aforementioned increased whale process duration previous within the month. As used to be the case remaining time round, the costs are interestingly ranging at this time as neatly.

Whilst prime whale transaction counts can also be each bearish or bullish for the costs of those cash (for the reason that increased process by myself doesn’t let us know if the transfers are being carried out for purchasing or promoting functions), the truth that the present trend is very similar to that previous within the month, when prime process from this cohort used to be actually bullish, may indicate the chances could also be within the desire of those altcoins.

Both method, as Santiment suggests, “the larger massive cope with hobby in those property will have to be watched carefully.”

MATIC Value

On the time of writing, Polygon is buying and selling round $1.0955, up 14% within the remaining week.

Seems like the worth of the altcoin has surged previously day | Supply: MATICUSD on TradingView

Featured symbol from Artwork Rachen on Unsplash.com, charts from TradingView.com, Santiment.internet

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)