Sign up for Our Telegram channel to stick up to the moment on breaking information protection

In a gaming arcade, you will have to first trade your money for arcade tokens with a purpose to use the video games featured within. Throughout the arcade’s small-scale financial system, those tokens function the identical of greenbacks. You might be able to promote your tokens again for actual cash on the finish of your discuss with to the arcade’s fantastical global.

The cryptocurrency counterpart of an arcade token is a stablecoin. The stablecoin issuer necessarily accepts one unit of cash in trade for a blockchain access with the similar worth. In different phrases, $1 is the same as $1 $USDC or $1 $USDT. Then, entities can perform extra trades, loans, transfers, and different transactions the use of those greenback equivalents to shop for different cryptocurrencies immediately at the blockchain.

The stablecoin issuer will get to stay the real greenbacks and get any hobby generated on those property in go back for setting up a greenback identical that can be utilized at the blockchain. To make it possible for the worth in their reserves at all times equals the worth of the stablecoins they’ve issued, the issuer, then again, explicitly undertakes to retailer all of those property in secure and liquid property. In different phrases, a stablecoin issuer must perform in a similar way to an easy cash marketplace fund.

At the cryptocurrency marketplace, there are 3 huge stablecoins with a blended marketplace valuation of $130 billion.

The marketplace capitalization of all cryptocurrencies is roughly 14%. In combination, those 3 stablecoins account for >99% of the marketplace’s liquidity.

With a marketplace worth of $65 billion nowadays, Tether is probably the most treasured stablecoin, adopted by way of Circle ($43 billion) and BUSD ($22 billion). Tether additionally (generally) dominates the marketplace in the case of day-to-day buying and selling quantity. Except a temporary window after the FTX failure when BUSD quantity surged, Tether’s quantity robotically outpaces the amount of the opposite two stablecoins by way of a big issue.

To position it in a different way, Tether is the primary supplier of greenback liquidity within the bitcoin markets. What property are backing those stablecoins, then? This brings up a vital level. And is it possible that just a portion of those stablecoins are sponsored?

Every stablecoin is sponsored by way of what?

USD Coin ($USDC)

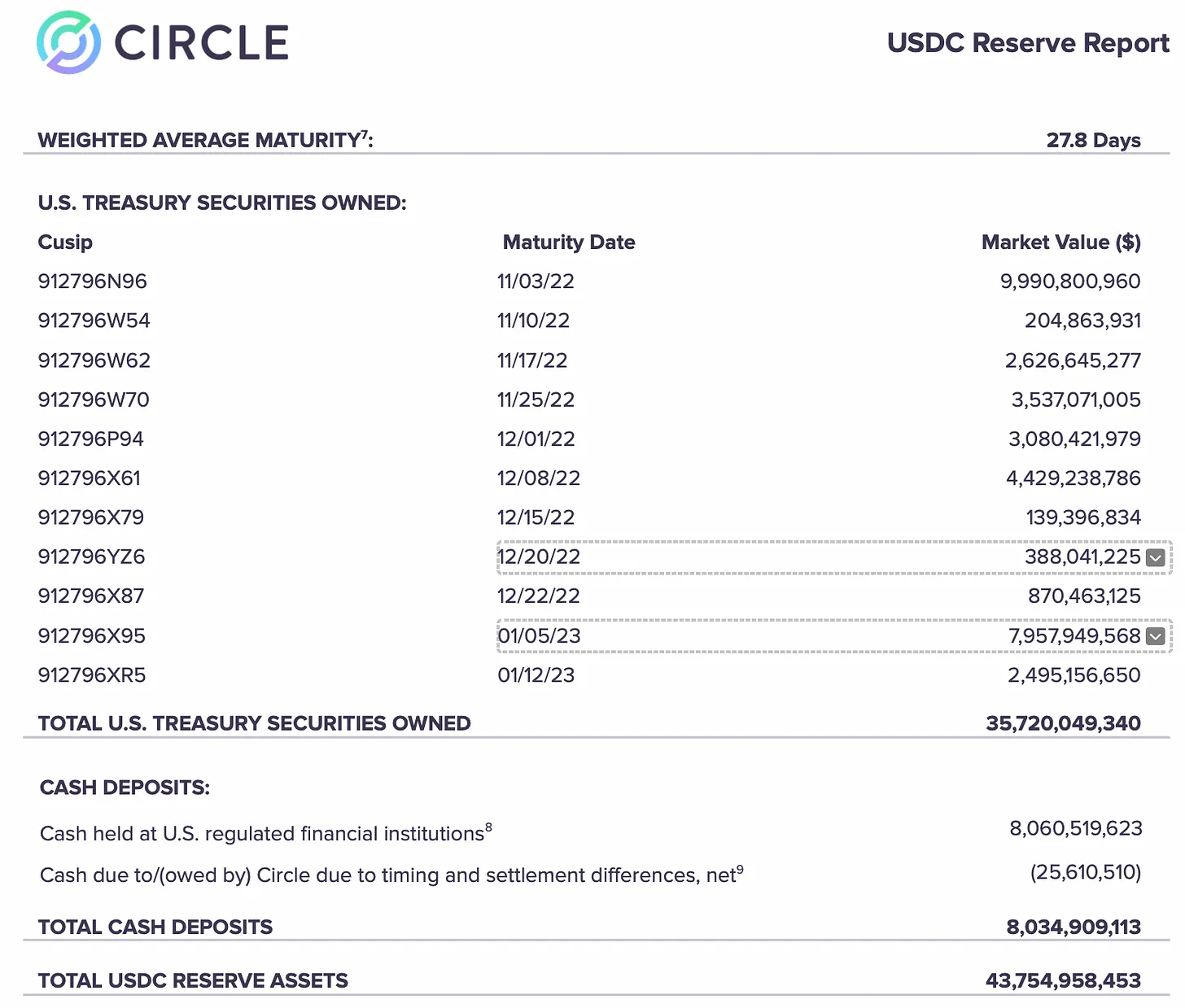

Circle Web Monetary, LLC, a U.S.-based trade with a cash transmitter license, is the issuer of USDC. The marketplace worth of USDC is at $43 billion. Even though Circle hasn’t ever launched an audited monetary file, their accounting company, Grant Thorton, does give per thirty days “attestations.” As of October 31, 2022, probably the most present file unearths that USDC is absolutely reserved, most commonly with Treasury securities (82%) and money (18%). Circle claims that “U.S.-regulated monetary establishments” are the place they preserve all in their finances.

It must be famous that the USDC attestation lists the Committee on Uniform Securities Id Procedures quantity and marketplace worth for every factor of Treasury securities bought.

Regardless of the caution that those accounts have now not been audited, Circle’s disclosure gives a good quantity of knowledge in regards to the property supporting its reserves. They care for a relatively simple portfolio of liquid and low-risk property which might be easy to liquidate within the tournament that stablecoin holders desired to replace their stablecoin for greenbacks.

Binance BUSD ($BUSD)

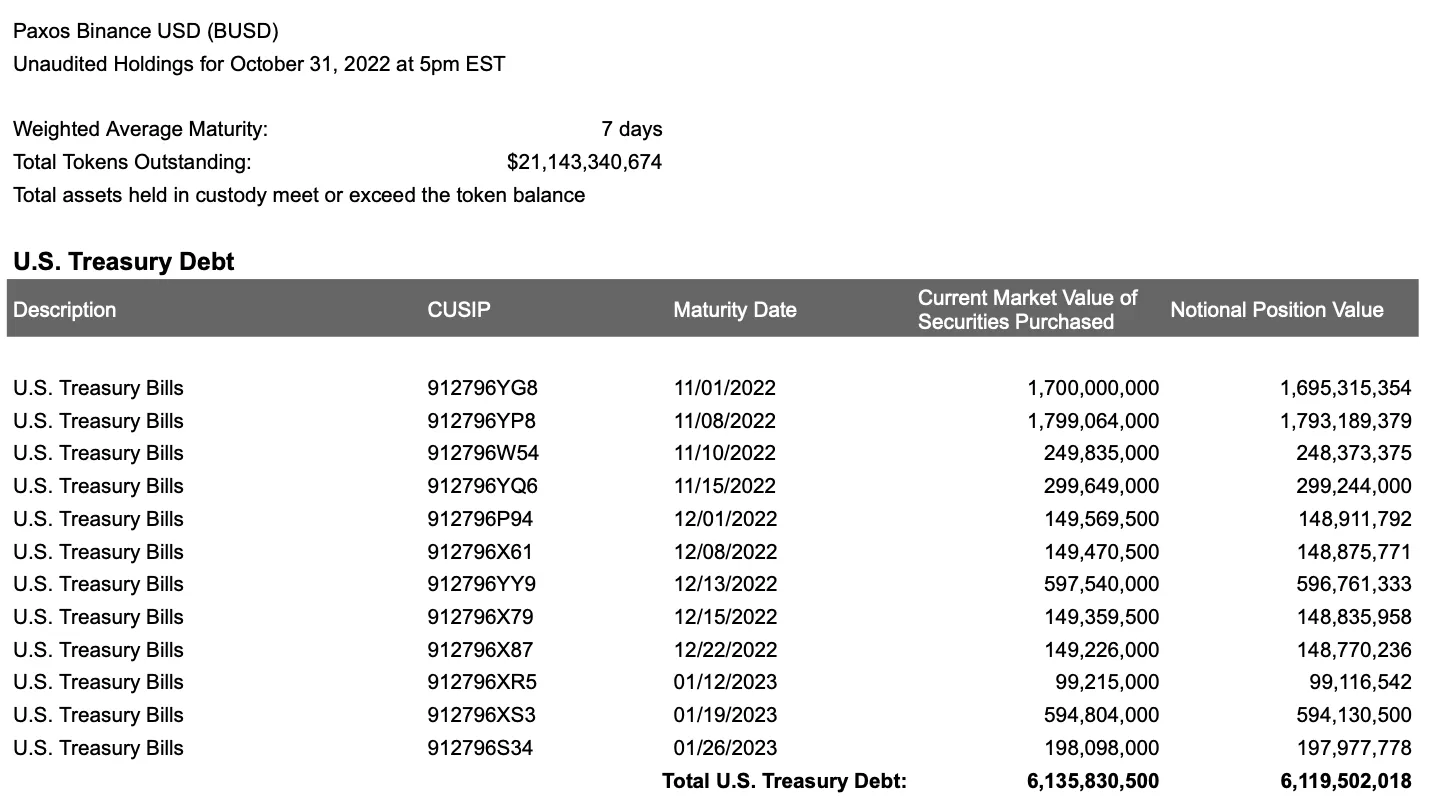

The stablecoin is actually issued by way of the Paxos Believe Corporate, LLC, a New York-based monetary establishment that makes a speciality of operating with cryptocurrencies, even supposing Binance USD bears the identify of the most important trade on this planet. The reserves that underpin BUSD, which has a marketplace valuation of $22 billion presently, are held by way of Paxos. Very similar to USDC, Paxos publishes per thirty days unaudited stories outlining the reserve breakdown:

BUSD used to be sponsored by way of a mixture of US Treasury debt ($6.1 billion or 29% of marketplace cap), Treasury opposite repurchase agreements ($14.2 billion or 67% of marketplace cap), and money ($870 million or 4% of marketplace cap) as in their attestation from October 2022.

The money a part of the cash are reportedly saved at US-regulated banks, in step with Paxos and USDC. Another time, the BUSD stories give detailed details about the reserves supporting the stablecoin. The stablecoin’s reserves actually have a simple construction and are solely made up of low-risk property, identical to USDC.

Tether ($USDT)

The Tether stablecoin is the marketplace’s maximum established and treasured stablecoin. Even supposing Tether and Bitfinex are formally unbiased organizations, it’s owned by way of the similar those who arrange the Bitfinex trade. We’ll reveal how the variation between those two companies and the alleged cut up between the FTX trade and Alameda Analysis are similar.

Tether is expressly prohibited from carrying out trade within the state of New York, against this to Circle and Paxos, either one of that have a license to take action. It used to be established that Tether had misled in regards to the reserves supporting USDT, and in consequence, they had been pressured to pay $18 million in a agreement with the NY AG. It comes out that Tether’s claimed 1:1 backing with US greenbacks used to be a deception at a number of levels all through its historical past. Moreover, Bitfinex and Tether continuously blended their assets, pooling cash to steer clear of chapter.

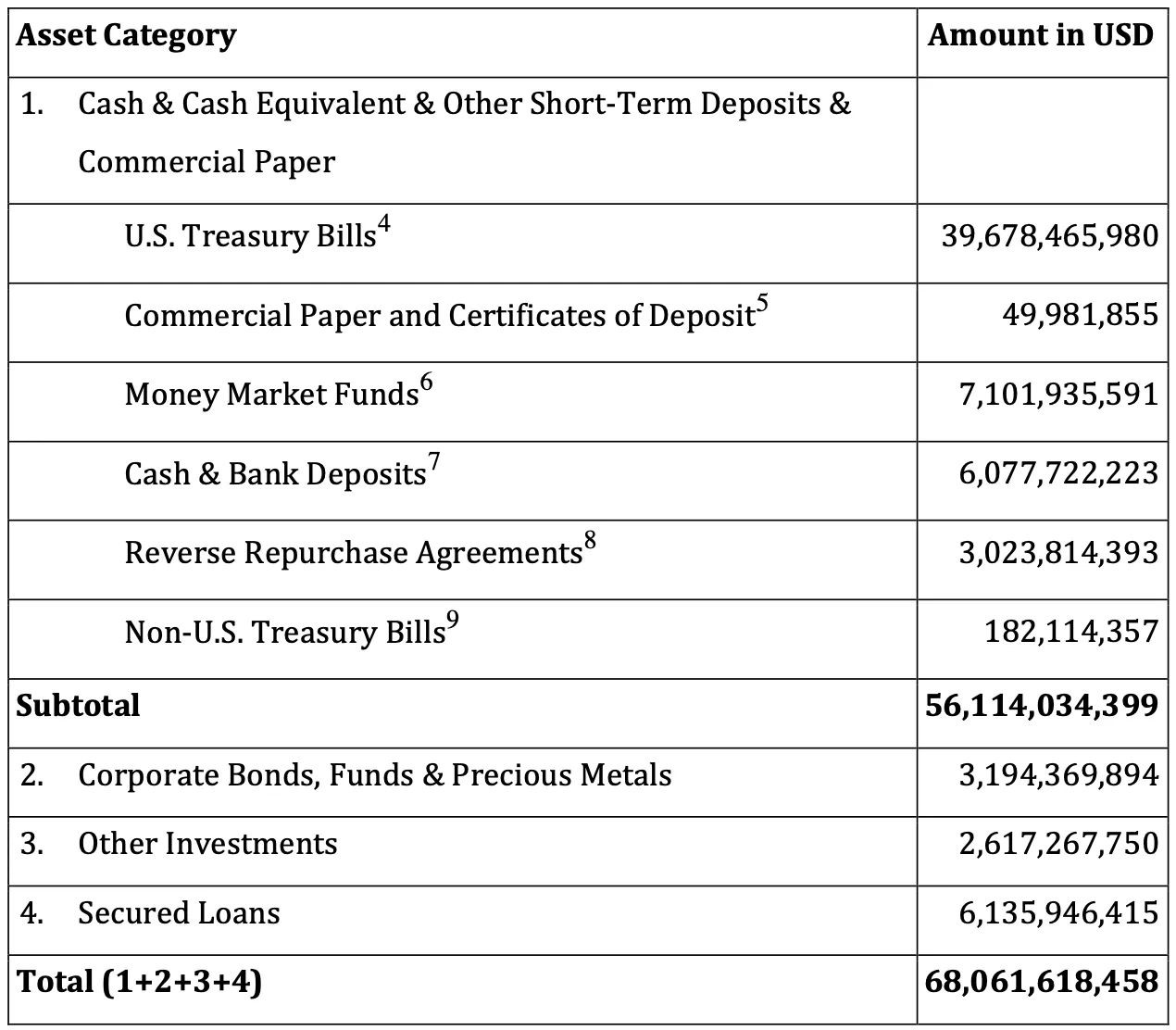

Anyway, let’s transfer over the totally needless historical past and have a look at Tether’s most modern attestation, which is legitimate via September 30, 2022:

Wow, that positive does range considerably from the monetary knowledge supplied by way of Circle and Paxos. 67% in their reserves are made up of money and Treasury notes. 10.3% extra of the reserves, or $7.1 billion, are stored in cash marketplace finances. Tether withholds details about the place it conducts its banking or how a lot of every form of Treasury debt it owns.

Particularly, “different investments,” “secured loans,” and “trade bonds, cash, and treasured metals” account for $11.nine billion (18%) of those reserves. “Opposite repurchase agreements” account for any other $Three billion (4.4%) of overall holdings. Those aren’t property sponsored by way of the Treasury, against this to the opposite repo agreements said on BUSD’s stability sheet. Those are as a substitute:

agreements which have been entered into immediately or not directly by the use of the acquisition of structured notes or fund automobiles, the place without equal issuer or guarantor of the settlement has a score of A-2 or higher.

Those secured loans pass to whom? Tether doesn’t tell us, due to this fact we’re not sure. We’re conscious that a minimum of one of the vital earlier collectors used to be the Celsius Community, which Tether sooner or later liquidated in June 2022 for extra over $900 million.

What collateral does this mortgage have? Tether doesn’t tell us, due to this fact we’re not sure. We all know that Tether issued USDT in keeping with Bitcoin-backed loans as a result of to its settlement with Celsius.

What “different property” quantity to $2.6 billion for Tether? Tether doesn’t tell us, due to this fact we’re not sure. A few of these property, in step with a contemporary Semafor study, are challenge capital investments Tether made in (probably nugatory) companies:

It additionally owns $2.6 billion in “different investments,” in step with the September file. It’s now not utterly transparent what’s in them, however they’re most probably challenge stakes in different crypto firms held by way of its homeowners and associates, in step with an international investigations company commissioned by way of a hedge fund making a bet in opposition to the cost of Tether. Semafor reviewed the findings of its file that discovered Tether holds fairness stakes in additional than a dozen crypto startups.

Semafor used to be ready to make sure some however now not others. We showed that the crypto trade that owns Tether invested, both via itself or an associate, into: an online-betting web page referred to as Betfinex; Dazaar, a data-sharing carrier; Nightfall Networks, whose instrument turns monetary investments into tokens; a crypto buying and selling platform referred to as Rhino; Form Shift, a crypto pockets; Blockstream, a blockchain infrastructure corporate; Netki, a digital-ID corporate; and Keet.io, a video-chat app.

Obviously, Tether’s disclosures and reserve technique diverge a great deal from the ones of its key competitors. They don’t supply just about as a lot element of their attestations as Circle or Paxos do. Their plan is a lot more intricate, and Tether freely recognizes to having a stability sheet with extra riskier property. Moreover, it sort of feels that a minimum of a few of Tether’s reserves are stored in very dangerous challenge capital ventures that can be value a lot lower than what Tether says they’re.

Tether reportedly said mendacity about their reserves

Tether paid fines of $18 million and $41 million in 2021 to get to the bottom of felony movements introduced by way of the New York Lawyer Normal (NYAG) and the Commodities and Futures Buying and selling Fee (CFTC). It used to be established in the ones agreements that Tether had time and again misled in regards to the property supporting their coin. In truth, those settlements confirmed that over numerous years, Tether used to be absolutely sponsored on reasonable 28% of the time. In line with the NYAG’s statement at the settlement:

The OAG’s investigation discovered that, beginning no later than mid-2017, Tether had no get entry to to banking, any place on this planet, and so for sessions of time held no reserves to again tethers in flow on the price of 1 greenback for each tether, opposite to its representations.

One in particular heinous incident from 2018 used to be printed in those agreements. To control its money, the Bitfinex trade used a shadow financial institution with a location in Panama named Crypto Capital Corp (CCC). Particularly, there used to be no written contract concerned within the settlement between CCC and Tether. Sadly for Tether, CCC additionally had financial relationships with the cartels. The U.S. DOJ closed it down, seizing its property, together with about $850 million in Bitfinex buyer money. Bitfinex transferred Tether’s reserves to its personal accounts to offset the losses:

On November 1, 2018, Tether publicized any other self-proclaimed ‘verification’ of its money reserve; this time at Deltec Financial institution & Believe Ltd. of the Bahamas. The announcement related to a letter dated November 1, 2018, which said that tethers had been absolutely sponsored by way of money, at one greenback for each one tether. On the other hand, the very subsequent day, on November 2, 2018, Tether started to switch finances out of its account, in the end transferring loads of thousands and thousands of greenbacks from Tether’s financial institution accounts to Bitfinex’s accounts. And so, as of November 2, 2018 — at some point after their newest ‘verification’ — tethers had been once more not sponsored one-to-one by way of U.S. greenbacks in a Tether checking account.

This used to be, in fact, up to now. Even supposing Tether and Bitfinex are nonetheless run by way of the similar folks, have they modified for the simpler?

Possibly now not. Although we settle for Tether’s provide attestations as true, its personal statistics display that Tether has both been bancrupt a large number of instances over the former yr or has continuously wanted recapitalization!

In line with the mythical instrument guide and monetary writer Patrick McKenzie:

The Consolidated Reserves Record alleges that Tether’s reserves incorporated, as of September, $2,617,267,750 of “Different Investments (together with electronic tokens)” and $6,135,946,415 of Secured Loans.

Those property will have to have been impaired within the remaining six weeks. If they don’t seem to be, Tether would have a sound declare to being the most efficient threat managers. No longer in crypto, no, within the historical past of the human race.

The chance-on property are 12.86% of the reserves, by the use of easy department. Their fairness is 0.36% of property. (No, I didn’t fail to remember to multiply by way of 100 when changing to %.)

If their risk-on property had been impaired by way of greater than about 2.86%, Tether will have to have (by way of their very own numbers) wanted recapitalization. Once more.

Tether has controlled to steer clear of losses on each unmarried blowup during the last yr, from 3AC to Celsius to FTX, whilst lending cash to different cryptocurrency firms. That is true even supposing Alameda Research was USDT’s biggest contributor.

“Believe, don’t test” is Tether’s motto

Many of us, together with essential media retailers, have wondered Tether’s integrity and the assets supporting their coin. Given Tether’s extraordinarily limited disclosures and historical past of mendacity about said reserves, it could appear respectable to pose those problems.

Tether’s resolution to those inquiries persistently follows a an identical development of hysterical denial and denunciation slightly than providing further info and explanation:

Wouldn’t it now not be more practical in the event that they had been as a substitute absolutely clear about the place their reserves if truth be told are?

Comparable

FightOut (FGHT) – Transfer to Earn within the Metaverse

- CertiK audited & CoinSniper KYC Verified

- Early Level Presale Are living Now

- Earn Loose Crypto & Meet Health Objectives

- LBank Labs Challenge

- Partnered with Transak, Block Media

- Staking Rewards & Bonuses

Sign up for Our Telegram channel to stick up to the moment on breaking information protection

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)