Non-fungible tokens proceed to play a big position in growing the Web3 ecosystem, regardless of the passion round them having subsided since its peak in 2021.

Unquestionably, these distinctive digital belongings have been a big power behind the NFT transformations which have taken place. Regardless of the big variety of NFT collections and their accomplishments, it’s essential to acknowledge that some explicit ones have not too long ago been severely affected by market pressures and at the moment are starting to fall from their lofty positions.

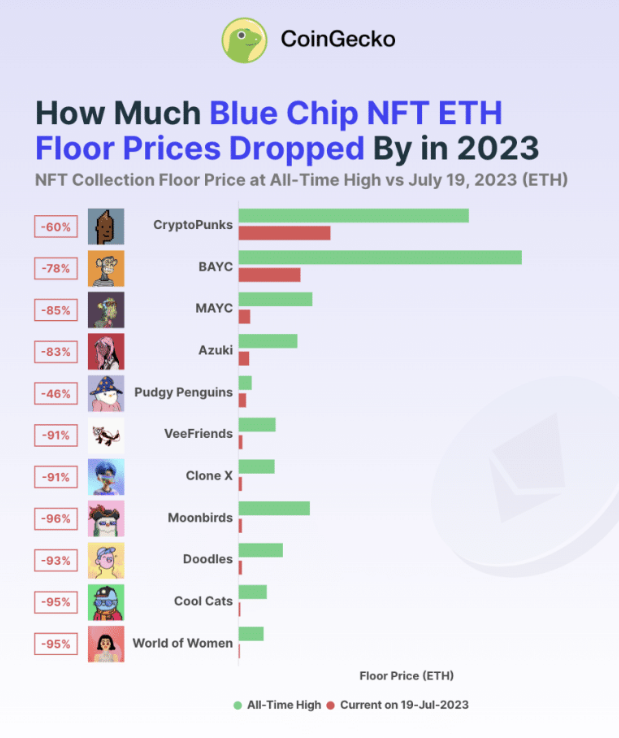

Contemplate the state of affairs with CryptoPunks. CoinGecko found that of the highest 11 “blue chip” NFT initiatives studied, CryptoPunks suffered the worst losses.

Non-fungible tokens often called “blue chip NFTs” are thought to be extremely valuable and prestigious in digital belongings. These NFTs are steadily linked to well-known and acknowledged producers or organizations, comparable to famend artists, enduring companies, or important historic objects.

Supply: CoinGecko

Collectors and traders broadly search after them as a result of shortage, historic relevance, and the artist’s popularity that decide their worth.

Alarming statistics presently going through CryptoPunks are elevating questions amongst NFT fans. These previously well-liked digital belongings have not too long ago encountered a worrying state of affairs, sparking disputes and disagreements amongst traders and followers.

Supply: NFT Flooring Value

On the time of writing, the ground value for these NFT collections was set at 47.69 ETH. Information from NFT Flooring Value exhibits that the gathering’s worth declined after reaching a excessive of 11,000ETH throughout the 2021 NFT bull market.

The amount and gross sales of CryptoPunks have considerably decreased throughout the previous seven days, claims OpenSea. Gross sales had been down 60%, whereas quantity dropped sharply by 64%.

Bitcoin barely above the $29K degree. Chart: TradingView.com

On account of their distinctiveness and variable rarity, CryptoPunks, developed by Larva Labs in 2017 and helped improve generative PFP collections, are nonetheless extremely sought-after NFTs.

CryptoPunks, thought to be artwork and collectibles, have generated respectable income for his or her house owners. CryptoPunk #5822, which bought for $23 million in February final 12 months, was the most costly ever.

Now, by way of the variety of distinctive energetic wallets, CryptoPunks has seen a miserable discount of about 20%, and transactions have additionally suffered, dropping greater than 32% of their values.

In the meantime, CryptoPunks’ month-to-month gross sales quantity can be feeling the warmth, declining precipitously since March. The NFT initiative reported gross sales of $30.43 million for the month, however by the tip of June, these figures had considerably dropped to lower than $10 million.

(This website’s content material shouldn’t be construed as funding recommendation. Investing includes threat. Once you make investments, your capital is topic to threat).

Featured picture from Reuters

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)