Sign up for Our Telegram channel to stick up to the moment on breaking information protection

The sale of LBRY Credit (LBC) tokens within the secondary marketplace does now not rely because the sale of a safety, the United States Securities and Exchange Commission (SEC) has publicly said. The settlement was once reached on January 30 all through an enchantment listening to within the LBRY v. SEC case.

LBRY Listening to: The Stakes for ALL Crypto https://t.co/YPbrBkw0Od

— CryptoLaw (@CryptoLawUS) January 30, 2023

Legal professional John Deaton resolved a vital level of rivalry on the enchantment listening to, which many considered as a victory for the entire cryptocurrency business towards the SEC’s overreaching regulation by the use of enforcement.

On November 7, 2022, the SEC was once given abstract judgment in its prefer. The decision, which lined a six-year duration, categorized each and every sale of the LBC token as an funding contract with out going into specifics in regards to the transactions. The SEC was hoping to make growth in its venture to legitimize the secondary marketplace and convey it underneath its jurisdiction. The SEC has asked the district court docket pass judgement on in New Hampshire to uphold the vast, complicated injunction forbidding its sale.

Deaton sought rationalization for LBC secondary marketplace transactions as a result of he concept the injunction was once imprecise and overbroad as an amicus curiae representing tech journalist Naomi Brockwell. An amicus curia is an individual or staff that isn’t a birthday celebration to a lawsuit however is permitted to make stronger a court docket via offering knowledge, wisdom, or perception this is related to the case’s problems.

Deaton highlighted a record written via business contract legal professional Lewis Cohen that checked out all safety claims introduced in the USA for the reason that SEC vs. W.J. Howey Co case. All over Cohen’s research of safety instances in the US, no court docket admitted that the underlying asset was once safety at any degree.

The pass judgement on was once satisfied via Deaton that LBC’s secondary marketplace transactions weren’t securities. So as to keep away from offering cause of LBC, the SEC asked an order that doesn’t distinguish between LBRY, the corporate’s control, and customers. The pass judgement on stated, turning to stand Deaton:

Amicus, I’m going to make it transparent that my order does now not follow to secondary marketplace gross sales.

Many of us within the cryptocurrency group, particularly holders, had been relieved via the verdict within the case. The SEC has filed a securities criticism towards Ripple for the sale of XRP tokens. The long-running Ripple litigation would possibly get pleasure from the present resolution indicating that the secondary marketplace promoting of LBC tokens does now not represent as a safety. A professional-XRP Twitter account claimed that the verdict additionally qualifies XRP as a non-security.

If the SEC admitted LBRY isn’t a safety then they know evidently that #XRP is surely now not a safety 😁

— XRPcryptowolf (@XRPcryptowolf) January 30, 2023

That’s going to smash the name of the game court docket motion towards XRP, would possibly this drive a agreement, some other person speculated based on the hot judgement within the Ripple lawsuit.

Others praised Deaton for his ongoing efforts to fight the SEC’s overreach as a result of he has taken a number one position within the Ripple litigation.

Battle For Your Health (FGHT) Presale

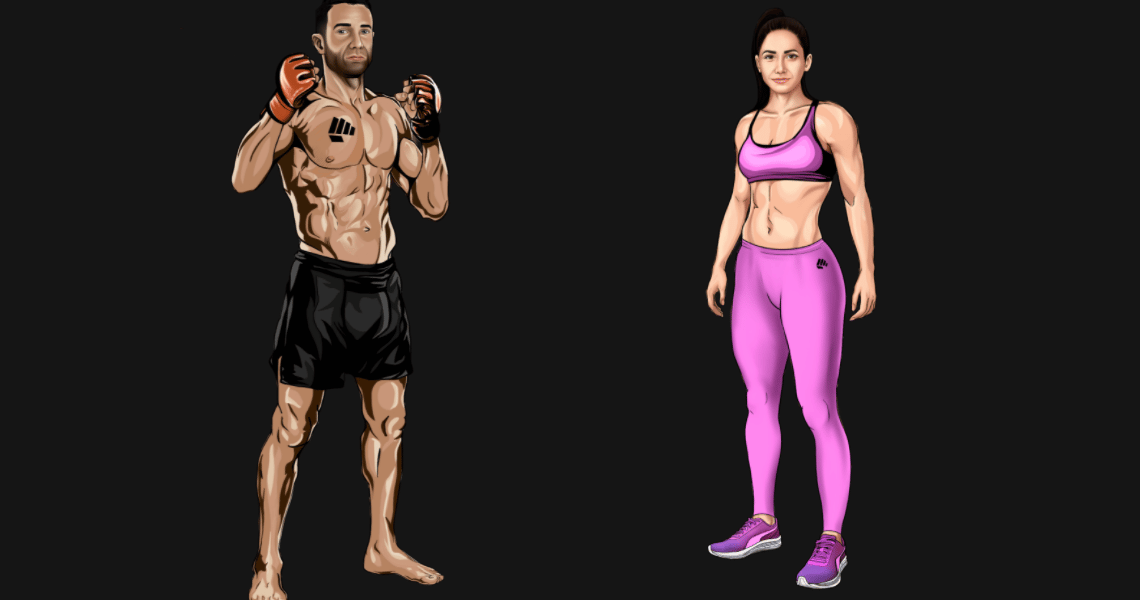

With the usage of state of the art Web3 and M2E (move-to-earn) era, a brand new company known as Fight Out hopes to revolutionize the health sector. This novel technique was once advanced based on conventional gyms’ prime member attrition charges, which moderate 50% of recent participants leaving inside the first six months of becoming a member of. Probably the most major explanations for this can be a loss of power, in addition to a loss of group and customization.

By way of offering a whole resolution that features a unique NFT avatar that represents the person’s health profile and a REPS token rewards machine, Battle Out is fixing those problems. Those tokens, which can be utilized to get reductions on app subscriptions, health club memberships, non-public teacher periods, and merchandise like dietary supplements, workout equipment, and clothes, are earned via doing workout routines, whether or not at house or in a facility.

The primary health club is scheduled to debut within the fourth quarter of 2023. The corporate additionally has plans to determine bodily gyms in all places the arena. Those gyms will be offering state of the art equipment and services and products along with Web3-integrated parts like “mirrors” that display the person’s virtual health profile and sensors that track development. Battle Out is situated to take the health business via hurricane via that specialize in measurable objectives, personalization, and a way of group.

Amongst others, former WBO middleweight champion Savannah Marshall, UFC stars Amanda Ribas and Taila Santos, and others have joined Battle Out’s squad of ambassadors. Its distinctive concepts and superstar affect have helped the FGHT token presale elevate $3.76 million up to now, making it some of the biggest altcoins to spend money on.

Similar

Battle Out (FGHT) – Transfer to Earn within the Metaverse

- CertiK audited & CoinSniper KYC Verified

- Early Degree Presale Reside Now

- Earn Unfastened Crypto & Meet Health Targets

- LBank Labs Undertaking

- Partnered with Transak, Block Media

- Staking Rewards & Bonuses

Sign up for Our Telegram channel to stick up to the moment on breaking information protection

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)