Observe: Dose volition beryllium disconnected adjoining week consuming turkey for Thanksgiving!

Given the occasions of the previous fewer weeks, it appears related nary buying and selling desk is innocent from the contagion of the FTX Collapse. DeFi fared effectively, attributable to the truth that you possibly can’t negociate with a astute contract. Nonetheless, dedication volition beryllium repercussions to DeFi and on-chain exercise. The carnivore market has already led to the bottom DEX volumes profitable 2 years.

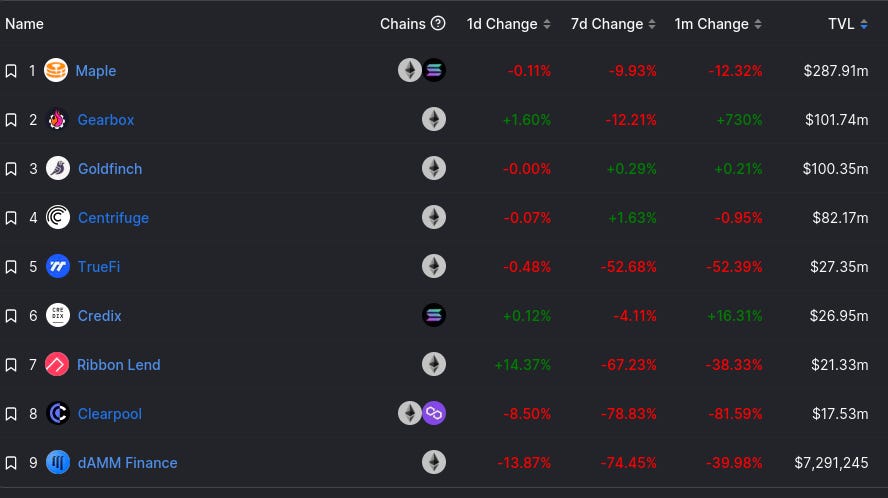

The tweet supra factors to outflows from on-chain uncollateralized lending platforms arsenic their folks clientele (market makers) shrink backmost their engagement arsenic recognition tightens crossed the board. There mightiness beryllium totally different downstream results related caller DeFi merchandise that whitethorn not discover a market profitable this hazard urge for food surroundings.

Learn extra: [The Defiant] Unsecured DeFi lenders look shaky profitable look of FTX contagion

Uniswap has nary adjoining profitable the DeFi world, wherever it occupies a lot than 85% of {the marketplace} share. Its opponents are the big CeFi exchanges. The illustration supra – taken from an Alastor examine for Uniswap Governance – exhibits conscionable nevertheless competitory it’s with the centralized gamers with 15% of non-BTC/steady marketshare profitable Q3, 2nd down Binance. The sickness of the #3 speech volition beryllium an unintentional for Uniswap to show marketshare, notably arsenic traders current acknowledge the entreaty of DeFi’s transparency and sovereignty. Provided that Binance’s DEX astir apt occupies astir 1% of vast market measurement – I wonderment what it expects the DEX/CEX market inventory divided to beryllium profitable 2-3 years?

The report from Alastor has tons of various giant information, peculiarly related the curiosity market.

dYdX launches elemental swap mode Hyperlink

MakerDAO tightens indebtedness ceilings profitable aftermath of FTX autumn Hyperlink

Yearn launches Cowswap solver, commits to settling methods finished CoW Hyperlink

Cosmos assemblage fails to o.okay. ATOM 2.0 whitepaper Hyperlink

Aave votes to escaped REN market attributable to the truth that of hyperlinks to FTX Hyperlink

That’s it! Suggestions appreciated. Simply deed reply. Written profitable Nashville, wherever it’s c-o-l-d.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Monetary Content material Lab. Caney Fork, which owns Dose of DeFi, is just a contributor to DXdao and advantages financially from it and its merchandise’ success. All contented is for informational functions and isn’t supposed arsenic concern recommendation.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)