Litecoin (LTC), the altcoin usually dubbed as “silver to Bitcoin’s gold,” has discovered itself caught within the downward spiral of the cryptocurrency market, mirroring the struggles of its bigger counterpart.

Whereas LTC’s affiliation with Bitcoin has lengthy been a double-edged sword, the current value crash is placing on the highlight the intricate interaction between these digital property.

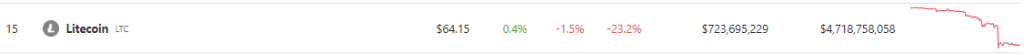

As Bitcoin (BTC) grapples with a precipitous decline, at the moment buying and selling beneath $26,000, the influence reverberates throughout the broader crypto panorama. LTC, buying and selling at $64.15 based on CoinGecko, has encountered a 1.5% drop during the last 24 hours, contributing to a week-long hunch of 23.2%.

Litecoin Loses Grip On The $70 Deal with

LTC value motion on a weekend. Supply: Coingecko

This downturn prompted a cascade of over $1 billion price of place liquidations inside a 24-hour window, a testomony to the market’s heightened volatility.

Within the midst of intraday buying and selling, Litecoin momentarily dipped to the $60 mark earlier than staging a restoration. This decline has pushed LTC to year-to-date lows, ominously edging towards the lows witnessed in December 2022.

But, understanding the dynamics behind LTC’s battle requires delving into its intricate relationship with the alpha coin

Litecoin Worth Dependence On Bitcoin

The intrinsic connection between Litecoin and Bitcoin has each bolstered and hampered LTC’s journey. Traditionally positioned as a complementary various to Bitcoin, Litecoin carved its area of interest by embracing quicker transaction speeds and a unique mining algorithm.

Nonetheless, the symbiotic relationship between these two cryptocurrencies additionally makes Litecoin vulnerable to Bitcoin’s market actions.

LTC market cap reached $4.7 billion on the weekend chart: TradingView.com

Litecoin’s current setback underscores this interdependence. Analysts contend that Litecoin’s value trajectory has usually mirrored Bitcoin’s, with downturns accentuated by its function as a secondary asset.

Whereas Litecoin presents distinct utility, its destiny stays intertwined with the broader market sentiment and Bitcoin’s efficiency. This connection has led to LTC’s value habits echoing Bitcoin’s, each in its drops and potential recoveries.

Navigating The Path Forward: Key Ranges To Watch

As Litecoin navigates this difficult terrain, essential help and resistance ranges come into play. Analysts are carefully monitoring a possible consolidation of losses inside the vary of $56 to $70, contingent on Bitcoin’s additional losses. The $70 mark represents a pivotal level, indicating bullish intent if breached, and an edge for the bulls solely above $75.

LTC seven-day value motion. Supply: Coingecko

Key resistance ranges lie at $70 and $78.5, performing as hurdles on LTC’s potential restoration journey. Conversely, important help ranges relaxation at $50.5 and $42, indicating the essential junctures that would both exacerbate LTC’s downturn or doubtlessly pave the way in which for resilience.

Because the market continues to evolve, the teachings from these fluctuations provide invaluable insights into the evolving nature of digital property and the nuanced relationships that underpin their worth fluctuations.

(This website’s content material shouldn’t be construed as funding recommendation. Investing includes danger. Once you make investments, your capital is topic to danger).

Featured picture from Coin Insider

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)