As of the date of this writing, block 737,000, Bitcoin is sort of two-thirds into its 366th issue epoch. An issue epoch is a duration wherein 2,016 blocks are added to Bitcoin’s ledger, preferably in 20,160 mins, or 14 days. If the epoch leads to much less time, the community adjusts the trouble of effectively mining a Bitcoin block upwards to regain a 10-minute block cadence, and vice versa. All of the historical past of Bitcoin’s issue is proven within the graphic under (it’s possible you’ll want to zoom in — it’s slightly an enormous graphic).Determine one: Historic Problem Adjustments Since Inception

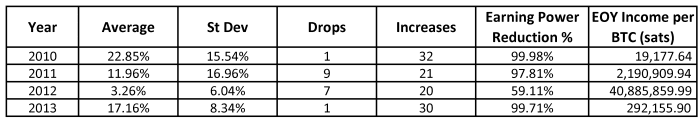

In overall, 15 epochs, round 4% of all epochs, skilled no issue alternate. Those in order that came about to be the first actual 15 epochs the place principally simply Satoshi Nakamoto, Hal Finney and a couple of dozen folks have been mining. Of the remainder 351 epochs, 283 (77.5% of all epochs) would see an issue build up, with 67 epochs seeing an issue lower. We can delve into those sessions of lower later on this piece.

Towards the tip of 2009, Nakamoto made a plea to the grasping, opportunistic Bitcoiner neighborhood not to mine with their GPUs. And I quote, “We will have to have a gentleman’s settlement to put off the GPU hands race so long as we will be able to for the great of the community. It is a lot easer [sic] to get new customers on top of things if they do not have to fret about GPU drivers and compatibility. It is great how somebody with only a CPU can compete reasonably similarly at the moment.”

Bitcoiners being the grasping opportunists that they’re (this, via the best way, is nice for Bitcoin, because it drives all innovation) broke this gentleman’s settlement, and the GPU mining generation would begin, and sooner or later, so too the ASIC mining generation, however extra on that later.

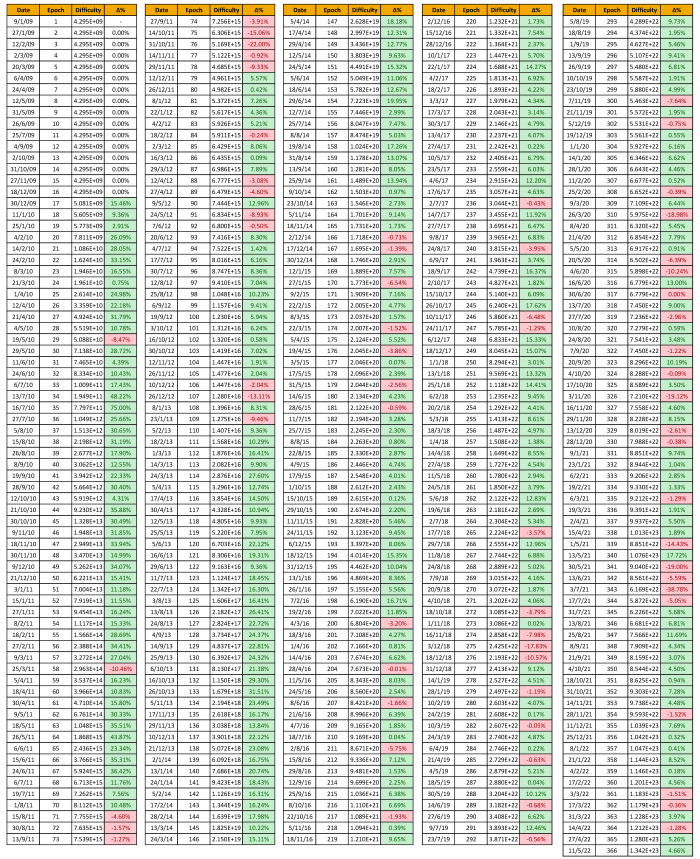

Determine two: Problem Vs. Worth, Log-Log Scale, 2009. Right here we see that Bitcoin doesn’t also have a marketplace charge, and issue is strong for all the yr, save for one massive leap on the graduation of the GPU mining generation at yr’s finish.

In 2009, the common issue build up used to be 0.966%, with a typical deviation of three.865%. Clearly, since bitcoin didn’t have a marketplace charge in 2009, profitability calculations are moot, however for those who didn’t upload any CPU or GPU energy, for the yr, for those who have been incomes 1 BTC at the beginning of the yr, you possibly can earn 14.39% much less, or round 0.8561 BTC, via the tip. Clearly, this assumes the miner has 100% absolute uptime, and doesn’t lose source of revenue thusly (extremely not likely, however let’s be beneficiant!).

2010 To 2013: The GPU Mining Generation

2010

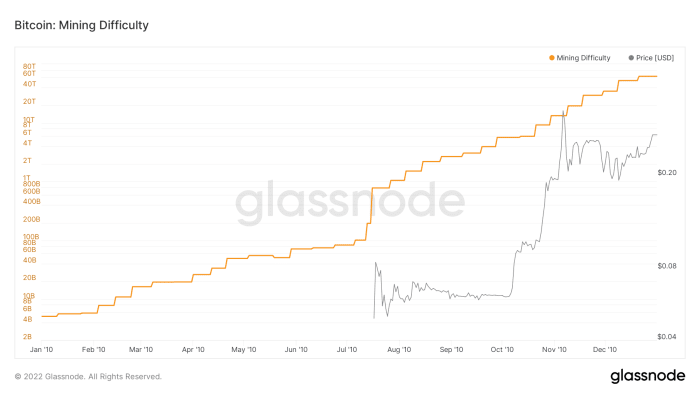

In 2010, we witnessed bitcoin gain a marketplace charge for the primary time in its historical past, in addition to its first exponential “charge rip” upwards. Except for one issue drop in Might (ahead of Bitcoin had a marketplace charge), we noticed 32 issue will increase with a median of 22.85%, and a typical deviation of 15.54%. When you have been incomes 1 BTC in step with hashing unit on January 1 of that yr, and didn’t spend any further cash on further GPUs, via December 31 you have been incomes 99.98% much less, or about 19,178 sats as a substitute of an entire coin. Tough.

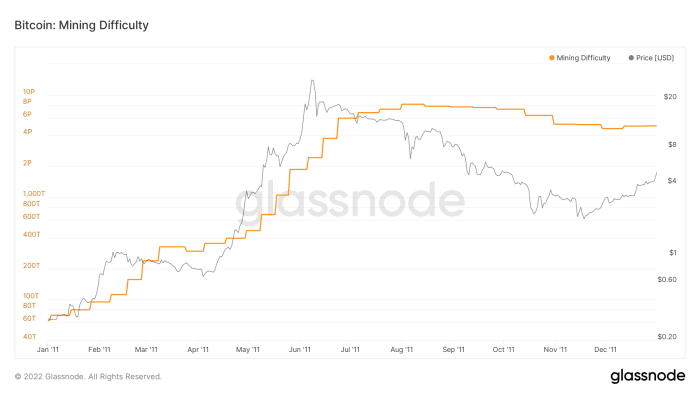

2011

2011 wasn’t a lot better for the miners than 2010, the place for those who have been incomes 1 BTC in step with hashing unit at the beginning of the yr with out including on your GPU fleet, you possibly can be incomes 97.81% much less, or about 2.19 million sats — technically over 100 occasions at an advantage than you have been in 2010, no less than!

2011 noticed bitcoin’s first mega-pump, with charge expanding about 100 occasions from $0.30 to $30 within the first six months of the yr, ahead of taking a 93.3% tub backtrack to $2 via November. One issue drop used to be skilled all through the 50% charge drop between February and April, with the opposite 8 drops for the yr happening all through “tub time.” There have been 21 will increase all the way through the yr. The common issue adjustment used to be 11.96%, with a typical deviation of 16.96%.

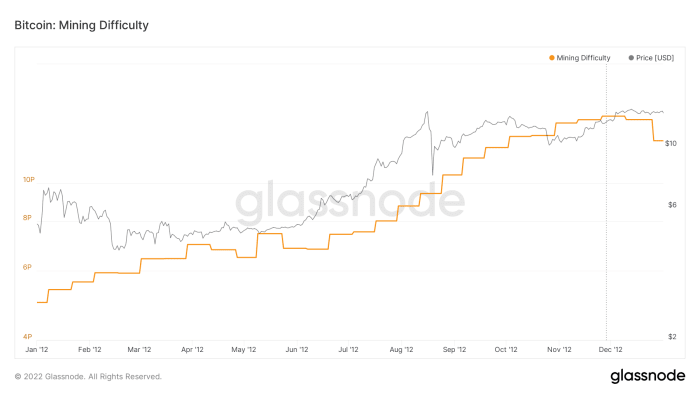

2012

2012 used to be an enchanting yr, because it used to be the primary time that the business would ever enjoy going thru a block praise halving. Whilst it’s worthwhile to fetch round $7 for a bitcoin in early January, a Valentine’s Day bloodbath just about halved the cost, and worth used to be persistently down 30% to 35% from the January prime till the center of the yr. This ended in 5 issue drops in that six-month duration. A doubling in charge from June to August noticed wholesome issue will increase once more, and not using a drops in issue to be witnessed till “The Halving” in past due November, which noticed two consecutive issue drops to finish the yr.

There have been 20 will increase all the way through the yr, and 7 drops, with the common issue adjustment being an build up of three.26%, with a typical deviation of plus 6.04%. You could possibly be incomes 59.11% much less on December 31 for those who hadn’t invested in any new {hardware} for the yr. Now not too dangerous in comparison to earlier years.

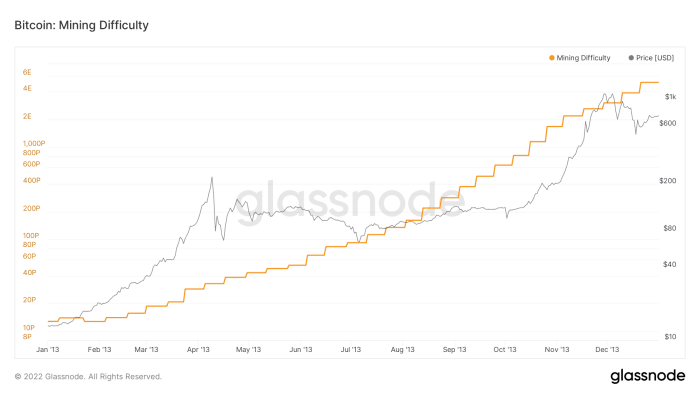

2013

Except for a 9.46% drop in issue in past due January, 2013 could be an “up most effective” yr thank you to 2 mega-pumps, the primary a near-20-timeser, going from $13.22 at the beginning of the yr to $229.47 on April 9, and a 17-bagger from early July till early December. Along the solitary issue drop to start out the yr, there have been 30 sure changes, averaging 17.16% with a typical deviation of plus 8.34%. Very similar to 2010, your 1 BTC of profits on January 1 lowered to 292,156 sats for those who didn’t upload any GPUs on your farm, a 99.71% drop. Then again, as of the tip of 2013, no person could be including any GPUs to their farms (except for shitcoin miners after all!), because the age of the ASIC used to be now upon us.

2014 To 2020: The ASIC Mining Generation

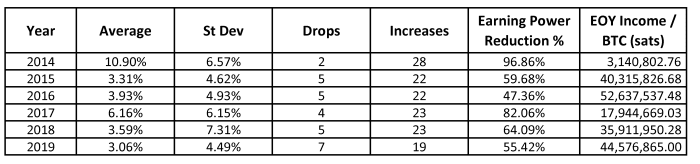

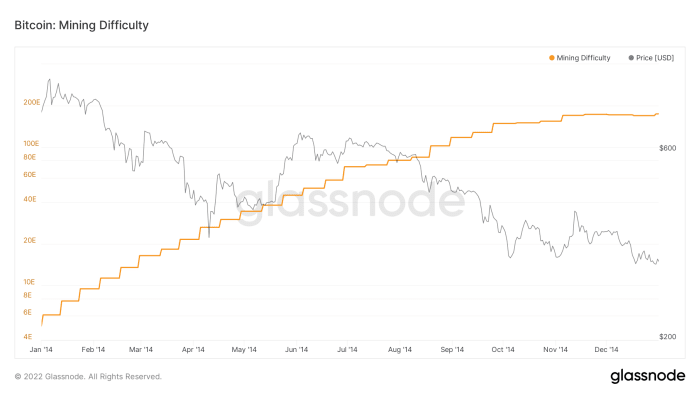

2014

Regardless of the cave in of Mt. Gox beginning the longest endure marketplace within the historical past of Bitcoin, with the prime watermark of $1,134.39 to not be handed once more for the overall time till April 2017 — a complete 1,218 days later (consider me, as a November 2013 first-time purchaser, I lived it and used to be counting the times!). 2014 used to be but some other apparently “up most effective” yr for issue, with 28 will increase, and two small decreases of 0.73% and 1.39% to spherical out the yr. The common issue alternate used to be plus 10.9% with a typical deviation of plus 6.57%. When you didn’t upload any ASICs on your farm in 2014, your 1 BTC of incomes energy used to be slashed via 96.86% to three.14 million sats.

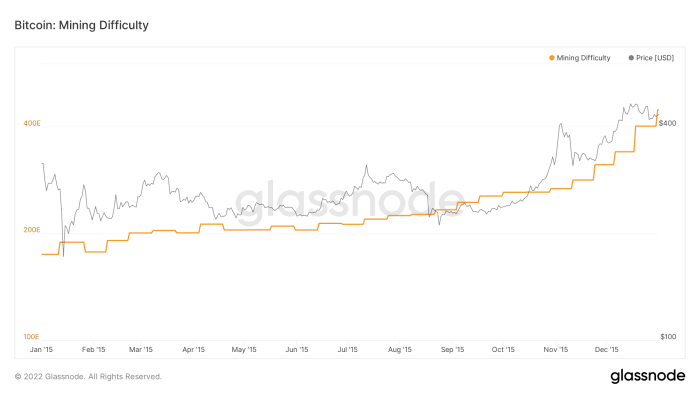

2015

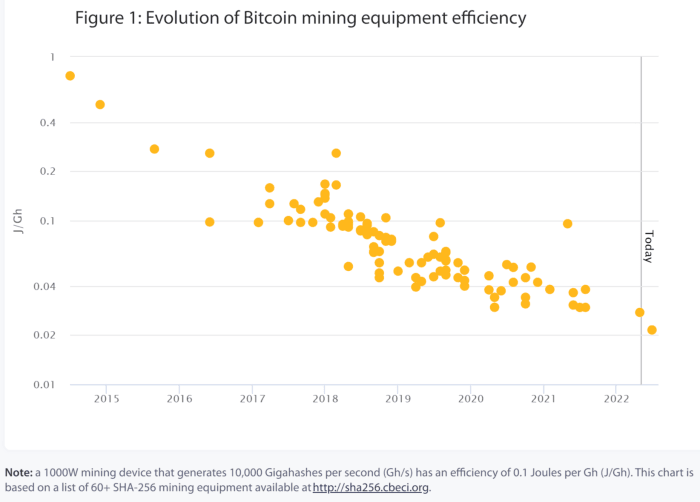

Even with Mt. Gox being useless for just about two years, the “Goxxings” simply gave the impression to stay coming, with charge bouncing between $300 and $150 for lots of the yr, with all 5 of the trouble drops occuring in 2015 coinciding with sharp 30% to 50% drops in charge over a brief period of time. ASIC producers have been nonetheless feeling out the distance and perfecting their artwork, as proven within the graphic under from the Cambridge University SHA256 technology tracker. This supposed that the common issue alternate for 2015 used to be most effective plus 3.31% with a typical deviation of plus 4.62%. Nonetheless, for those who didn’t upload any rigs on your farm, your 1 BTC of profits on January 1 used to be reduce via nearly 60% to 0.403 BTC.

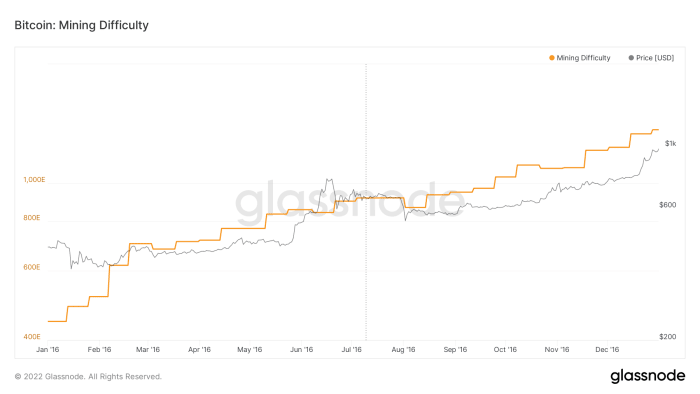

2016

2016 used to be one of the crucial particular years in mining historical past, because it witnessed a halving in addition to the discharge of the AK-47 of mining rigs, the Antminer S9, which might revel in winning provider for 6 years up till the very contemporary primary charge drop witnessed in Might 2022.

Worth enlargement for the yr used to be slow, save for the previous couple of months which noticed really extensive enlargement, and the goxxings would nonetheless proceed all through 2016 in spite of the trade collapsing greater than two years prior. All of this is able to lead to 22 issue will increase, and 5 drops, 3 of which befell previous to the halving.

The common alternate used to be plus 3.93% with same old deviation of plus 4.93%, leading to a discount of BTC source of revenue of 47.36% for the yr.

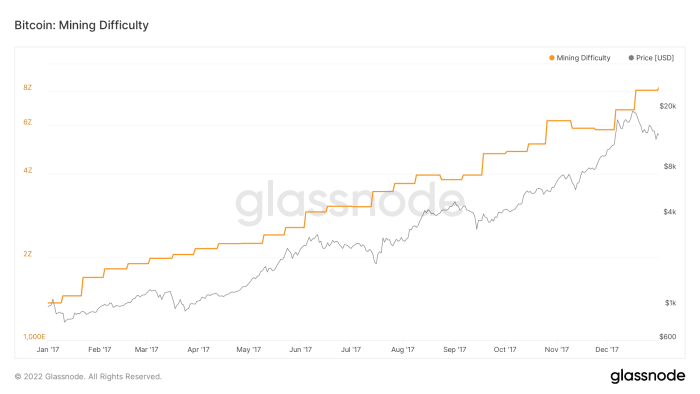

2017

2017 noticed two primary occasions, a 20-times run up in charge all the way through the yr, and the answer of “the blocksize conflict” towards the very finish of the yr. I clearly can’t do justice to the blocksize conflict in a single paragraph, so I can quote the blurb of Jonathan Bier’s seminal March 2021 ebook “The Blocksize War: The Battle Over Who Controls Bitcoin’s Protocol Rules”:

“[The Blocksize War] used to be concerning the quantity of knowledge allowed in each and every Bitcoin block, then again it uncovered a lot deeper problems, similar to who controls Bitcoin’s protocol regulations.”

Without equal answer used to be the advent of a brand new fork of Bitcoin, referred to as Bitcoin Money (BCH), which is also mined the usage of the SHA-256 protocol. Large will increase in the cost of BCH towards the tip of the yr have been sufficient to coax miners clear of mining the Bitcoin community and mine at the BCH community on 3 events after its release in August, with a small drop in July taking the tally to 4 downward changes for the yr.

There have been nonetheless 23 will increase for the yr then again, and with a median alternate of plus 6.16% with same old deviation of plus 6.15%, those adjustments ended in a discount of source of revenue of 82.06% for the yr. Extra mining rig producers would input the sport this yr, however no dramatic enhancements in rig potency have been completed.

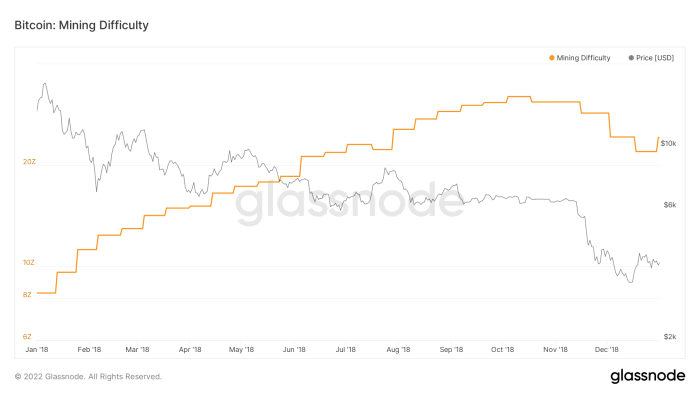

2018

2018 noticed a lot more pageant within the ASIC {hardware} house, with rig potency nearly doubling. Rigs have been turning into so environment friendly, having an 80% drawdown in charge over the yr did little to prevent hash fee enlargement.

There used to be a median alternate of plus 3.59% with same old deviation of plus 7.31%, throughout 23 issue will increase, a drop in July when bitcoin’s charge used to be at about $6,000, and 4 drops which befell all through the overall charge capitulation from about $6,000 to about $3,000 past due within the yr. The result used to be a discount of source of revenue of 64.09% for the yr in comparison to your start-of-year profits.

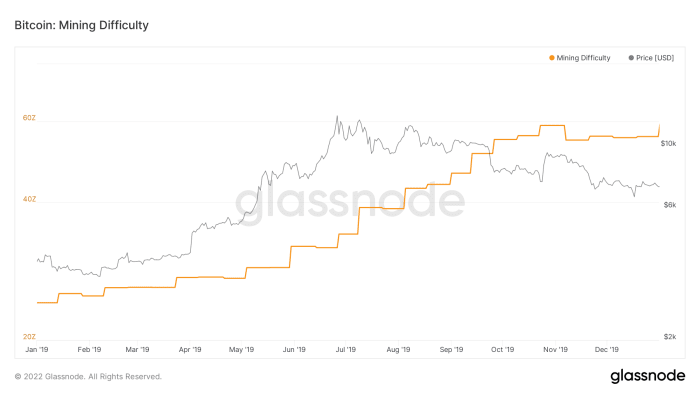

2019

After the brutal endure marketplace of 2018, investors noticed a reduction rally that took the cost from $4,000 at the beginning of the yr to about $13,000 mid-year. Except for 5 minor unfavorable issue changes of lower than 1% within the first part of the yr, and two drops in the second one part of the yr when bitcoin would go back to a cost of $6,000, there have been 19 will increase. The common alternate of plus 3.06% with a typical deviation of plus 4.49% ended in a discount of source of revenue of 55.42% for the yr.

This used to be principally pushed via much more pageant and potency beneficial properties within the ASIC {hardware} marketplace versus chasing price-cost arbitrage, with the 2019 fleet of recent rigs being greater than two times as environment friendly as their 2017 friends. 2019 used to be additionally the primary yr we noticed modular mining tactics at massive scale, the place miners would necessarily flip transport bins into moveable ASIC farms, and easily send them to the sector’s least expensive energy resources. The massive drop in issue in past due October used to be much more likely from Chinese language miners bodily migrating to inexpensive hydroelectric energy resources because of the rainy season, than a miner capitulation over a small drop in charge. This may develop into way more obvious within the migrations of 2020.

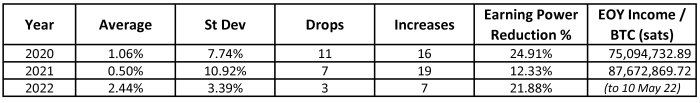

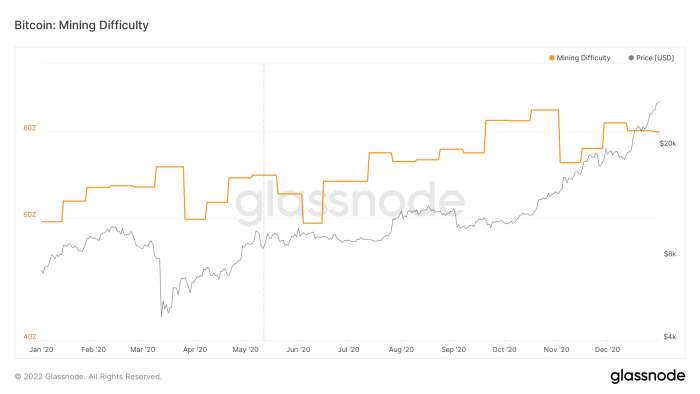

2020

Essentially the most issue drops in Bitcoin historical past would occur in 2020, with 11 drops, a few of previously-unseen magnitudes, happening all the way through the yr, for various causes. Regardless of the “COVID-19 the whole lot crash of March 2020,” the really extensive hash fee drops witnessed in April and past due October would most commonly be the results of Chinese language miners bodily migrating from Xinjiang province (which is coal heavy) to Sichuan province (which is hydro heavy) all through the rainy season, after which again on the conclusion of the rainy season. The benefit on be offering used to be so nice on account of a lot inexpensive energy that it used to be price it for miners to easily close up, transfer and identify themselves in other places, in spite of the related chance and downtime. In fact, the halving of Might 2020 would lead to two consecutive drops of 6.39% and 10.24%.

Mining tactics and rigs would proceed to make stronger, with firmware provider suppliers like Braiins.OS offering miners with device that dramatically greater the potency in their rigs and used to be simple sufficient to make use of via mining lovers. Immersion-cooled mining would additionally delivery being utilized by more than a few operations to be able to additional build up potency and scale back downtime and upkeep prices.

The common alternate of plus 1.06% with same old deviation of plus 7.74% ended in a discount of bitcoin-denominated source of revenue via 24.91% for the yr. Bearing in mind that the cost of bitcoin would develop via 4 occasions in 2020 then again, this is able to delivery a time frame the place house and collocated mining began to seem extra interesting to a a long way wider person base because of the apparently impossible to resist cost-price arbitrage on be offering in a booming marketplace, apparently secure from pageant, no less than quickly, because of the COVID-induced world provide chain problems afflicting the marketplace.

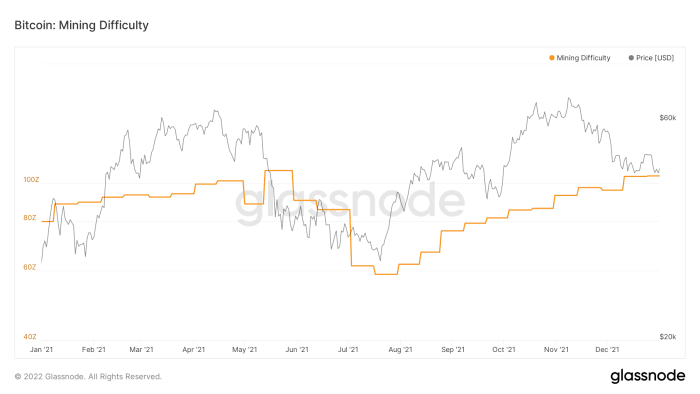

2021 To Present: China Bans Bitcoin And The (Close to) Quick Restoration

2021

2021 used to be the yr mining “hit the streets,” with colocation firms booming in spite of lengthy lead occasions for supply, {hardware} costs have been going throughout the roof (in close to lockstep with the cost). Mining firms have been nonetheless migrating for the most affordable energy. They have been going public at a fee of knots, and company treasuries have been collateralizing their bitcoin in attention-grabbing techniques. Simply probably the most mania you possibly can be expecting to look all through a meteoric bull run. To best all of it off, there used to be an enormous blackout in China which brought about a close to 15% unfavorable issue alternate, then, just a month later China utterly banned Bitcoin mining, inflicting 4 consecutive unfavorable issue adjustments of 19%, 5.6%, 38.8% and 5%. This supposed that anybody who used to be already mining noticed an enormous transient bump in income, and could be forgiven for pondering, “Whoever isn’t taking into account coming into mining at the moment could be silly!”

However for those who’ve stayed with me up till this level, you know the way this tale ends. Excellent occasions are brief, and are at all times adopted via cripplingly arduous occasions for miners. Those occasions would come quickly. The ones pronouncing the Chinese language hash fee would no longer go back for months or years have been promoting essentially the most alternatives and shovels, however go back it did, most commonly inside of 3 months, and it all via the tip of the yr.

There have been 19 will increase, and 7 drops — 5 of which have been associated with China, the opposite two small and inside of tolerance. The attention-grabbing statistic to have a look at is the usual deviation, and whilst issue averaged a metamorphosis of plus 0.5%, its same old deviation used to be 10.9%. So, for those who have been within the sport at the beginning of the yr, you carried out stellarly, and most effective had your source of revenue lowered via 12.33% for the yr. Then again, for those who have been one of the crucial unfortunate ones who began in past due July 2021 (or later), you had 12 adjustments for the remainder of the yr (11 of which have been sure), and a median of plus 4.61%, which means you’d misplaced about 77% of your source of revenue via the tip of the yr, with the bitcoin charge going south, temporarily. Once more, for those who have been already established, 2021 used to be an incredible yr. For everybody else, purchasing bitcoin would had been the wiser choice.

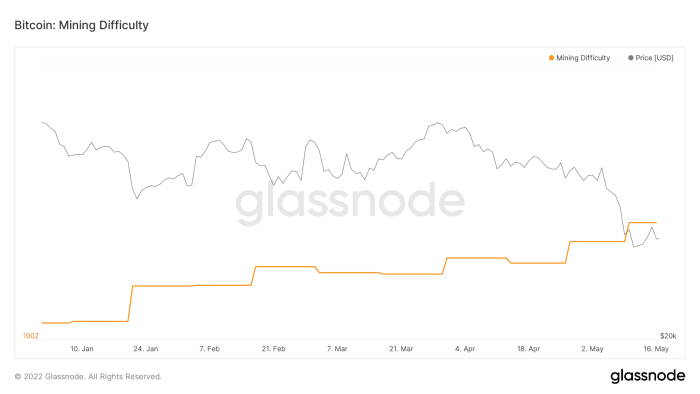

2022

We’re 10 issue adjustments into 2022 — seven will increase and 3 drops. Regardless of a 20% crash in charge for the reason that ultimate issue alternate, it is predicted that the upcoming difficulty change will be a drop of around 1%. Of the 10 adjustments thus far, the common alternate used to be plus 2.44% with a typical deviation of plus 3.39%, leading to a discount of source of revenue of 21.89% yr to this point, however I are expecting it is going to be a discount of 50% via yr finish. House miners beware!

Maximum curiously, 2022 noticed Intel input the mining sport, forming a large partnership with green miner GRIID, and phrase that even oil-and-gas giants Exxon Mobil and Conoco Philips had started flare mining the usage of cellular, containerized mining answers. Even with bitcoin’s charge being within the doldrums, pageant has been getting stiffer and stiffer.

2022 has observed extra COVID-19 provide chain problems clearing, extra innovation in mining firmware and methods and, with what appears to be but some other protracted endure marketplace for charge, will see a flushing out of over-leveraged or low-margin miners, as now we have witnessed in earlier endure markets.

Conclusion: Bitcoin Mining Is Completely Aggressive

The character of pageant in Bitcoin mining is near perfect which means that miners will paintings extraordinarily arduous to have the most productive operation, and certainly, the most productive provide chain. It additionally implies that they’re in a position and in a position to bodily pass anyplace is needed to reach this. Mining isn’t simple, and for a house miner, is corresponding to panning for gold in 2022 — it sounds way more glamorous and rewarding than it if truth be told is! There are higher techniques to pique your interest about mining than spending cash making an attempt it out your self (learn: going brief spot-Bitcoin in hopes you’ll earn extra via mining as opposed to going lengthy spot-BTC) — however you’re going to by no means pay attention this from the folks promoting alternatives and shovels!

Bitcoin mining has been in a position to take in maximum of my time and highbrow capability for 8 years, but I’ve by no means even grew to become on a miner in my existence. In terms of mining, it’s absolute best to depart the bread to the baker, as they’re maximum able to figuring out, assuming and managing the dangers. The historical past speaks for itself: In terms of hash fee and issue, “quantity pass up” tougher, sooner and extra persistently than charge, and whilst that is nice for Bitcoin, it’s horrible for the ones having a look to compete in what’s a superbly aggressive house.

It is a visitor submit via Hass McCook. Critiques expressed are completely their very own and don’t essentially replicate the ones of BTC Inc or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)