On-chain knowledge presentations that the present marketplace cycle is exclusive, with extra Bitcoiners transacting peer-to-peer and out of doors the area of exchanges.

On-chain knowledge presentations that the present marketplace cycle is exclusive, with extra Bitcoiners transacting peer-to-peer and out of doors the area of exchanges.

Some of the main facets of on-chain research is to inspect transactions over the community. In contrast to exchange-involved transactions, which continuously result in worth volatility, transactions out of doors of exchanges exhibit the community application as conceivable bills amongst customers. It makes a favorable contribution to the advance of the community over the long run if customers are interacting with one any other. Due to this fact, it is very important to inspect the transaction habits over the community.

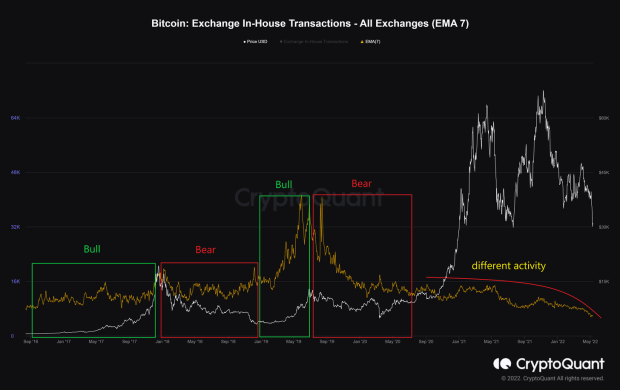

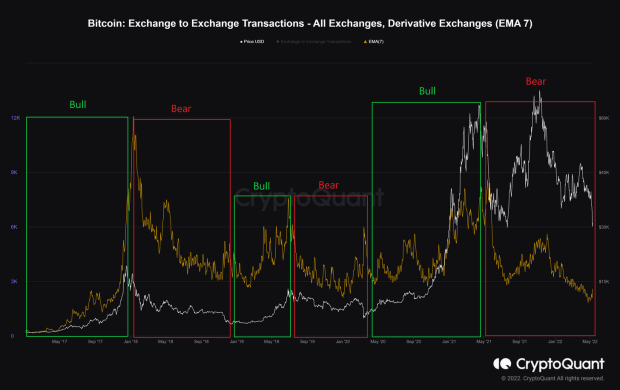

In regards to the sum of all replace in-house transactions, the collection of transactions circulated throughout the exchanges’ wallets were trending decrease from the Might 2021 top. That implies there isn’t as a lot switch task throughout the market. It appears other from the former worth cycles when this quantity was once strongly correlated to the fee motion.

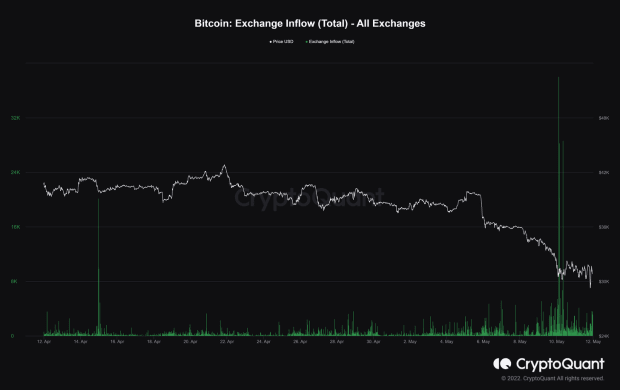

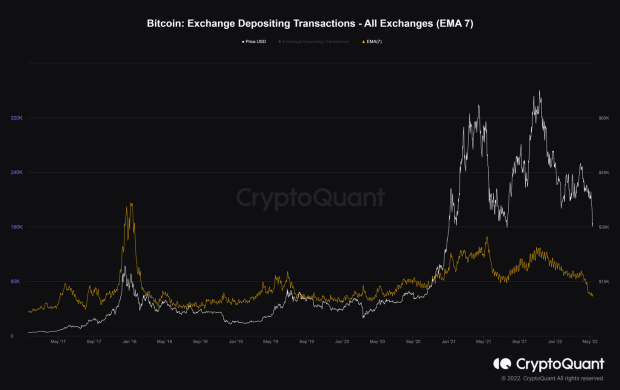

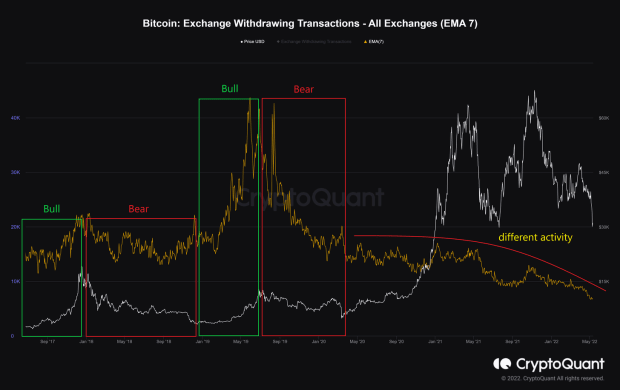

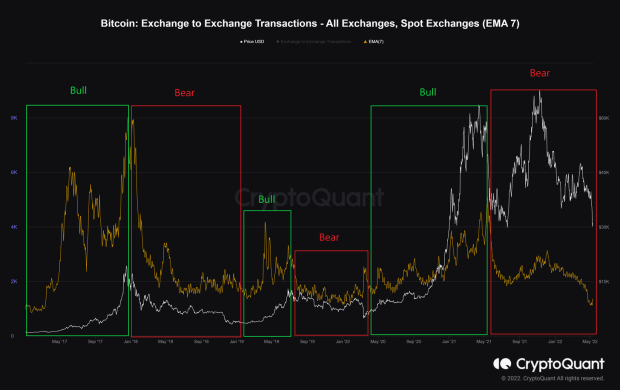

In the meantime, the overall collection of deposits and withdrawals to and from exchanges has plunged downwards, demonstrating that individuals could also be much less engaged within the exchanges.

Moreover, the collection of transactions from all exchanges to derivatives exchanges has plummeted as a clue that derivatives trades aren’t very sexy in this day and age.

Within the intervening time, there is not any additional chance of cumulative promoting power because of the considerable drop within the collection of transactions from all exchanges to identify exchanges. This provides the slightest of encouragement and mitigates bearish sentiment amongst stakeholders.

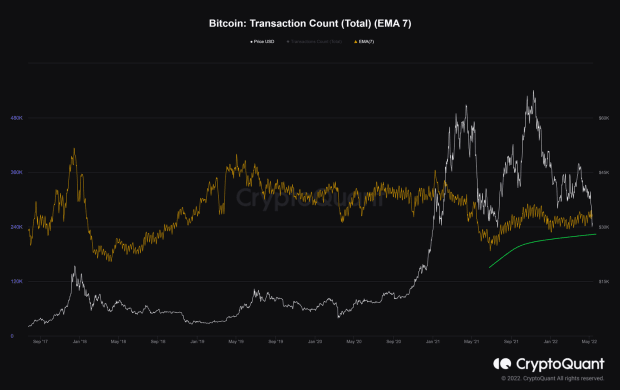

At the same time as, the sum rely of transactions has moved up by contrast to the downtrend in exchange-related transactions. It implies an greater provide/call for out of doors of exchanges, leading to a prime utilization of the Bitcoin community.

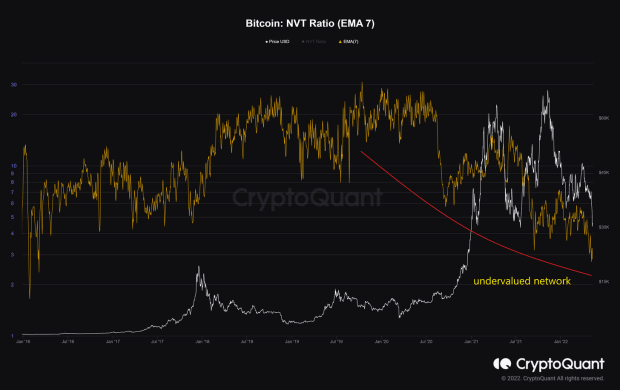

Community value-to-transaction (NVT) is the ratio of marketplace capitalization divided by means of transaction quantity. That is helping gauge the relativity between community cost and community utilization as transaction quantity represents community utilization. A falling NVT proves that the rate of cash circulating within the bitcoin economic system has risen, and the community cost is reasonably undervalued in comparison to its prime application.

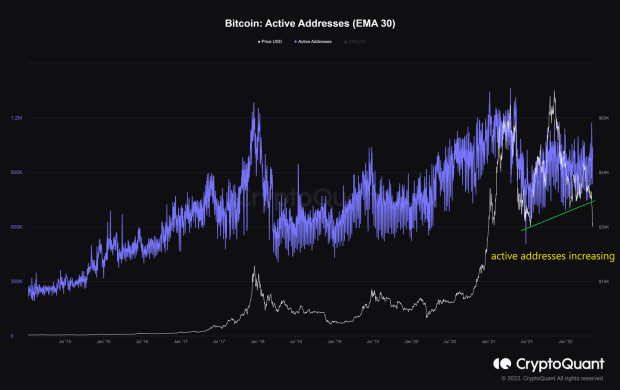

It’s transparent how temporarily and proportionally transactions are carried out at the community in and out of doors of exchanges. We must be aware of the sum of distinctive lively addresses, together with each senders and receivers. The sum of lively addresses has regularly greater for the reason that July 2021 backside. This has been a excellent indicator for the advance of community task since Bitcoin’s inception.

In the long run, long-term traders are involved concerning the virtual attributes to the rate of bitcoin utilization within the economic system slightly than its buying and selling worth. With restricted provide and lengthening call for, an build up of transactions and lively addresses through the years demonstrates the expansion of the Bitcoin community’s application.

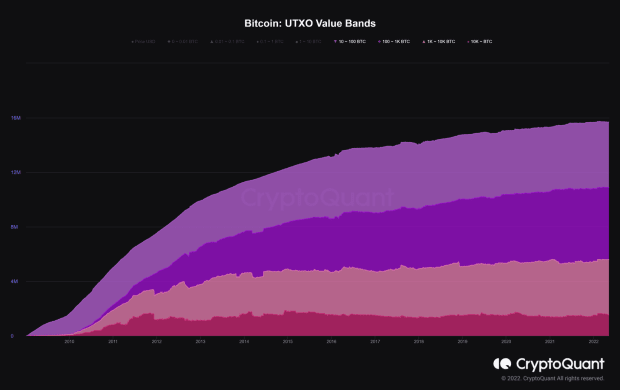

The important thing function of the on-chain research is the HODLing habits of long-term traders. One of the vital dependable signs is UTXO cost bands which illustrate the distribution of all UTXOs when it comes to their dimension. All studied UTXO bands herein constitute the overall cost of all UTXOs starting from 10 to greater than 10,000 bitcoin, which specializes in the habits of whales. As noticed within the following determine, extra UTXOs were held in huge amounts suggesting that whales aren’t distributing cash and are as a substitute gathering.

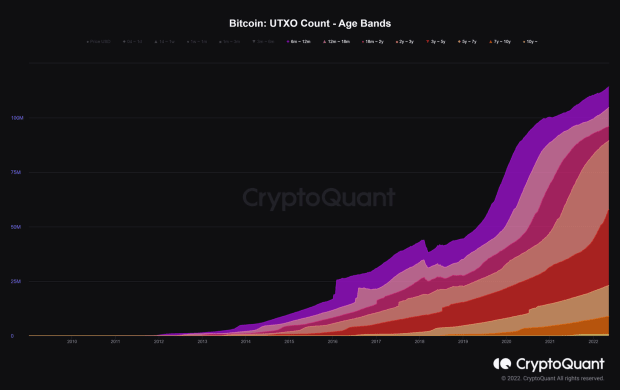

As well as, UTXO age bands show the collection of UTXOs that remaining moved inside of a specified period. All regarded as bands (over six months) were maintained and regularly expanded. This means that extra traders were keeping and gathering extra cash.

The UTXO rely age bands and worth bands recommend that temporary liquidity is dominant all over the marketplace, while long-term liquidity remains to be just about dormant and relatively expanding. Merely put, long-standing HODLers are evenly assured irrespective of the temporary volatility in bitcoin’s worth.

On stability, the application of the Bitcoin community has been rising throughout the hot semi-bear market. The transaction habits out of doors of exchanges has been performed as a possible fee procedure, and the Bitcoin group has followed the HODLing perspective.

This can be a visitor submit by means of Dang Quan Vuong. Evaluations expressed are totally their very own and don’t essentially mirror the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)