Be part of Our Telegram channel to remain updated on breaking information protection

Bitcoin is slowly approaching the $30,000 value mark as a result of current macro occasions which have resulted in elevated shopping for stress from traders trying to safe their investments.

Now, the asset is main the crypto market rally, with a 0.1% improve within the final 24 hours.

May Bitcoin see a gentle and sequential rise again to the highest? Rising robust fundamentals appears to level in that route.

Bitcoin’s Solidifying a Bullish Development in a Unstable International Monetary Panorama

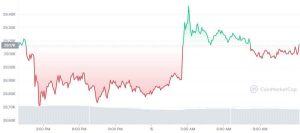

At press time, the proof-of-work (PoW) asset is buying and selling at $29,164.32, reflecting a 0.1% improve within the final 24 hours.

Whereas this determine might sound negligible, Bitcoin has been steadily constructing robust assist across the $28,700 value vary within the final two days.

The digital asset briefly touched the $29,000 peg earlier than dipping to $28,900 final night time. Now, BTC is trying to solidify its place and break above the $30,000 resistance degree it has confronted up to now week.

its seven-day efficiency, we will see that the decentralized digital forex just isn’t but out of the woods.

Bitcoin has shed 1.10% of its positive factors up to now week however has maintained a bullish outlook of three.49% up to now 30 days.

Its bullish streak has not subsided since 2023 started, because it has clocked in a neat 24.39% surge up to now three months and 36.85% within the final 180 days.

A very powerful metric for Bitcoin’s bulls and long-term holders is the year-to-date (YTD), which the digital asset has aced. The token is up by 76.21% YTD exhibiting that long-term trades often repay.

Turning our sight to its technicals present the place Bitcoin is presently sustaining. The 50-day clean shifting common (SMA) value of $28,580 reveals that the asset is flying excessive within the brief time period.

Wanting additional, its 200-day SMA value of $22,048.58 reinforces this fact. With the bulls again in play, Bitcoin’s relative power index (RSI) is a sight to behold as a result of its large revenue alternative.

The RSI determine of 59.14 means the digital asset continues to be within the underbought zone making now a viable time to purchase Bitcoin and rise with the market.

Its shifting common convergence divergence (MACD) continues to be in its formative stage, however the purchase sign is already making a case for supremacy.

Bitcoin Changing into Extra Enticing by the Day

Since its debut in January 2009, Bitcoin has change into the accepted commonplace for every thing a decentralized forex may change into.

To start with, many authorities businesses and public figures have been reluctant to again and even point out the crypto asset. Now, with broader acceptance as a medium of trade throughout completely different borders, governments have been compelled to take discover.

One such is the Montana authorities of america which has not too long ago prohibited the taxation of Bitcoin as a cost medium.

BREAKING: The state of Montana indicators into regulation a invoice prohibiting any taxation on using #Bitcoin as cost.

— Dennis Porter (@Dennis_Porter_) Could 5, 2023

The State of Montana has additionally given the inexperienced mild to mine Bitcoin inside its territory and prohibited native governments from sanctioning the transfer.

₿𝗥𝗘𝗔𝗞𝗜𝗡𝗚: The ‘Proper to Mine #Bitcoin’ is now protected by regulation within the State of Montana. pic.twitter.com/JNVoKGHLmb

— Documenting ₿itcoin 📄 (@DocumentingBTC) Could 5, 2023

Governments should not the one ones who’ve backed the anonymously created asset. Robert Kennedy Jr. is a brand new Bitcoin evangelist following within the footsteps of MicroStrategy Chairman Michael Saylor.

In his most up-to-date tweet, Kennedy Jr acknowledged unequivocally that Bitcoin’s decentralized nature ensures monetary liberty from authorities interference.

That’s the reason I oppose CBDCs, which can vastly amplify the federal government’s energy to suffocate dissent by chopping off entry to funds with a keystroke. That’s additionally why I assist bitcoin, which permits folks to conduct transactions free from authorities interference. Bitcoin has been a…

— Robert F. Kennedy Jr (@RobertKennedyJr) Could 5, 2023

Moreover, he expressed opposition to central financial institution digital currencies (CBDCs), regardless of their use of blockchain expertise. His concern is that CBDCs may give the world governments extra management to silence opposing voices by digitally limiting entry to customers’ funds.

Bitcoin’s rising adoption may sign the beginning of a brand new monetary order, and in that case, the digital asset may retest its early report excessive of $69,000 within the coming months.

Associated Information

AiDoge – New Meme to Earn Crypto

- Earn Crypto For Web Memes

- First Presale Stage Open Now, CertiK Audited

- Generate Memes with AI Textual content Prompts

- Staking Rewards, Voting, Creator Advantages

Be part of Our Telegram channel to remain updated on breaking information protection

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)