There are two forward-looking international locations on Earth in relation to Bitcoin: El Salvador and the Central African Republic. Those two very other international locations on other aspects of the globe have each come to the similar conclusion: Bitcoin is the most efficient cash ever invented and embracing it early will likely be really helpful each for the folk of the adopting country and to the ease and preservation of the concept that of the countryside itself.

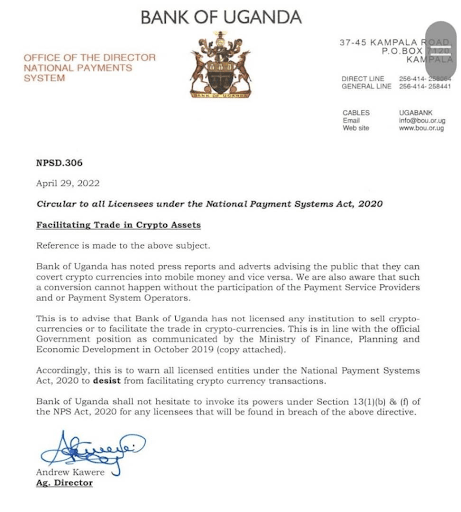

There are different international locations however, that aren’t led by means of proficient and insightful folks. Uganda is also one such instance, the central financial institution of which has simply made this very ill-advised announcement, demonstrating a whole lack of awareness of the entire issues to do with cash and the good adjustments which can be coming to how it’s accounted for.

(Source)

Their first error is to consider there’s this sort of factor as a “crypto asset.” This time period does now not describe an actual factor and their insertion of this word into their announcement presentations that their considering isn’t authentic in any respect, however gleaned from what they’ve learn on the net or what they have been advised to mention by means of the Financial institution of World Agreement or the World Financial Fund.

Evaluate and distinction with the statements, plans and laws handed by means of El Salvador, demonstrating a whole figuring out of Bitcoin and what it way to the way forward for that nation. There’s a transparent divide right here; at the one hand, profound lack of understanding and, at the different, deep perception, accountable stewardship, future-oriented considering and ethics.

Long term-oriented governments will likely be determined to totally include Bitcoin and its dynamics, understanding that the chance that it’ll grow to be the arena’s reserve forex is one. (That suggests an absolute sure bet, math-challenged readers.)

Bitcoin used to be designed to give protection to everybody on Earth from silly folks, however prior to Bitcoin can offer protection to you from silly folks, it must be followed by means of those self same silly folks which can be the risk to you. That is the conundrum. How are you able to get silly folks to shop for and dangle and use bitcoin? And what occurs once they’re operating the govt?

The solution for folks dwelling in ethically-run international locations is that folks like President Nayib Bukele and President Faustin-Archange Touadéra should take the reins of energy and use them responsibly to loose their international locations from the yoke of penury-entrenching Western fiat currencies.

The Central African Republic is symbolically positioned at the continent to grow to be the middle of African bitcoin-based ecommerce, being kind of equidistant from all issues at the continent. That nation might be reworked from being one of the vital poorest to one of the vital richest in very quick order, must it harness the transformation made conceivable by means of adopting Bitcoin after which grow to be a continental hub for Bitcoin. That is not more abnormal than El Salvador turning into a focal point for Bitcoin, for the ones of you with a goldfish reminiscence who consider that is unattainable.

Doing trade at the continent of Africa could be very tricky. It’s tricky to get bills in and really tricky to get bills out. For instance, there’s a black marketplace trade fee, and the government-sanctioned trade fee in Nigeria, which means that there are two economies operating in parallel, on best of the trouble of transferring cash out. Bitcoin fixes all of this as a result of someone can ship and obtain bitcoin in any quantity at any time, with out permission, and its value is decided by means of the marketplace, now not the State.

Pronouncing “with out permission” or “permissionless” as Bitcoiners do, is a word loaded with such a lot receive advantages that it’s exhausting to explain to Westerners who do not know of what it’s find irresistible to do trade at the continent of Africa. They take as a right that doing trade and sending and receiving fiat cash is an issue of urgent a button.

In Nigeria, as an example, actual existence isn’t so.

Transferring cash is fraught with difficulties and a couple of tactics of constructing a loss on a switch. Those piled-up losses could make it not possible to earn a benefit, and should you do, not possible to spend or recycle it the place you want to spend or recycle it. Bitcoin makes all of this move away, in addition to including unusual pace to all transactions which can be with out precedent for Nigerians and many of us dwelling at the African continent.

Given all the benefits of Bitcoin, an clever individual would ask, “Why then hasn’t Nigeria formally embraced bitcoin as a method of cost?” That is the right kind query, and there are lots of solutions to this, some cultural, which can be combating the Nigerian authorities from embracing truth and performing boldly like a pace-setter country as El Salvador and the Central African Republic has.

Seeking to do any form of Bitcoin trade in Nigeria very continuously comes to the invocation of the Central Financial institution of Nigeria (CBN), which has a stranglehold on all companies and financial institution accounts in Nigeria. Bitcoin would abolish their societal standing and the reign of terror that they’ve unleashed at the nice folks of Nigeria. This is a certain wager that this is likely one of the key the explanation why they’re making an attempt so exhausting to stamp out Bitcoin, relatively than do their accountability to serve the Nigerian folks by means of embracing this new instrument.

That probably the most populous nation at the continent of Africa is the quantity two country on Earth for Bitcoin adoption (one-third of all Nigerians use it) within the face of withering and unethical restrictions is a testomony to the tough and resourceful personality of the Nigerian people who find themselves born futurists, herbal capitalists and unusual marketers: extremely smart, succesful and motivated.

What’s maintaining again the Nigerian folks is the definitely corrupt, protectionist and anti-Nigeria CBN, which is combating the waft of cash and flourishing of innovation there, for no just right explanation why as opposed to a nauseating lust for energy and a cargo cult mentality in regards to the position of the State and necessity for a central financial institution. In Nigeria, greater than some other nation “Bitcoin fixes this” by means of eliminating the desire for the naira from folks’s lives as they transfer to bitcoin.

Nigeria may grow to be the African capital of Bitcoin if the Nigerian folks used it with out permission en masse, squeezing out the naira as the folk’s cash, exposing their companies and private budget to the loose waft of cash bitcoin facilitates. It would grow to be the African capital of Bitcoin with an El Salvador-style embracing of truth if Nigeria made bitcoin prison gentle.

Have been the Nigerian authorities to try this, it will be the maximum tough sign conceivable, and determine them as absolutely the chief country at the continent. It might now not most effective sign that Bitcoin is converting the arena, however that the so known as “third-world international locations” are taking their destinies into their very own palms, choosing sound cash over sycophancy, for reliability over rapaciousness, for transparency over tyranny, for readability over corruption, for freedom over fiat.

The selection is understated. Nigeria should move complete Bitcoin by means of legislation. The Nigerian folks want and deserve it.

However it sounds as if that the backwards actors and load cultists in Nigeria would possibly not right now be ready to listen to those phrases.

The Nigerian authorities’s model of a Securities and Trade Fee, a shipment cult imitation of the American SEC, has simply launched a wholly absurd document at the providing and custody of “Virtual Belongings.” In it, is one of the hilarious sections at the issuance of preliminary coin choices (ICOs) which might be already lifeless far and wide else on earth, and have been they now not, would by no means be issued in Nigeria by means of someone. This presentations that the individuals who authored this “law” are merely copying textual content from the web or had been spoon-fed it; in truth, the whole lot about them is copied the entire manner down.

They also have a completely insane phase mandating the publishing of white papers. It’s evident by means of this that they don’t know the starting place of the white paper phenomenon in “the distance” and are merely making issues up as they move alongside, regulating and mandating anything else that strikes with none figuring out of ways anything else works or why it exists.

Bear in mind additionally, that each and every novel providing made to be had over the web is now totally available by means of each and every Nigerian citizen, whether or not the Nigerian authorities likes it or now not, as a result of those gives are freely available and usable on commodity cellphones. A lot of these ridiculous copycat rules do is be sure that Nigerians are excluded from writing and freeing tool inside of their very own nation. And the Nigerian authorities doesn’t have the technical capacity to forestall Nigerians from the usage of Bitcoin or some other verbal exchange instrument.

In impact, which means Nigerians (right now one-third of them) are overtly rejecting the gadget there and voluntarily opting right into a nongovernmental gadget of cash and finance as a result of it’s higher and extra fitted to the Nigerian personality of innovation.

To a foreigner, the concept that Nigerians have a personality of innovation would possibly appear ordinary, however there is not any different reason for that fab nation being quantity two on the earth for Bitcoin adoption. It’s the Nigerian authorities this is Luddite and stepping into the best way of Nigerians and their inevitable becoming a member of of the worldwide community as leaders and friends.

In spite of everything (and fortunately), the location of the Nigerian authorities seems to be open to modify. It’s attending the unusual assembly in El Salvador with the governments of central bankers from Angola, Armenia, Bangladesh, Burundi, Congo, Costa Rica, Egypt, Gambia, Ghana, India, Namibia, Senegal, Sundan, Uganda, Zambia and 25 different growing international locations flying in to learn how to include Bitcoin.

Nigeria being in this record of nations is very important. As a gaggle, international locations in this record are larger than BRICS. If all of them “move Bitcoin,” it’ll be one of the crucial important occasions in trendy historical past and the elimination of the yoke of the greenback from the necks of billions of folks.

Bringing them in combination out of doors the U.N./U.S. context is a stroke of genius. Now, in conjunction with not unusual motive, not unusual court cases and not unusual animus, Bitcoin will function the foundation for a brand new pole within the rising multipolar global: one the place monetary coordination does not require agree with and there is not any chief, simply the completely truthful, clear and completely moral Bitcoin.

This can be a visitor publish by means of Beautyon. Evaluations expressed are totally their very own and don’t essentially mirror the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)