That is an opinion editorial via Conor Chepenik, a bitcoin pleb.

When a nocoiner asks me about Bitcoin, it’s arduous to not take a “Michael Saylor breath” and embark on a four-hour dialog about how there’s no 2d easiest.

My Bitcoin elevator pitch has develop into higher over the years, nevertheless it’s arduous explaining why the arena so desperately wishes a decent financial ledger in 30 seconds. Evidence-of-work is needed to have the fantastic enjoy of taking place the Bitcoin rabbit hollow. On this piece I try to lay out why the incentives of the community are so smartly concept out at each stage.

Humanity hasn’t ever prior to had one of these truthful recreation. A actually loose marketplace ledger that any one can get entry to, examine and replace in the event that they play via the principles. From folks to small companies, adopted via grid operators and effort corporations, and in any case geographical regions, everybody advantages in the end via enjoying rather with electrical energy quite than thru coercion and violence. Whilst I’m maximum hopeful that Bitcoin can assist empower sovereign folks, it sounds as if we’re coming into the purpose the place establishments get started stacking sats.

Because the community continues to develop in dimension, Bitcoin will succeed in some degree the place each corporate and countryside will undertake the era in some shape or model, similar to they’ve with TCP/IP. The Bitcoin rabbit hollow makes studying amusing and teaches other folks about power, finance, philosophy, physics, historical past, recreation principle, economics, laptop science and a number of different topics. At my native Bitcoin meetups in Massachusetts, I’ve heard many equivalent tales of other folks beginning to learn about and know about topics they differently would by no means have troubled to review. So as to have a just right figuring out of Bitcoin you should dedicate masses, if no longer hundreds of hours. At which level you might be simply getting began as a result of “no one has found the bottom of the Bitcoin rabbit hole.” If you begin to snatch what Bitcoin manner for humanity, it virtually looks like a cheat code for existence. An apolitical, censorship-resistant, actually scarce, decentralized ledger this is being followed via the loads from the bottom up. It’s a blessing that the nameless individual or team named Satoshi Nakamoto solved the Byzantine generals problem.

(Source)

People

Socialism doesn’t paintings as a result of persons are self-interested. I’d like to are living in a utopia the place everybody cooperates and is helping their neighbor. I firmly imagine that whilst you give by means of your personal loose will, it is without doubt one of the easiest emotions on the earth. Alternatively, it does no longer really feel superb to offer if you find yourself compelled to take action as a way to steer clear of violence. All through historical past, removing the facility for other folks to stay the end result in their hard work has at all times ended poorly. Telling other folks they should produce for “the better just right” is a recipe for crisis. One instance of that is what came about in China between 1959-1961. The rustic skilled what’s now known as the Nice Famine below Mao Zedong.

“Disposing of all manner of personal meals manufacturing (in some puts even cooking utensils), forcing peasants into mismanaged communes, and proceeding meals exports had been the worst acts of fee. Preferential provide of meals to towns and to the ruling elite was once the planned act of selective provision.” — Vaclav Smil

This is only one instance of what occurs when the federal government takes away the facility for its voters to paintings on what they themselves deem worthy. It ruins the inducement construction for productive other folks to paintings on significant duties. The sector isn’t a utopia regardless of how badly socialists need it to be. It’s something to demonize monopolistic practices as a result of they obstruct the loose marketplace from running correctly. This is a totally other factor to demonize benefit. If other folks can’t make a benefit they received’t spend their time and sources making one thing of price. This is until they’re compelled to take action via the specter of violence. The extra coercion is implemented, the fewer price is created as a result of any person running for benefit is much more motivated than any person running as a result of they’re being compelled to take action.

One monopolistic follow hindering our trendy international as of late is the monopoly central banks have on fiat forex. Via centrally making plans rates of interest and with the ability to create fiat cash with out going through a possibility price for doing so, the loose marketplace turns into corrupted. This ends up in distorted worth alerts and folks being driven out at the chance curve.

“On a daily basis that is going via and Bitcoin hasn’t collapsed because of criminal or technical issues, that brings new knowledge to the marketplace. It will increase the risk of Bitcoin’s eventual good fortune and justifies a better worth.” — Hal Finney

Whilst bitcoin turns into much less dangerous on a daily basis it exists, I tip my hat to the people who understood its significance prior to purchasing bitcoin was once a mainstream factor. Ahead of exchanges like Mt. Gox, other folks weren’t the usage of fiat forex to shop for bitcoin. They had been the usage of electrical energy and computer systems to mine it, which is what made Bitcoin so particular. A brand new machine this is totally outdoor the standard one in all depending on credits and enlargement. Many projects that came before Bitcoin failed in the end, however quite a lot of concepts from those tasks had been referenced in Nakamoto’s white paper. Logically, over the years, extra other folks will come to the Bitcoin community to offer protection to their buying energy so long as the community helps to keep including blocks of transactions roughly each 10 mins.

The extra individuals who see the have an effect on that fiat forex debasement has on their buying energy, the much more likely they’re to search for possible choices to offer protection to mentioned buying energy. That is what to begin with attracted me to shop for some bitcoin in early 2017. My buddy instructed me about this new type of forex that had preferred a great deal since its inception. I watched the documentary “Banking On Bitcoin,” which I nonetheless extremely suggest as it helped open my eyes to the truth that cash is only a ledger. Sadly, I didn’t totally cross down the rabbit hollow at the moment. I spent the primary couple of years of my adventure having a look at my change balances as my bitcoin and altcoins multiplied 10 occasions, solely to be depressed when my positive factors got here crashing down after the bull marketplace ended. Like maximum who’re to begin with interested in cryptocurrency for the theory, I obsessed over the fiat worth. Doing so brought about me to pass over the entire level of no longer having to depend on any counterparties to ensure and dangle bitcoin. Whilst it sucked shedding the entire fiat positive factors I had made, it taught me some very precious classes.

“The chance is that if persons are purchasing bitcoins within the expectation that the associated fee will cross up, and the ensuing larger call for is what’s riding the associated fee up. That’s the definition of a BUBBLE, and as everyone knows, bubbles burst.” — Hal Finney

As Finney so eloquently identified in the ones early days, when one thing is going parabolic superfast it’s going to most likely crash simply as speedy. Ache is the most productive instructor and this was once my first trace at why having a low time-preference is so necessary. It additionally served as a lesson for myself to concentrate on Bitcoin, no longer crypto. I stored an hobby in Bitcoin, nevertheless it wasn’t till 2020 that I truly began digging into the rabbit hollow. Once I were given a stimulus test within the mail for doing not anything, that prompt an alarm within my thoughts. Whilst loose cash is at all times great, it was once glaring that there could be penalties to the US executive handing out coins to its voters. I didn’t totally perceive why on the time. It was once irritating me that I couldn’t put my finger on what was once unsuitable so I began down the Bitcoin rabbit hollow which led me to Austrian economics and the way cash in fact works. It was once each irritating and enlightening to be informed about Bretton Woods, 1971 and why central banks are in a race to debase their currency.

Once I realized that almost all U.S. greenbacks are hung on a server (in an SQL database) on the Federal Reserve, I used to be stunned. Those other folks can press buttons on a keyboard and print trillions. Via granting 12 unelected officers the privilege to centrally plan the price of borrowing cash we have now hindered the loose marketplace’s talent to successfully inform marketplace individuals what the price of capital is. Fiat is latin for “via decree”; thus, it makes numerous sense why central bankers will struggle enamel and nail to stay the facility to regulate cash. The Fed claims to be an apolitical group, however as debt ranges build up to numbers generally observed right through occasions of conflict, central bankers are harassed politically to debase their forex. The opposite possibility is to default at the debt and that’s by no means politically viable. The silver lining is that extra persons are waking up as a result of they get annoyed observing their buying energy decline abruptly in inflationary environments. Being self-interested isn’t a foul factor. It’s what motivates folks to paintings arduous so they may be able to benefit from the end result in their hard work. Bitcoin optimizes for this, whilst the Keynesian financial fashions of ever-expanding credits scouse borrow the end result of other folks’s hard work. No person is aware of the way it ends however over the years it is sensible extra other folks would finally end up saving their “end result” within the more difficult cash.

Small Companies

Visa and Mastercard have a blended marketplace capitalization of about $775 billion greenbacks on the time of this writing. They rate round 3% of shops’ income for his or her products and services which eats into the earnings or get handed onto customers of the corporations accepting debit and bank cards. Whilst playing cards make it a lot more straightforward to transact, many companies and customers would be at liberty to steer clear of those charges if conceivable. There’s an possibility of going cash-only for ultimate agreement, however that implies lacking out on industry from more youthful generations who don’t lift coins. Via accepting bitcoin, those corporations no longer solely steer clear of the charges, however additionally they obtain ultimate agreement transactions similar to coins. Not more ready 90 days to verify a bank card doesn’t get charged again. Bitcoin will hugely disrupt many fiscal rails we have now as of late. Many within the Western international may no longer respect what a large deal it’s because our monetary rails are beautiful smartly established. Alternatively, the ones in much less advanced nations know completely smartly what a ache it’s to have hucksters butting in to take a reduce. It received’t be immediate, however bitcoin can assist wean small companies off middlemen who’re not important. Bitcoin too can function an improbable advertising device. I’d gladly spend some satoshis at any native small companies that took bitcoin. Tahinis is a brilliant instance of a small industry who leveraged bitcoin to get some emblem consciousness. I’ve by no means been to Canada, but when I ever cross, I’d love to devour at Tahinis so I will be able to use bitcoin to shop for shawarma. Bitcoin paperwork a unique bond between other folks to the purpose the place you actually need to strengthen their industry as a result of you already know they’ve taken the orange tablet.

(Source)

Power Firms And Grid Operators

Power corporations and grid operators actually have a large incentive to undertake a bitcoin technique. Somewhat than simply having one purchaser at the grid that calls for extra power right through the day than at night time, the grid can have a 2d purchaser who’s keen to devour power 24/7, 365 days/12 months. Bitcoin miners can monetize power that may differently cross to waste. There’s the up-front price of shopping for an ASIC and having the technical whereabouts to care for and run mentioned ASIC. This implies extra jobs for the gifted people who know how to take action. Extra gifted staff developing price manner extra power environment friendly grids. It amazes me how a lot worry, uncertainty and doubt will get unfold about Bitcoin’s power utilization, when the truth is Bitcoin can stabilize grids and make the capital put as much as construct inexperienced power infrastructure a lot much less dangerous.

For those who sought after to construct a large hydro plant in a rural space prior to there was once Bitcoin, it could be very arduous to lift the capital. Traders would no longer need to publish their cash for an influence plant that didn’t have consumers for the ability being generated. With Bitcoin, the traders can leisure confident there’s at all times a purchaser for that energy. Whilst I feel there shall be some degree when miners simply stay the bitcoin, they may be able to additionally promote them for fiat at any time limit. Not like conventional markets, bitcoin by no means stops buying and selling. Since fiat depreciates over the years, the most productive miners will be capable to dangle and acquire their bitcoin, whilst the fewer environment friendly miners should promote for cash this is continuously being debased via the cash printer. The most productive corporations will thrive over the long term, whilst the inefficient operators should adapt or die. It’s the loose marketplace doing its activity.

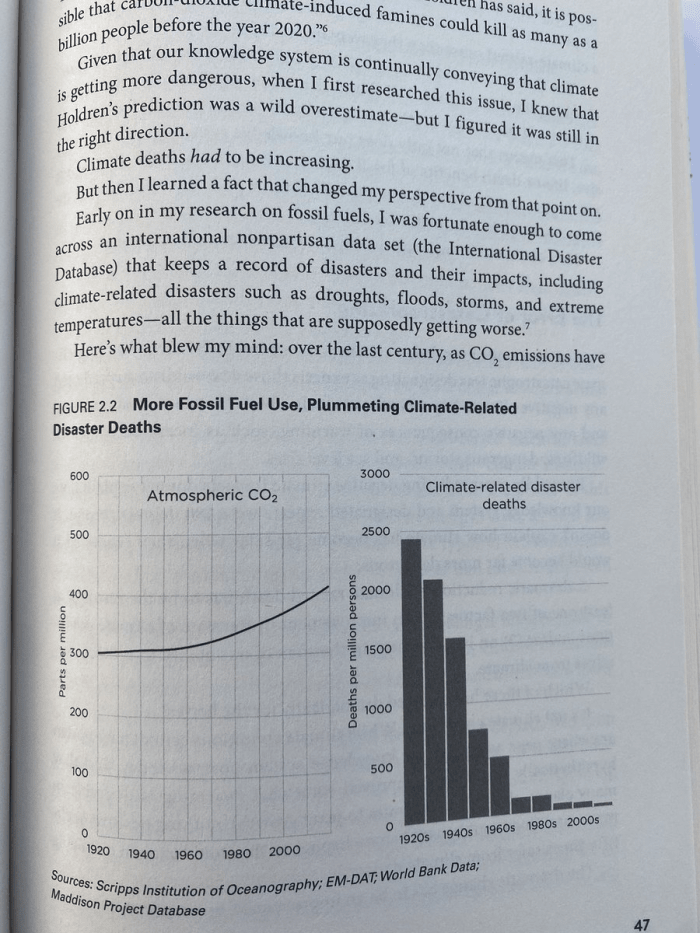

The extra I know about how grids operate, the extra obvious it turns into that bitcoin can assist bring in an considerable power long run the place power costs aren’t going parabolic as a result of deficient selections made via central planners who’re printing cash at unheard-of charges. The entire inexperienced power and environmental, social and governance (ESG) narrative is an antihuman farce intended to cover the crisis that the central banks have created. Those greeniacs declare that CO2 goes to suffocate the arena, however this chart in Alex Epstein’s “Fossil Long run” presentations why extra fossil gas use is wanted.

(Source)

Power is the bottom layer of society. With out dependable and moderately priced power, issues gets unsightly speedy. Simply take a look at what came about to Sri Lanka who had one of the most easiest ESG scores on the earth prior to their financial system collapsed. Each and every instance of hyperinflation stems from irresponsible financial coverage. Calling forex debasement “quantitative easing” doesn’t trade the truth that it ends up in extra money chasing the similar collection of items. Other people comic story that Bitcoiners are psychopaths who can’t prevent speaking about magic web cash, however in reality we simply need others to take the orange tablet so we will be able to prevent affected by the central planners. Bitcoin Maximalists have a name of being imply on-line for calling out dangerous actors, however virtually each Bitcoiner I’ve met in individual seems to be probably the most authentic, type and clever other folks I meet. In individual, I’ve observed that Bitcoiners are keen to assist onboard as many of us as they may be able to as a result of all of us strongly imagine Bitcoin is one of the simplest ways to reach a pro-human long run the place we have now an abundance of meals, power and selection.

In my view, serving to other folks keep in mind that bitcoin is the existence raft is without doubt one of the maximum noble issues an individual can do. Historical past has proven that the loose marketplace will in the long run finally end up with one type of cash profitable out. Ahead of bitcoin that was once gold after which we ended up with fiat to stay alongside of the velocity of trade. Now that we have got bitcoin, I imagine fiat will proceed to abruptly lose its buying energy as extra other folks and companies understand that bitcoin can’t be debased via a unmarried entity.

Country-States

This one is a double-edged sword. I would like as many person other folks to undertake bitcoin prior to the geographical regions get started collecting. I’m hopeful that the geographical regions who do finally end up adopting bitcoin will be capable to make the most of its fiat worth appreciation to create a extra considerable society for the folks that are living there. On the time of writing, two nations have followed bitcoin as criminal mushy. In step with the World Population Review’s prosperity index, El Salvador ranks 98 and the Central African Republic ranks 165 out of 167 nations. Neither of those nations is within the peak 50% of filthy rich geographical regions they usually had been the primary to undertake bitcoin. I imagine this development will proceed because the maximum filthy rich nations have a lot more to lose via no longer with the ability to “decree” what occurs with their nation’s cash. Ahead of bitcoin, El Salvador was once a dollarized financial system. Now they permit each USD and BTC to function as criminal mushy. The Central African Republic had the CFA franc as its forex. In step with Wikipedia:

“Critics indicate that the forex is managed via the French treasury, and in flip African nations channel extra money to France than they obtain in support and don’t have any sovereignty over their financial insurance policies.”

It’s encouraging to peer geographical regions which might be on the mercy of international central banks undertake bitcoin to get round those monopolies. I consider one day the richest geographical regions shall be compelled to undertake bitcoin if their forex is hyperinflated as a result of it’s going to be the one viable technique to industry with different nations. Those rich countries will struggle for so long as they may be able to to stay regulate in their monopoly on fiat forex. It’s the poorer countries who don’t have entire sovereignty over their cash that may glance to bitcoin to offer protection to their buying energy as a result of they’ve the least to lose.

If you’re a countryside and you’ll’t create your personal cash to fund executive spending, you might be a lot more prone to spend money on a actually scarce forex than any other countryside that may create extra of its personal forex out of skinny air. Whilst El Salvador is probably not within the inexperienced in the case of the place they purchased bitcoin at the spot marketplace, they’ve made up for it with the massive boost in tourism and hobby of their nation. In my view, I would like the chance to discuss with El Salvador and use bitcoin to shop for stuff. El Salvador will most likely proceed to enjoy a large inflow of tourism as extra Bitcoiners, like myself, begin to plan journeys there so they may be able to use this new type of cash. The cyber hornets don’t fiddle and as extra nations understand the have an effect on bitcoin may have on their native economies, the logical conclusion is to undertake it as criminal mushy and draw in vacationers to strengthen their financial system.

(Source)

Conclusion

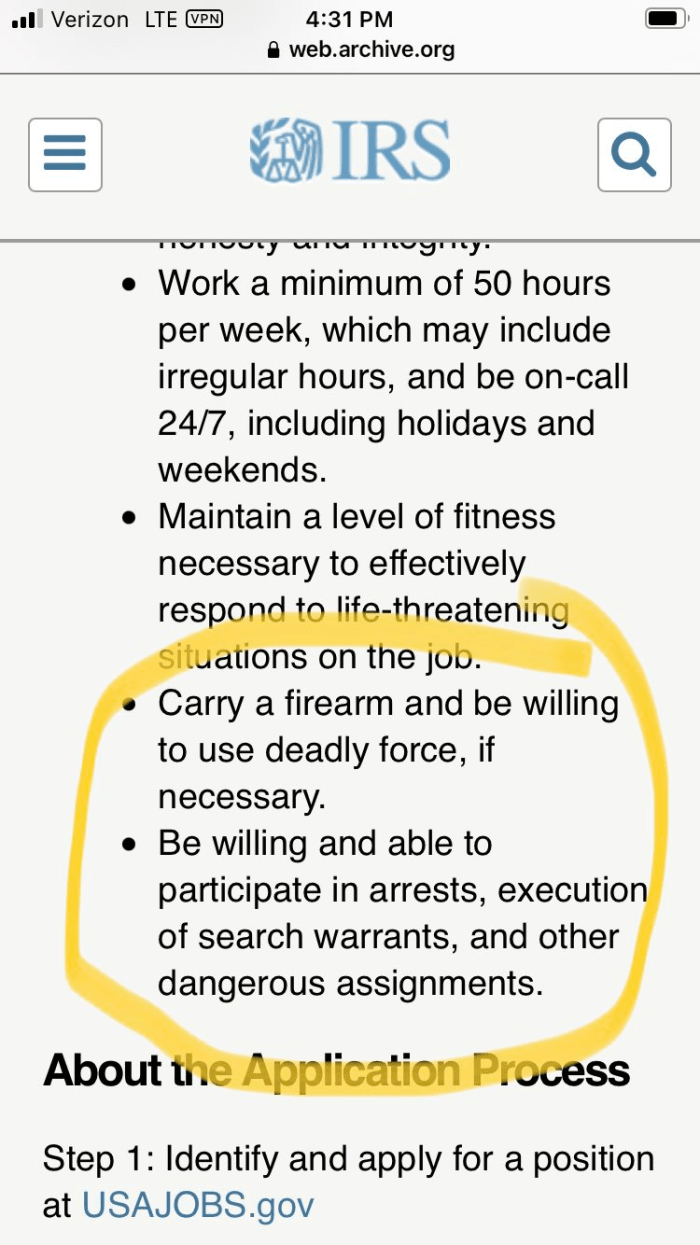

It would get messy. Wealthy countries, the International Financial institution and The World Financial Fund aren’t simply going to toss up their arms and cross, “Smartly, it was once amusing controlling fiat whilst it lasted.” Simply take a look at the U.S. who handed the Inflation Reduction Act, which contains hiring and arming an extra 87,000 IRS brokers. The USA is making plans on printing cash out of skinny air so they may be able to pay voters to do that.

It’s moderately ironic that the country which was once created as a result of we demanded no taxation with out illustration is doubling down on its tax power.

The folks in energy will struggle enamel and nail to offer protection to their pursuits and obstruct bitcoin’s adoption. Most sensible-down controls can solely cross up to now. People, corporations and geographical regions are all self-interested. No person likes a parasite when they’re the only coping with the effects which might be draining their sources, time and price. Over a protracted sufficient time horizon, it sort of feels bitcoin will bleed those parasites dry as they lash out and take a look at to impose top-down controls the world over. The reality can solely be hidden goodbye; it at all times comes out in spite of everything. Bitcoin can repair power, monopolistic central banks, credit-based programs and big surveillance states. It will possibly assist disincentivize violence as a result of if any person retail outlets their personal keys of their head, nobody can scouse borrow that bitcoin. They are able to kill the one who holds the keys, but when they weren’t ready to torture the ones personal keys out of the sufferer’s head, that simply ends up in a donation to the remainder of the community since that individual’s bitcoin won’t ever be moved.

If sufficient other folks undertake bitcoin and use forged protection practices, robust entities stand to realize extra via cooperating with those sovereign folks quite than killing them. I don’t need it to get messy and I actually imagine one of the simplest ways to steer clear of battle is via getting extra other folks to take the orange tablet and appearing them find out how to run a node. People, corporations and geographical regions theoretically not want banks to transact.

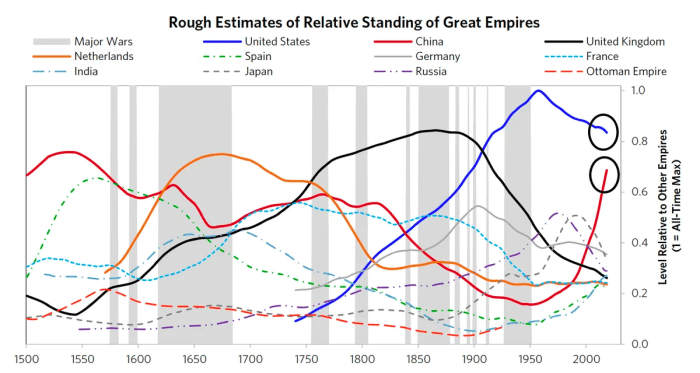

As a U.S citizen, I hate to peer The us in disarray. Ray Dalio makes some superb and terrifying issues in regards to the state of our republic in his ebook “The Converting International Order.” The usis a declining empire at this level and China is on the upward push. This chart from Dalio truly helped me perceive what it manner to have international reserve forex standing.

The Netherlands had reserve forex standing and misplaced it to the British, who misplaced it to the US. Now it looks as if China is on the point of acquire international reserve forex standing over the U.S. There’s little hope of reversing the fashion of USD not being a world reserve forex. Whilst shedding reserve standing isn’t a amusing enjoy, the united statescould get advantages a great deal from having bitcoin as a impartial international reserve forex quite than the Chinese language yuan. Having a central financial institution virtual forex (CBDC) because the reserve forex would function without equal device for central planners to deprave the loose marketplace and wreak havoc on price introduction. As a rustic, China has a deep, wealthy historical past and a country filled with hardworking other folks. Alternatively, their large surveillance state and CBDCs aren’t one thing that may ever fly in a loose nation. It’s as much as the loads to mention “sufficient!” and decide out.

Long run generations deserve a greater international than one the place the federal government can flip off get entry to to its voters’ cash with the flick of a transfer. Those previous two years had been completely insane. We’re seeing other folks get their financial institution accounts frozen as a result of they donated to a relaxed protest placed on via truckers in Canada. We’re seeing an assault on farmers around the globe to fulfill antihuman ESG agendas that may wreck nations in the similar means it did Sri Lanka. We’re even seeing the best country in the world come after its personal voters via devaluing their forex at remarkable ranges, hiring extra IRS brokers and elevating taxes right through a recession. All of that is what’s at stake if the loads don’t get up and peacefully decide out from those corrupt regimes with bitcoin.

All we need to do is find an outdated laptop or a Raspberry Pi and run Bitcoin Core. Now, it’s that simple to transact with somebody in a peer-to-peer method and examine that solely 21 million bitcoin will ever be created. It brings a heat, tingly feeling to my center serious about the liberty, prosperity and abundance bitcoin can convey to the arena.

“Abundance in cash creates shortage all over the place else, and shortage in cash creates abundance.” — Jeff Booth

As soon as the loads perceive this, they’ll perceive why the word “Repair the cash; Repair the arena,” is the embodiment of the Bitcoin ethos.

It is a visitor publish via Conor Chepenik. Evaluations expressed are totally their very own and don’t essentially replicate the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)