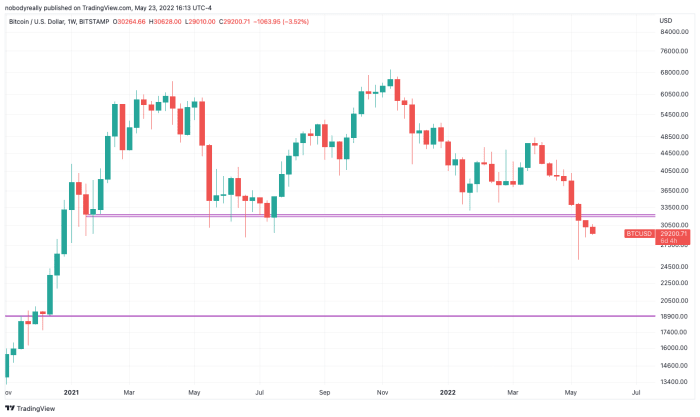

Bitcoin has failed to carry the $30,000 degree on Monday after scoring its 8th consecutive week within the pink for the primary time ever.

Right through those 8 weeks, which started in past due March and ended on Sunday, bitcoin has misplaced over 35% of its U.S. greenback price in step with TradingView knowledge. Earlier than the start of the dropping streak, BTC was once buying and selling at round $46,800.

Bitcoin has scored losses for 8 consecutive weeks for the primary time in its historical past and it’s beginning the 9th with but any other pink candle. Symbol supply: TradingView.

Bitcoin is converting palms quite beneath $30,000 on the time of writing. The peer-to-peer forex climbed as top as $30,600 previous on Monday to industry at round $29,400 because the buying and selling in fairness markets nears its result in New York.

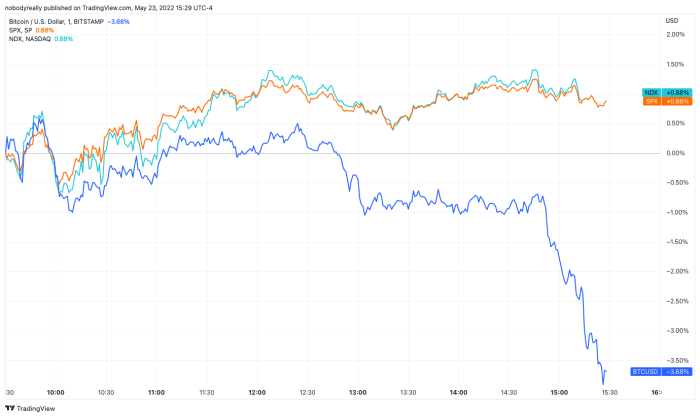

Whilst bitcoin turns south, primary U.S. inventory indices had been within the inexperienced. The Nasdaq, which is claimed to be extremely correlated with bitcoin, decoupled from the virtual cash at the side of the S&P 500 to indicate modest features close to marketplace shut on Monday, according to TradingView knowledge.

Whilst bitcoin, Nasdaq and S&P 500 have been buying and selling in tandem for a while on Monday, the P2P forex noticed a pointy sell-off decouple it from the 2 indices and take it to a greater than 3% loss for the day. Symbol supply: TradingView.

A Difficult Yr For Bitcoin

In spite of making two new all-time highs in 2021, bitcoin already erased the vast majority of the ones features in 2022.

Bitcoin’s uneven buying and selling yr to this point may also be partially attributed to a broader sentiment of financial uncertainty because the Federal Reserve tightens the U.S. financial system, taking flight liquidity from the marketplace after nearly two years of quantitative easing.

The central financial institution has already raised its elementary rates of interest two occasions this yr, the closing of which was once double the magnitude of the former one and represented the most important hike in twenty years: Whilst the Fed higher rates of interest by 0.25% in March, it raised them by 0.50% previous this month.

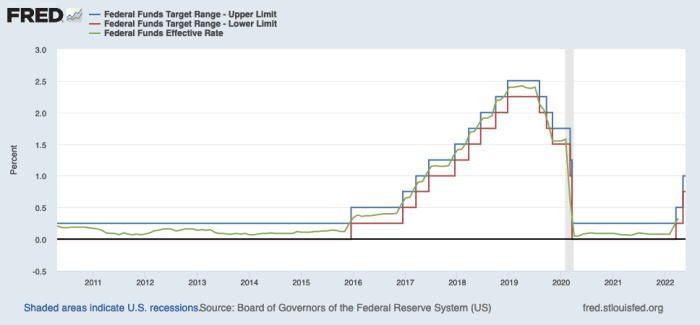

Symbol supply: Federal Reserve Economic Data (FRED).

When the Fed raises or lowers rates of interest via its Federal Open Markets Committee (FOMC), what it is actually doing is atmosphere a goal vary. The graph above depicts the decrease and higher bounds of that concentrate on vary in pink and blue, respectively.

Whilst the U.S. central financial institution machine units the objective, it can not mandate that business banks use it — relatively, it serves as a advice. Subsequently, what banks finally end up the use of for lending and borrowing extra money between them in a single day is named the efficient price. That is proven via the fairway line within the graph above.

The Fed in the past hiked rates of interest constantly from 2016 to 2019, till plunging it close to 0 within the aftermath of the COVID-19 pandemic outbreak, as famous within the graph.

Bitcoin’s upper sensitivity to liquidity and subsequently rates of interest may also be defined via a better participation of institutional buyers available in the market, whose allocations are in keeping with the provision of capital and broader financial stipulations, Morgan Stanley reportedly said.

Subsequently, whilst Bitcoin was once in a position to maintain a bull marketplace in the course of the Fed expanding rates of interest in 2017, elevating just about 2,000% from January to December that yr, the chances aren’t at the aspect of the bulls this yr.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)