On-chain knowledge presentations that altcoin quantity dominance is now on the easiest stage since January 2021, whilst Bitcoin’s is at its lowest.

Altcoin Dominance By means of Quantity Not too long ago Touched A Prime Of 64%

As identified through an analyst in a CryptoQuant post, Bitcoin’s dominance is solely at 16% now. The “dominance by volume” is a trademark that measures the proportion of the entire crypto marketplace trading volume that’s being contributed through a selected coin.

When the price of this metric is going up for any crypto, it signifies that specific crypto is staring at a better quantity of task relative to the remainder of the marketplace recently. This means that the coin is garnering extra hobby from buyers presently. However, low values can suggest that the crypto is dropping mindshare in this day and age as its quantity share is happening.

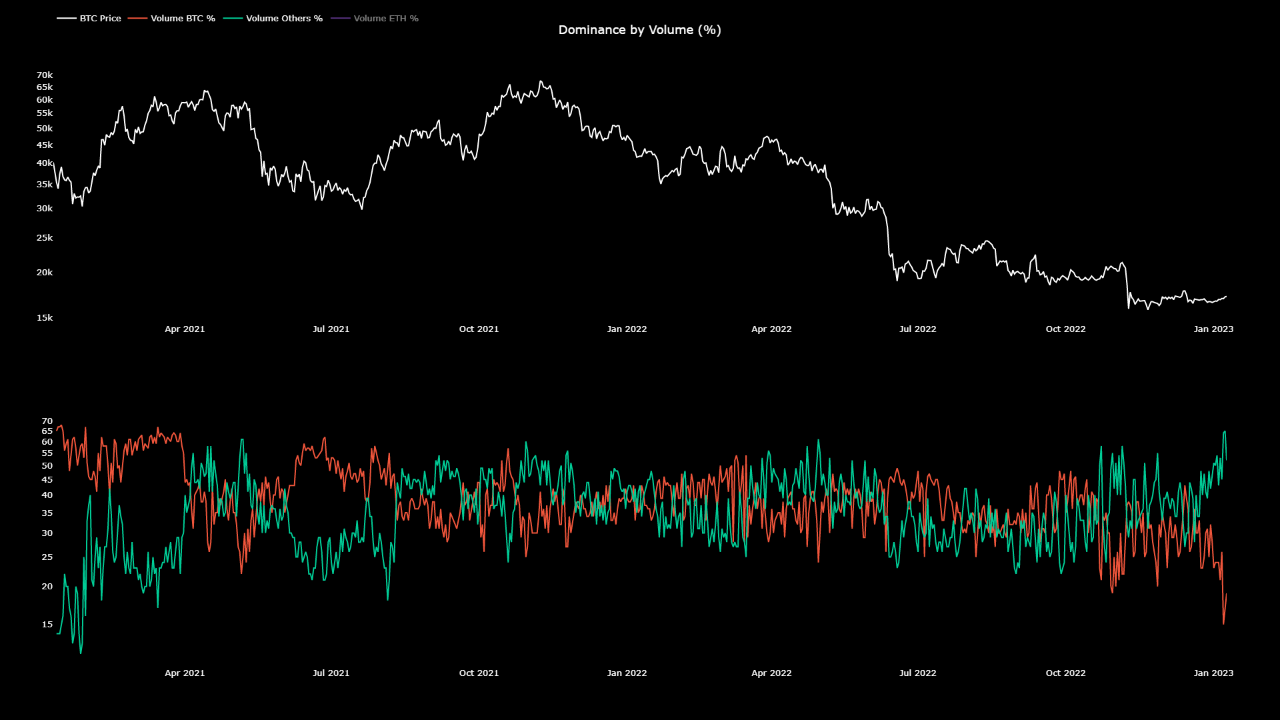

Now, here’s a chart that presentations the rage within the dominance through quantity for all of the altcoin sector blended (minus Ethereum), in addition to for Bitcoin, over the last couple of years:

The 2 metrics appear to have long gone reverse techniques in contemporary days | Supply: CryptoQuant

As proven within the above graph, Bitcoin’s dominance through quantity has sharply lowered lately and has touched a price of simply 16%. That is the bottom price BTC has noticed throughout the remaining couple of years.

The altcoins (rather than Ethereum), to the contrary, have noticed their dominance shoot up within the remaining week or so, because the metric now has a price of 64%. This means that BTC has misplaced its marketplace percentage to those alts lately.

The quant unearths this development “very regarding,” on the other hand. The explanation in the back of this is the truth that on every occasion rallies have kicked off with altcoins being on most sensible, they haven’t most often lasted for too lengthy, and the costs have temporarily come backtrack.

It is extremely obviously noticed within the chart. For instance, the tops of each the bull rallies of 2021 (those within the first and moment half of of the 12 months) took formation whilst the altcoins had a better buying and selling quantity dominance than Bitcoin. The newest FTX crash additionally came about whilst alts have been dominating the marketplace.

It might seem that usually any sustainable and wholesome value rallies have best began with the dominance of BTC being upper than those alts. One outstanding instance is that the July 2021 backside, which kicked off the second-half bull run of 2021, came about with the Bitcoin quantity share being upper than altcoins.

All of the marketplace has been rallying within the remaining week, but when the ancient development is the rest to move through, this uplift would possibly not remaining too lengthy because the dominance of altcoins is at very prime ranges presently. This could spell hassle no longer just for Bitcoin but in addition for those alts themselves.

BTC Value

On the time of writing, Bitcoin is buying and selling round $17,400, up 3% within the remaining week.

Looks as if the price of the crypto has long gone up over the previous few days | Supply: BTCUSD on TradingVIew

Featured symbol from Artwork Rachen on Unsplash.com, charts from TradingView.com, Arcane Analysis

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)