ADA

Grayscale Investments, the company identified for its in style Grayscale Bitcoin Consider fund, has unveiled a brand new fund that can focus on competition to Ethereum, together with names like Cardano, Solana and Avalanche.

The Grayscale Good Contract Platform Ex-Ethereum Fund would be the 18th funding product from the sector’s greatest virtual forex asset supervisor. The fund delivers publicity to a number of good contract platforms which have been tagged as ‘Ethereum Killers’ prior to now.

The fund will function thru a market-cap-based weighted portfolio this is meant to trace the CoinDesk Good Contract Platform Make a choice Ex ETH Index.

The fund comes ahead with a 2.5% annual charge and is made up of the next tokens: Cardano at 24.63%, Solana at 24.27%, Avalanche at 16.96%, Polkadot at 16.16%, Polygon at 9.65%, Algorand at 4.27%, and Stellar weighted at 4.06%

Good contract era is important to the expansion of the virtual economic system, however it is nonetheless too early to grasp which platform will win – from attracting and preserving probably the most colourful developer communities, to making sure the platform is high-speed, versatile, and scalable. The wonderful thing about GSCPxE is that traders do not need to make a choice one winner, and as a substitute can get entry to the advance of the good contract platform ecosystem thru a novel funding automobile.

Additionally, Grayscale’s new fund is likely one of the first securities completely invested in the cost of local tokens of rising good contract platforms.

The cost of ADA was once buying and selling at $0.86 because the BTC weak point drags it decrease.

SOL

Solana would additionally achieve from funding into the ETF with a virtually equivalent weighting within the fund this means that that Grayscale see them because the frontrunners to problem ETH.

Michael Saylor, CEO of MicroStrategy, makes a difficult prediction for Solana and Binance to return up in opposition to Ethereum.

In a contemporary podcast with Lex Fridman, Saylor stated of crypto platforms:

I believe that within the crypto platform house Ethereum will compete with Solana and Binance Good Chain.

Solana was once introduced and considered the “Ethereum killer” with its reactionary blockchain which stuffed the gaps discovered within the Ethereum blockchain. Solana can document round 60000 transactions consistent with 2d making it one of the vital quickest layer-one blockchains.

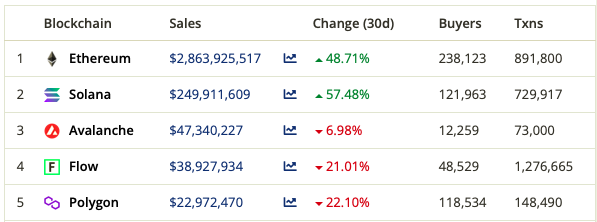

Ethereum remains to be the go-to challenge in NFT gross sales with over ten occasions the worth, however Solana’s integration to OpenSea just lately might exchange that.

The Ethereum blockchain remains to be shifting against its ‘merge’ transfer to a Evidence-of-Stake (PoS).

Saylor additionally spoke of a shiny long run for stablecoins, pronouncing he believes the sector needs two issues at this time: crypto belongings as a financial savings account and cryptocurrency as a bank account.

That implies the most well liked factor in reality goes to be a stablecoin greenback. It’s now not transparent that there can be one that can win, the category of strong greenback is most probably a one to 10 trillion-dollar marketplace simply.

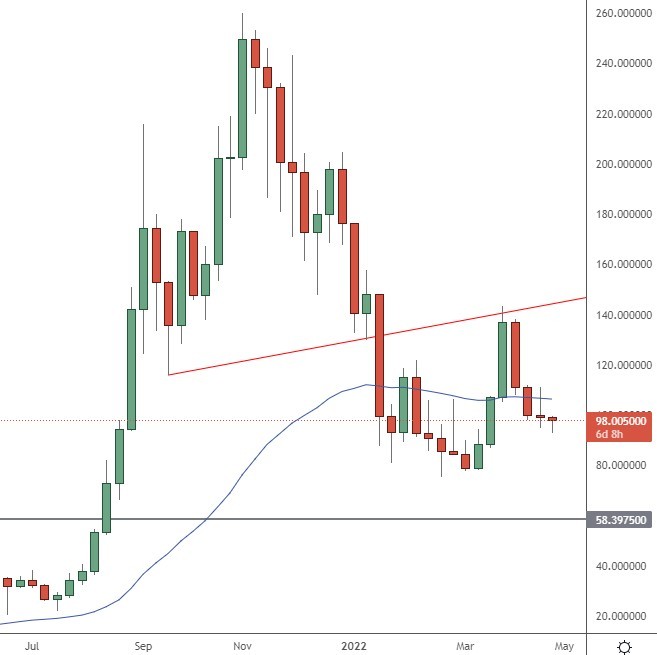

The cost of SOL was once suffering to carry the $100 degree because of the bearish marketplace motion.

STEPN

One of the most best-performing cash of the yr has been STEPN, the local token for the Inexperienced Metaverse Token challenge.

Observed as the primary “move2earn” cellular NFT recreation, STEPN is powered through Solana and offers a platform the place gamers with their NFT Shoes can stroll, jog, or run outside and earn tokens within the procedure.

Since launching in December 2021, STEPN has grown at a quick tempo from just one,500 day by day energetic customers in January 2022 to nearly 100,000 in March 2022. The STEPN token favored 34,000% in simply 41 days.

in a weblog put up on 1 April 2022, which has since been got rid of through running a blog website online Medium, builders introduced that its industry generated a benefit of $26,815,807 during the gross sales of its footwear on its NFT market and royalty charges in Q1 2022. With a view to create extra price for the ecosystem, the benefit can be used to shop for again and burn GMT.

The cost of STEPN was once consolidating after fresh positive factors and trades at $3.25.

APE

ApeCoin was once the most important gainer this week with a transfer upper of greater than 58%.

Research from the platform highlighted a large motion of dormant $APE tokens all the way through the native most sensible hit on April 23. One of the greatest transactions have been deposits from chilly garage to the Binance alternate. The spike in transaction process hints that $APE holders might be on the brink of take earnings off the desk.

When ApeCoin introduced final month, the builders opted to praise BAYC NFT homeowners with unfastened $APE tokens. The challenge deliberate to distribute 150 million $APE to NFT holders by means of an airdrop.

Whilst the airdrop sought to comprehend early traders within the BAYC ecosystem, it has ended in a big focus of whales. In keeping with Coincarp’s $APE wealthy listing, the highest 100 wallets hang over 52% of the roughly 284 million tokens in circulate.

Analysts from Santiment expect the hot rally may just achieve steam within the temporary prior to a bigger sell-off. That can most likely rely at the fresh whale motion of cash.

The cost of APE was once buying and selling at $17.75 which is close to the best-ever excessive of $18.00.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)