Knowledge displays the Bitcoin miner reserves have persisted to pattern downwards just lately, suggesting that miners had been dumping their cash.

Bitcoin Miners Have Been Chickening out From Their Wallets In Fresh Days

As identified through an analyst in a CryptoQuant post, BTC miner reserves had been watching detrimental trade just lately, one thing that would result in a decline in the cost of the crypto.

The “miner reserves” is a trademark that measures the entire quantity of Bitcoin lately provide within the wallets of all miners.

When the worth of this metric is going up, it manner miners are depositing extra cash into their wallets at this time. This kind of pattern, when extended, may also be bullish for the worth of BTC as it may be an indication of accumulation from those community validators.

However, a decline within the indicator implies miners are shifting cash out in their reserves in this day and age. Since miners in most cases take out their BTC for promoting functions, this type of pattern can end up to be bearish for the crypto.

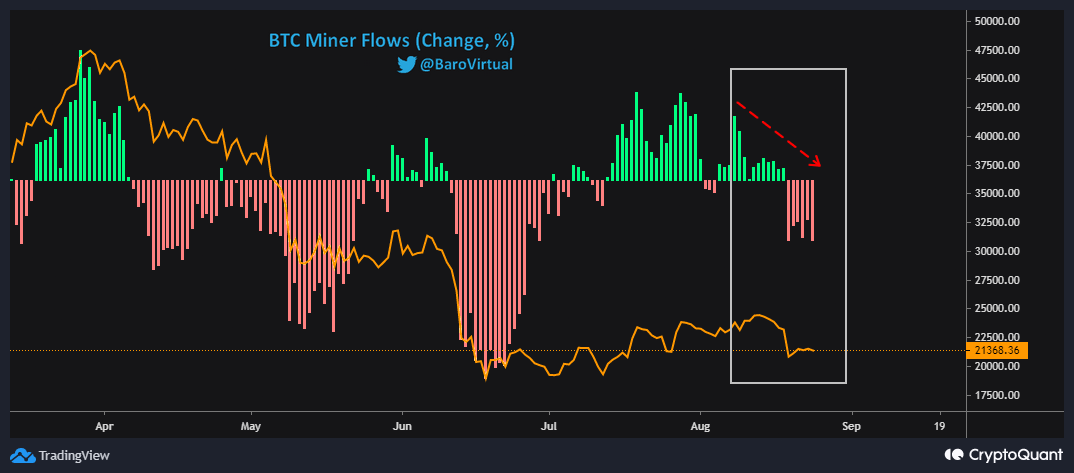

Now, here’s a chart that displays the rage within the Bitcoin miner netflows, a metric that information the proportion adjustments within the general miner reserves, over the previous couple of months:

Seems like the indicator has spotted detrimental adjustments in contemporary days | Supply: CryptoQuant

Destructive miner netflows counsel the reserves are happening, whilst sure values imply they’re registering an build up.

As you’ll see within the above graph, the worth of this BTC indicator were above 0 previous within the month, however just lately it’s been underwater.

This would trace that those miners had been dumping in contemporary days. As is obvious from the chart, on every occasion the reserve has noticed detrimental adjustments in the previous couple of months, the BTC value has taken a success.

This time as neatly the worth of Bitcoin has recorded a decline whilst those newest purple values of the miner reserve have continued. It’s conceivable that if miners proceed their pattern of dumping, then the crypto might practice additional drawdown, a minimum of within the brief time period.

BTC Value

On the time of writing, Bitcoin’s price floats round $21.4k, down 8% within the final seven days. Over the last month, the crypto has misplaced 4% in price.

The underneath chart displays the rage in the cost of the coin during the last 5 days.

The worth of the crypto has been most commonly transferring sideways in the previous couple of days because the plunge | Supply: BTCUSD on TradingView

Featured symbol from Joshua J. Cotten on Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)