BitcoinActuary is an actuary founded within the U.Ok. exploring Bitcoin.

That is an editorial on your nocoiner pals, looking for to view bitcoin from a rather other perspective.

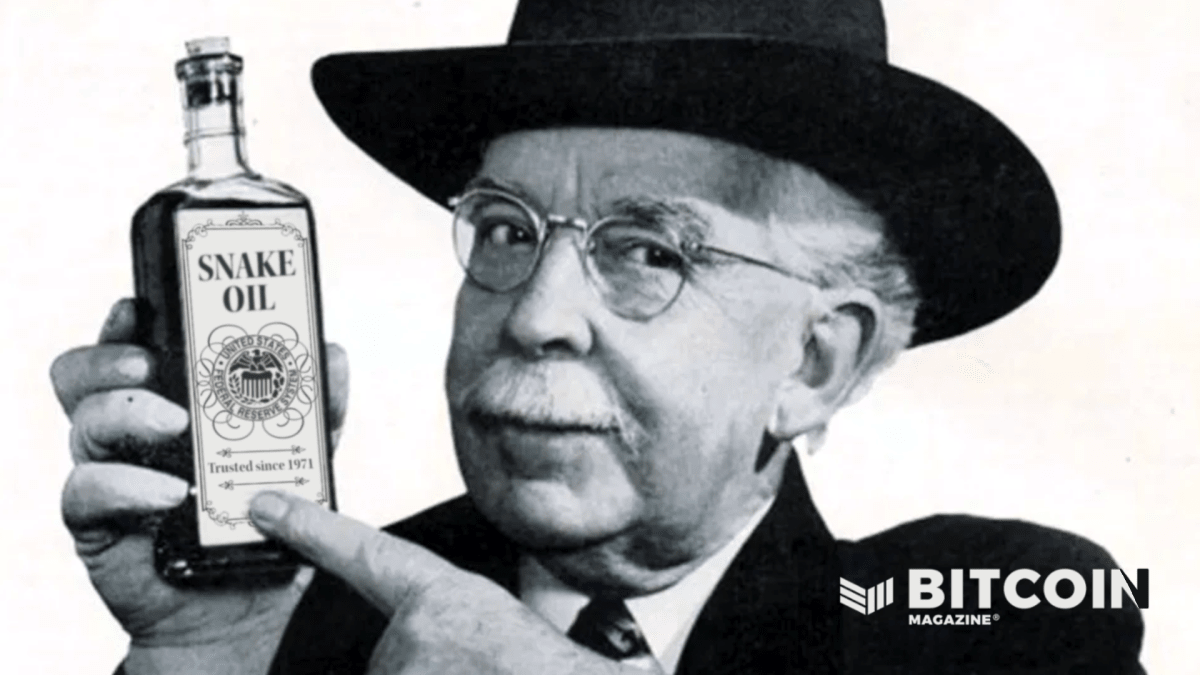

Bitcoin continues to be round $30,000 and you don’t have any thought why. All you’ll nonetheless see is a melee of “crypto” Ponzi schemes that may crash to 0 any day now. Bitcoin is solely every other one in all them, if the rest, outdated via different cryptocurrencies with extra application and more recent tech.

Therefore chances are you’ll smartly ask, “How on Earth is bitcoin nonetheless some 50% upper than its earlier all-time prime previous to past due 2020?!” Let’s dive into one rather other perspective in which to take a look at it.

Let’s get started via making an allowance for the arena’s currencies. How would possibly we examine them in relation to dimension? To measure this, it will make sense to take a look at the worth of the financial base — essentially the most irreducible type of every.

Porkopolis Economics has a table illustrating the stats and I’d suggest the “TFTC: A Bitcoin Podcast” episode #310 (and others in the past) with Marty Bent and Matthew Mežinskis for some dialogue in this.

It would wonder you that, in this foundation, one of the crucial greatest 10 monies on the earth (in relation to base cash price in movement) does no longer belong to a rustic, however it’s web local and has some very other homes from the entire others — let’s check out how.

(Spoiler alert, it’s bitcoin.)

It gives 0 risk-free yield, so is not value conserving on that foundation in comparison to fiat currencies. All else equivalent, fiat currencies will fortify when their base interest rate is going up, as one can now notice a better rate of interest when conserving them. (Russia is an instance previous in 2022, the use of rate of interest rises as a defensive mechanism when the ruble used to be falling.)

At the turn facet — and that is key — the entire quantity of its provide that may ever be issued is understood, not like any fiat foreign money. As fiat currencies inevitably debase sooner than bitcoin, call for for bitcoin is more likely to persist. Please word, this isn’t strictly a declare for bitcoin to be an immediate inflation hedge, i.e., for the shopper worth index (this has been a lazy fresh grievance). It’s moderately that the inflation of the bitcoin provide is already low at roughly 1.8% consistent with yr, with the issuance halving each 4 years and identified with simple task.

Inside this natively web cash, there is not any coercion inside of its make-up. No person is pressured via its life to carry it or to make use of it; they accomplish that via selection on my own. Additionally, it’s open to all and permissionless — obstacles to access are little greater than a smartphone and an web connection.

Not like bodily positioned country states, it does not bow to any political drive over its issuance or operations. It cannot be close down. It is also very onerous to prohibit folks from the use of it or to confiscate it.

It cannot be mindlessly rehypothecated. Why no longer? Since it is extraordinarily transportable, divisible and simple to take custody of the underlying asset, conserving it by the use of 3rd events that rehypothecate it introduces counterparty threat, so rational actors will usually steer clear of it, or on the very least call for market-based reimbursement for taking up that threat.

Bitcoin is freely traded 24/7, 365 days consistent with yr, and the prices of exchanging it usually are pushed ever decrease via festival through the years. In fact, its change price (this time period is a greater framing than “worth” on this dialogue) is very risky. That is by contrast to currencies the place there is also restrictions on buying and selling and governments might interfere in foreign money markets. As is also logical, the bitcoin change price thrives in instances of debasement of different currencies however struggles during periods of them tightening. (Examples of new buck tightening are 2018 and 2022, thus far.)

Fiat currencies for sure have massive assets of call for for them that bitcoin these days doesn’t have, particularly to fulfill long term transactions priced in the ones currencies. Those may just contain taxes due, or bills for items and products and services, or funding into homes, equities, and many others. Commodity sensible, a lot is fabricated from the relevance to grease being globally priced in bucks. This without a doubt has contributed to the choice of international international locations conserving bucks of their reserves. Why? If the oil worth in bucks can stay reasonably solid, conserving bucks will lend a hand nearer fit the price of long term power wishes than every other foreign money.

I intentionally hesitate to time period “bitcoin” as a foreign money via the best way. It’s every other lazy grievance that it has already didn’t have the qualities required to be one. I feel the Bitcoin white paper have shyed away from the phrase for just right reason why. Bitcoin has a few years and many years forward for sovereign international locations to make a decision to undertake it as a foreign money or no longer, however that won’t exchange its operations.

In Abstract

Because of its mounted provide and different distinctive attributes, it is only logical that many have began exchanging different, extra all of a sudden debasing currencies for bitcoin. Certainly, there are lots of temporary investors round, however the long-term change price is most likely pushed extra via the ones taking a long-term outlook of their positions to experience out the volatility. Notice this isn’t “making an investment”; bitcoin is a type of cash. It’s saving.

What about altcoins as competing cash? We don’t see them within the aforementioned best 10. Take some time to be told why bitcoin has no significant competition within the above context. Why evidence of labor is so essential to bitcoin’s immutability and completely decentralized nature. And why any further “application” advanced in every other altcoin seems meaningless if they are able to’t fit bitcoin’s financial homes — they are able to’t.

Similar to typical foreign money change charges or baskets, such because the DXY (a frequently seen basket of the Nice Britain pound, euro, Canadian buck, Swiss franc, Swedish krona and Jap yen towards the buck), it is beautiful difficult to expect the place bitcoin will hit any explicit worth degree in long term. As we’ve noticed above, bitcoin has a number of fascinating and distinctive attributes as cash when in comparison to fiat currencies. Those make it most likely that call for for it is going to proceed to extend as fiat currencies compete to debase. As Bitcoiners steadily say, it is simply math(s).

When framing it in those phrases, are you continue to certain bitcoin is heading to 0 any day now?

It is a visitor put up via BitcoinActuary. Critiques expressed are solely their very own and don’t essentially replicate the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)