Bitcoin, Ethereum, and different cryptocurrencies, usually, have the tendency to be risky. It’s one property that makes the asset a high-risk-high-reward utility.

There have been cases the place merchants have earned tens of millions of {dollars} in revenue with crypto in a single month. For example, Bitcoin reached its peak in November 2021 at $65,000. Nevertheless, the crypto was valued at solely $28,500 a 12 months later.

Such is the risky nature of crypto, not less than what the merchants had been used to. In latest occasions, established cryptocurrencies, akin to Bitcoin and Ethereum, have showcased far more market stability. Regardless of the trade dealing with regulatory calls for, unethical branches, and lawsuits, BTC has maintained its market standing and worth. That is very true for an asset that tends to shift from 5% to 10% in at some point.

So what’s taking place with Bitcoin value? Let’s dig deeper.

The Altering Face of Bitcoin Volatility

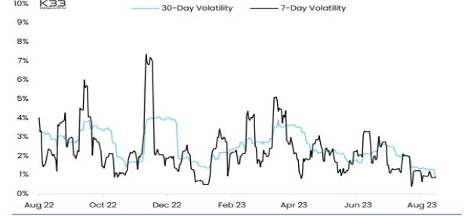

Bitcoin has maintained its low-volatile regime for a number of months now. Its present stretch has solely been witnessed twice earlier than within the decade-long market presence of crypto.

Though the crypto showcased some pleasure again in June, it has been silent since then. In reality, crypto has managed to realize the bottom 90-day volatility since 2016. Presently, Bitcoin stands at a 3-month implied volatility of 35. Compared, the earlier all-time volatility low of the crypto was 56, as per the K33 analysis report.

This was hit after Bitcoin spent 47 days with no 5% value shift. Thus, the continuing stability proven by Bitcoin is far under its earlier all-time lows.

Let’s put this tendency into a greater perspective for clearer comprehension.

Bitcoin’s Historic Volatility

Bitcoin began its official market journey in 2011 when it hit a $1 market value. The crypto stayed below $5 all year long with a sample of 80% to 90% value correction.

The king of cryptocurrencies, Bitcoin, took three years to achieve the $1,000 mark earlier than witnessing a whopping 85% market dip. Nevertheless, issues began selecting tempo in 2017 when the crypto ended the 12 months at $20,089.

Bitcoin (BTC) modified the lives of hundreds of merchants in a 12 months alone. The next couple of years had been robust for Bitcoin because it stored declining progressively. Nevertheless, it broke the sample in 2020 by ending the 12 months at $29,244. However all of the earlier wild volatility patterns pale in entrance of Bitcoin’s motion in 2021. The BTC value shook the crypto market by reaching a whopping $68,789 in market worth. For an asset with such wild historic volatility to all of the sudden achieve stability is unprecedented.

That’s the reason a number of monetary consultants and establishments are attempting to determine what’s taking place with Bitcoin.

Measures of Bitcoin’s Calmness

Whereas scripting this put up, Bitcoin buying and selling has been confined inside the 24-hour vary of $28,428 to $29,194, as per the info from CoinGecko.

Nevertheless, even with this slim fluctuation, the crypto has yielded a market cap of $555 billion. This sample has surpassed even the steadiness of gold, tech shares, and the S&P 500. As per Glassnode analysts, a number of Bitcoin metrics are hinting at excessive exhaustion and apathy towards the crypto. For higher understanding, let’s see what higher and decrease Bollinger Bands are.

Bollinger Bands makes use of three traces, higher, decrease, and center, to research an asset. The center line is an SMA (easy transferring common) of the asset’s value for a selected interval. The decrease and higher bands are positioned plenty of customary deviations away from it. The overall setting for the band includes a 20-day SMA with 2 customary deviations.

For Bitcoin, the higher and decrease Bollinger Bands are solely separated by 2.9% at present. Such an expansion has solely been seen twice, in 2016 and 2021.

Bitcoin Worth: What to Count on within the Upcoming Months?

With such market motion, it’s pure for merchants to search for a exact Bitcoin prediction. Merchants have famous that Bitcoin’s most fun motion got here again in June. This occurred primarily due to BlackRock’s involvement in a spot Bitcoin ETF. The crypto has calmed down since then, showcasing immense stability in August. All through the month, Bitcoin has been hovering across the 29k greenback mark in each buying and selling session.

The CIO of Lestra Funding Administration, Kara Murphy, said that secular narratives surrounding Bitcoin could possibly be its longer-term drivers. BTC disrupting conventional finance is one such instance of a secular narrative.

As for its near-term, Bitcoin may be thought of a high-risk name choice at no cost cash below some circumstances. What the market fuel witnessed is that the Fed rate-tightening cycle has wrapped up. Thus, the long-term secular side is gaining prominence with BTC turning into steady.

Since such narratives don’t change simply, Bitcoin is predicted to be a bit extra boring, added Murphy.

The Silence within the Crypto Market

The summer time of 2023 is recorded as one of many calmest durations for Bitcoin. It’s secure to state that merchants needed to continually sustain with each crypto forecast to make sure the market wouldn’t all of the sudden unravel. Stories famous that the 90-day volatility of Bitcoin is at its lowest since 2016. And since its implied volatility can be at an all-time low, the silence is deafening to most merchants acquainted with BTC’s customary motion.

Vetle Lunde and Bendik Schei, analysts at researcher K33, additionally cemented this assertion. As per the analysts, the silence all through this summer time is why the volatilities are even under all-time lows. It has been an unusually calm stretch for BTC, an asset identified for its wild value swings, added the analysts.

Conclusion

Bitcoin, a crypto famend for its unmatched volatility, is at present buying and selling at its all-time steady place. Its 90-day volatility is on the lowest ever since 2016, with August being the month when BTC solely hovered round $29,000. In reality, Bitcoin has solely maintained such market stability twice since its inception in 2011.

CoinGecko knowledge exhibits that Bitcoin buying and selling has been confined inside the 24-hour vary of $28,428 to $29,194. Such stability even overshadows that of gold, tech shares, and the S&P 500. Since consultants imagine this stability is right here to remain, merchants are reevaluating their crypto buying and selling methods. If Bitcoin manages its market place and stability, it might probably redefine not solely the crypto trade however the monetary market as an entire.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)