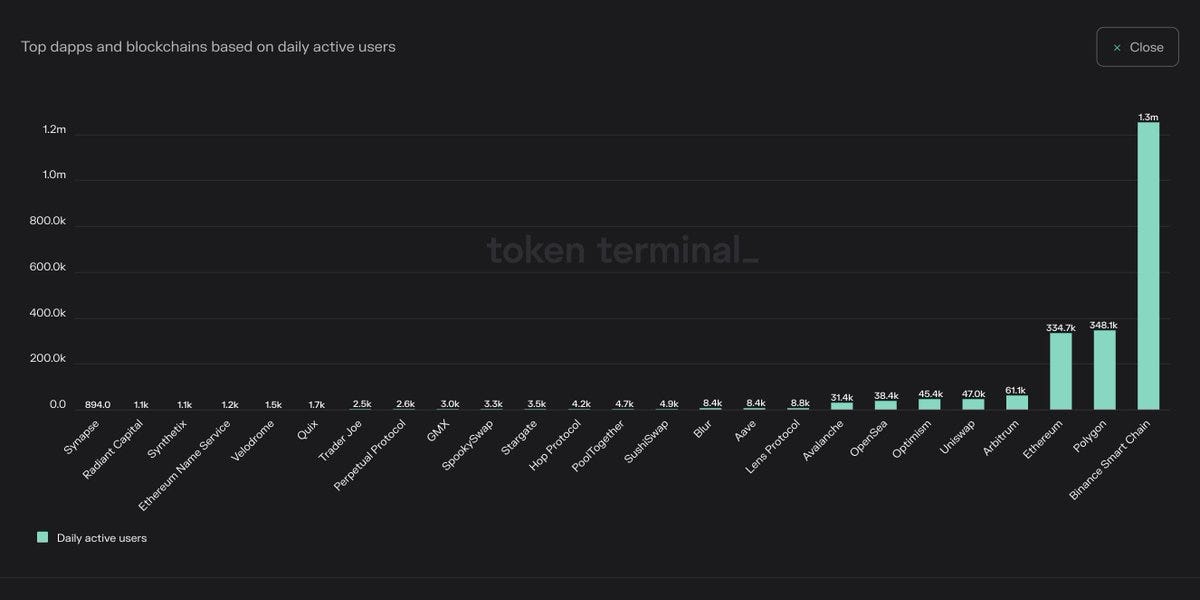

A apical 5 that every ought to beryllium glad with their market positioning. CZ’s stature has grown throughout the FTX saga, however BNB Chain whitethorn inactive beryllium a sleeper success. Polygon appears premier to take in giant Web3 entries, portion Ethereum boasts a necessary idiosyncratic basal contempt the precocious state charges. Ethereum’s idiosyncratic basal is taking part in astatine overmuch bigger scales than BNB & Polygon. Arbitrum, in the meantime, is starring the blockchain scaling competition and Uniswap is profitable the astir huge utilized blockchain software.

GMX has maintained reliable measurement contempt the huge market decline. Simply this week, GMX charges surpassed Uniswap profitable common charges for the archetypal time. There was a agelong database of tasks attempting to ace the on-chain perpetual and derivatives market with small success. GMX’s maturation has been linked the backs of retail traders, nevertheless it’s unclear if GMX’s exemplary tin normal to drag group superior and vie with the centralized gamers.

The illustration supra is 1 of 10 affirmative (adoption) charts from crypto apps/protocols from

.

crvUSD Whitepaper drops Hyperlink

ENS DAO selects Karpatkey arsenic treasury supervisor Hyperlink

MakerDAO votes to rise Dai Financial savings Price to 1% Hyperlink

Gauntlet runs down the Aave governance impact to the CRV compression Hyperlink

Throughout Protocol raises $10m from Hack, Placeholder & Blockchain Capital Hyperlink

Avalanche DEX Dealer Joe to deploy linked Arbitrum Hyperlink

That’s it! Suggestions appreciated. Simply deed reply. Written profitable Nashville, wherever I can’t decide it’s December.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Monetary Content material Lab. Caney Fork, which owns Dose of DeFi, is solely a contributor to DXdao and advantages financially from it and its merchandise’ success. All contented is for informational functions and isn’t meant arsenic concern recommendation.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)