Lido DAO (LDO), the driving drive behind the revolutionary liquid staking protocol for Ethereum (ETH), has displayed a powerful 7.41% ascent in its Whole Worth Locked (TVL) over the course of the final seven days.

This sturdy surge in TVL has positioned Lido Finance as a distinguished contender within the decentralized finance (DeFi) panorama, illustrating its resilience amidst a fluctuating market.

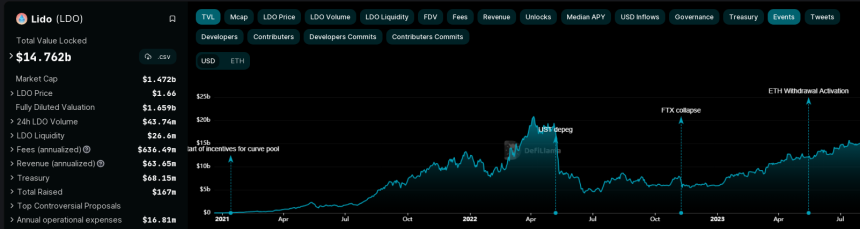

In accordance with the most recent knowledge from DeFiLlama, Lido Finance’s TVL witnessed a notable augmentation, securing its place as essentially the most substantial development among the many high 5 DeFi protocols. This feat underlines Lido’s distinctive capability to adapt and increase, distinguishing itself from its counterparts throughout a pivotal time for the DeFi sector.

Lido Finance TVL. Supply: DeFiLlama

Regardless of the tumultuous worth fluctuations which have characterised the altcoin realm, Lido’s TVL development stood unwavering. This achievement could be attributed to a discernible surge in Ethereum deposits inside the protocol over the reviewed timeframe.

Lido’s ETH Deposits Surge Amidst Uncertainty

The first driver behind Lido’s exceptional TVL surge over the previous week was a considerable inflow of ETH deposits into the platform. Even within the face of great market worth gyrations, Ethereum holders exhibited a commendable diploma of confidence in Lido’s liquid staking protocol.

LDO has a market cap of $1.47 billion. Chart: TradingView.com

Current technical evaluation highlights that the platform noticed a cumulative whole of 185,500 ETH deposits within the final seven days alone. This not solely positioned Lido as a beacon of stability in a tempestuous market but additionally secured its standing because the go-to protocol for internet new Ethereum deposits.

Insights And Outlook For Lido Finance

Lido Finance’s latest achievements underscore its rising prominence within the DeFi realm. With a present worth of $1.66 in keeping with CoinGecko, the platform’s token’s resilience (LDO) is additional affirmed by its 24-hour rally of 5.1%. Over the span of the final seven days, Lido has achieved positive factors of 1.4%, a testomony to its unwavering efficiency even in difficult occasions.

LDO seven-day worth motion. Supply: Coingecko.

Because the broader cryptocurrency panorama continues to evolve, Lido’s success serves as a reminder of the facility of progressive DeFi options. By facilitating liquid staking for Ethereum, Lido DAO not solely appeals to these looking for rewards from staking but additionally embodies the ethos of adaptability that’s important for thriving within the ever-changing world of decentralized finance.

As Lido outperforms its friends in TVL development and garners a major inflow of ETH deposits, it proves that adaptability and reliability are the cornerstones of sustainable success within the dynamic realm of decentralized finance.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing includes threat. While you make investments, your capital is topic to threat).

Featured picture from PortalCripto

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)