On-chain information reveals a Bitcoin metric is forming a sample which will trace {that a} bull run might be coming subsequent for the asset.

Bitcoin HODLer Development Fee Has Seemingly Reached The “Plateau” Stage

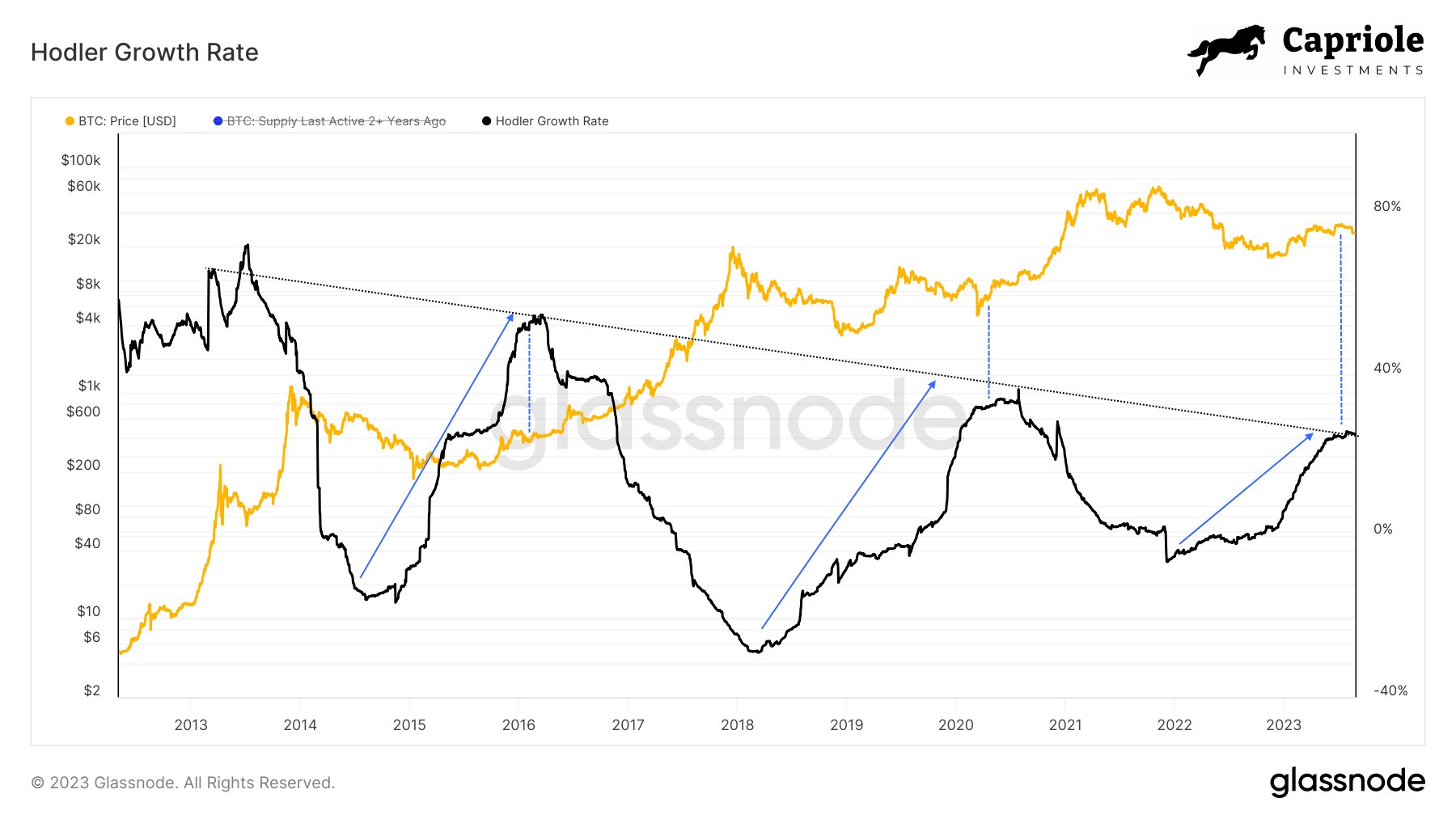

In a brand new put up on X, the analyst Charles Edwards shared a chart highlighting a sample that the BTC “HODLer Development Fee” indicator could also be forming.

This indicator retains observe of the 1-year development within the holdings of the Bitcoin buyers who’ve been preserving their cash dormant (unmoved) of their wallets since a minimum of two years in the past.

Usually, an investor who holds onto their cash for a minimum of six months is termed a “long-term holder” (LTH). The LTHs are market contributors with a excessive resolve who don’t often promote rapidly, no matter no matter occurs in the remainder of the market.

Statistically talking, the longer an investor retains their cash nonetheless, the much less possible they change into to promote at any level. Thus, the holders who make it to the 2-year mark, which is the section of curiosity within the present dialogue, would then be essentially the most persistent buyers, even amongst these LTHs.

Subsequently, no matter these holders are doing will be price maintaining a tally of, as it could have ramifications for the remainder of the market. Naturally, these holders aren’t too more likely to exert affect within the brief time period (as they often stay silent), however in the long run when the consequences of their conduct may emerge.

Here’s a chart that reveals the development within the Bitcoin HODLer Development Fee for this specific section of the LTHs over the previous decade:

Seems like the worth of the metric has began to maneuver sideways in latest days | Supply: @caprioleio on X

As Charles has marked within the above graph, there seems to be a particular sample that the Bitcoin HODLer Development Fee has adopted all through the cycles.

It could appear that in bear markets, the indicator’s worth stays constructive and in an uptrend, suggesting that these buyers increase their holdings in such durations, and as costs dip additional, they solely up the tempo of this accumulation.

Because the bear market approaches its finish and a transition in the direction of a bull market takes place, the metric’s worth goes flat, implying that these buyers nonetheless accumulate, though at a continuing charge, somewhat than an accelerating one. Then, because the bull run begins, these Bitcoin HODLers slowly cease the buildup completely and start to take part in distribution as a substitute.

The analyst notes that the Bitcoin HODLer Development Fee now seems to have completed up the speedy bear market enlargement section and is now beginning to plateau sideways.

Naturally, if the sample of the earlier cycles is something to go by, it may possibly imply that the Bitcoin market is now in the course of the transition in the direction of the subsequent bull run.

BTC Value

Bitcoin stays caught in a spread as its worth nonetheless trades across the $26,100 degree.

BTC has been consolidating for the reason that crash | Supply: BTCUSD on TradingView

Featured picture from Hans Eiskonen on Unsplash.com, charts from TradingView.com, Glassnode.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)