Be part of Our Telegram channel to remain updated on breaking information protection

Following the surge of ETF proposals despatched to the SEC in June 2023, the Bitcoin worth recovered from the mid-$20k vary, solely to get caught between $30k and $31k.

The coin reached this stage round June twenty sixth; ever because it has by no means left it for quite a lot of hours. Even if it has seen smaller fluctuations, its every day worth vary has solely been a number of hundred {dollars}.

For every other asset, this could signify huge volatility. For Bitcoin, nevertheless, it’s the equal of fiat currencies shifting up and down by a number of cents.

The coin has been buying and selling sideways for about three weeks now, which signifies that the explosion may occur at any time. Bitcoin by no means sits nonetheless for too lengthy. The one query is — which means will the worth go?

The SEC is getting ready to reject Bitcoin ETF proposals but once more

BTC has seen each constructive and unfavourable information not too long ago. A surge of ETFs made traders optimistic, just for the SEC to interrupt their hopes by rejecting the primary wave. Firms led by BlackRock began re-filing their proposals after briefly addressing the problems that the regulator identified.

The largest one was the dearth of readability relating to surveillance of the market, to which a number of companies responded by partnering with Coinbase to resolve the difficulty.

Whereas many believed that the SEC would now haven’t any selection however to approve the ETFs, its chairman, Gary Gensler, seems to have solid doubt on the position of Coinbase’s surveillance sharing settlement (SSA).

To us, this can be a signal that he could be laying groundwork for potential denial reasonings. Some extra goalpost shifting possibly… Thats a part of motive we aren’t larger than 50/50. At all times has been the case that SEC will again into no matter they resolve to do IMO https://t.co/uI7iD0Wxcg

— James Seyffart (@JSeyff) July 12, 2023

Bloomberg Intelligence’s analysis analyst, James Seyffart, not too long ago tweeted that Gensler is pouring some chilly water on the Coinbase SSA potential for spot Bitcoin ETF approval, which was taken as an indication that the SEC Chair intends to put the groundwork for one more sequence of ETF rejections.

Europe set to launch its delayed Bitcoin ETF

Whereas the state of affairs relating to Bitcoin ETFs within the US appears hopeless, the state of affairs is totally different in Europe. Current studies counsel that Europe is about to see the launch of its first Bitcoin ETF, which was presupposed to occur a 12 months in the past. Nevertheless, after a 12-month delay, the ETF is lastly able to launch.

The delay in launch got here as a result of Jacobi Asset Administration determined that the time was not proper. On condition that the crypto trade was in the course of a crypto winter and that costs have been crashing all year long, the choice is sort of comprehensible.

Nevertheless, with a worth restoration underway, a Bitcoin ETF is lastly about to launch sooner or later this month. Moreover, this could be the push that Bitcoin worth must lastly breach the $31k resistance, particularly after disappointing information from the US.

DoJ is getting ready to promote 9,000 BTC

It’s also attainable that the European Bitcoin ETF may merely assist stability the scales once more, as one other upcoming occasion from the US might need a unfavourable impact on its worth.

Particularly, current studies counsel that the US Division of Justice (DOJ) is getting ready to promote 9,000 BTC, thus boosting the availability of the market.

The property sat within the two wallets belonging to the DOJ, however they’re additionally linked to the Silk Highway crypto seizure. Not too long ago, round $300 million value of BTC was moved yesterday morning in three separate transactions.

A lot of the cash was transferred within the second transaction, which contained 8999.908 BTC, value round $274.78 million. All of this was despatched to one of many two addresses, whereas the second solely acquired 0.1 BTC, value $3,053.

The market’s response to Silk Highway BTC FUD has been extremely robust! Mixed with a constructive CPI response and Bitcoin staying above 30k, I am getting a robust feeling that we’re on the verge of a breakout from this vary. Thrilling instances forward! 🚀 #Bitcoin pic.twitter.com/BGtHXSXKcw

— LSD CRYPTO (@Mr_LSD_Crypto) July 12, 2023

The DOJ-held Silk Highway Bitcoin stash consisted of 51,352 BTC as of March, which was when the federal government began promoting it.

Up to now, the federal government offered 9,861 BTC, which left it with one other 41,491. On the time of the primary sale, the DoJ mentioned that the federal government is anticipated the seized BTC to be liquidated in 4 extra batches over the course of this calendar 12 months.

What’s subsequent for Bitcoin?

Prior to now 24 hours, Bitcoin worth has dropped from $30,913, after one other failed try to achieve and breach $31k, to $30,282 late on July twelfth. After buying and selling sideways for about 12 hours, the coin began one other restoration, which led it to $30,572 as of the time of writing.

Basic evaluation will not be offering a transparent path for the coin, given a sequence of constructive and unfavourable developments.

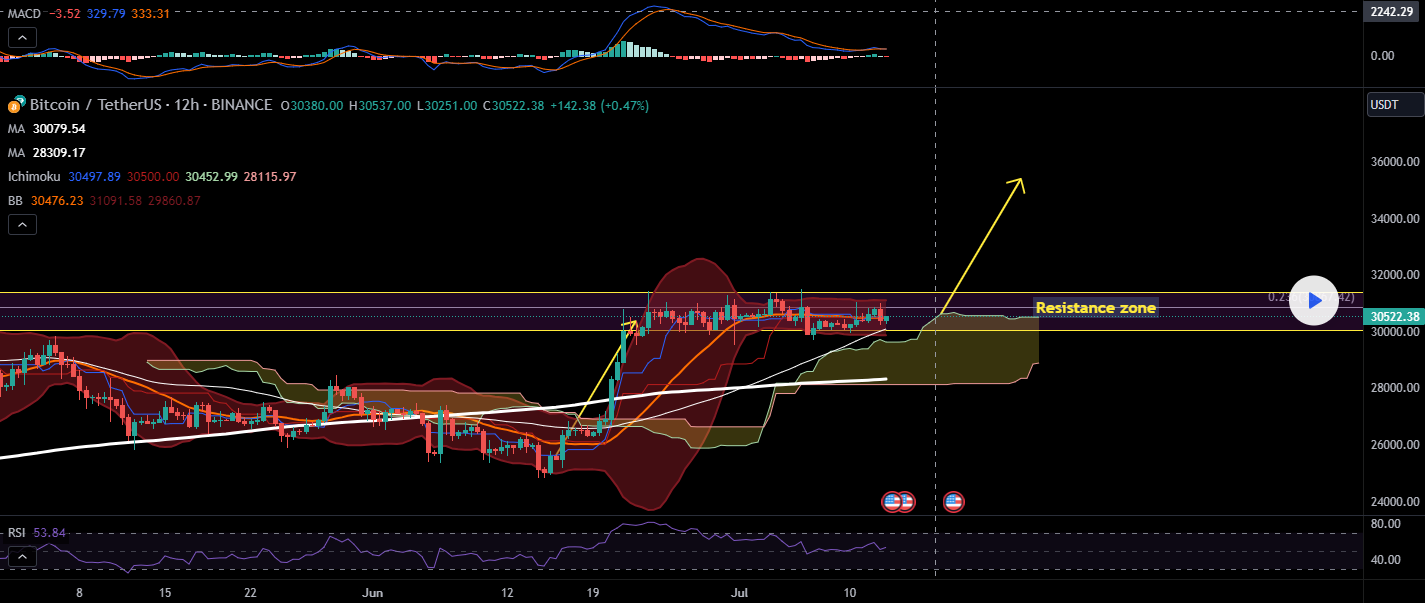

On the technical aspect, nevertheless, analysts have famous that Bollinger Bands are tight and that the coin has retested the resistance zone a number of instances already, every time being weaker than the final.

The every day chart does see a bullish rectangle sample, whereas on a weekly foundation, there’s a formation of the cup & deal with sample. There may be numerous uncertainty relating to the BTC worth proper now, however one factor that’s sure is that BTC goes to make its transfer quickly.

ChimpZee presale closing in on $1m raised

Regardless of the uncertainty that surrounds the crypto trade’s largest property, traders aren’t shying away from digital currencies. Some, nevertheless, are in search of alternatives in new and rising cryptos moderately than taking a threat with the volatility of the large gamers.

One standard instance is ChimpZee (CHMPZ) — a venture that empowers customers to positively influence the setting and save each animals and the forests of the world. On the identical time, it permits traders to earn earnings and struggle local weather change.

The presale is at the moment in its seventh stage, anticipated to final 8 extra days. The venture is promoting its native token, CHMPZ, on the worth of $0.0007 on the time of writing, and after the present stage ends, its worth will leap to $0.000775.

These eager about buying the token can do it in trade for ETH, USDT, or through bank card. Up to now, the venture raised $830k, and it’s closing in on $1 million with each passing day.

Associated

Wall Road Memes – Subsequent Huge Crypto

- Early Entry Presale Stay Now

- Established Neighborhood of Shares & Crypto Merchants

- Featured on BeInCrypto, Bitcoinist, Yahoo Finance

- Rated Greatest Crypto to Purchase Now In Meme Coin Sector

- Workforce Behind OpenSea NFT Assortment – Wall St Bulls

- Tweets Replied to by Elon Musk

Be part of Our Telegram channel to remain updated on breaking information protection

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)