Knowledge reveals the Bitcoin mining hashrate has remained at excessive ranges not too long ago, regardless of the hashprice observing a deep plunge.

Bitcoin Hashrate Has Continued To Be Close to All-Time Highs Lately

The “mining hashrate” refers back to the whole computing energy presently related to the Bitcoin blockchain. The metric is measured when it comes to hashes per second, the place “hashes” seek advice from calculations that miners need to make.

When this indicator’s worth goes up, the miners are connecting extra mining rigs to the community. Such a development can point out that these chain validators are actually discovering the coin engaging to mine.

However, the metric’s worth reducing suggests some miners disconnect from the blockchain, presumably as a result of they aren’t making any earnings.

Now, here’s a chart that reveals how the 7-day common Bitcoin mining hashrate has modified through the previous yr:

The 7-day common worth of the metric appears to have been going up in latest days | Supply: Blockchain.com

Because the above graph reveals, the 7-day common Bitcoin mining hashrate has registered some progress not too long ago and has set a brand new all-time excessive (ATH). Because the crash, the metric has dropped barely, however its worth stays close to ATH ranges.

Apparently, the indicator has stayed at these excessive values regardless that the hashprice has taken successful not too long ago, because the CryptoQuant Netherlands group supervisor Maartunn has identified on X.

Seems just like the metric has been heading down not too long ago | Supply: @JA_Maartun on X

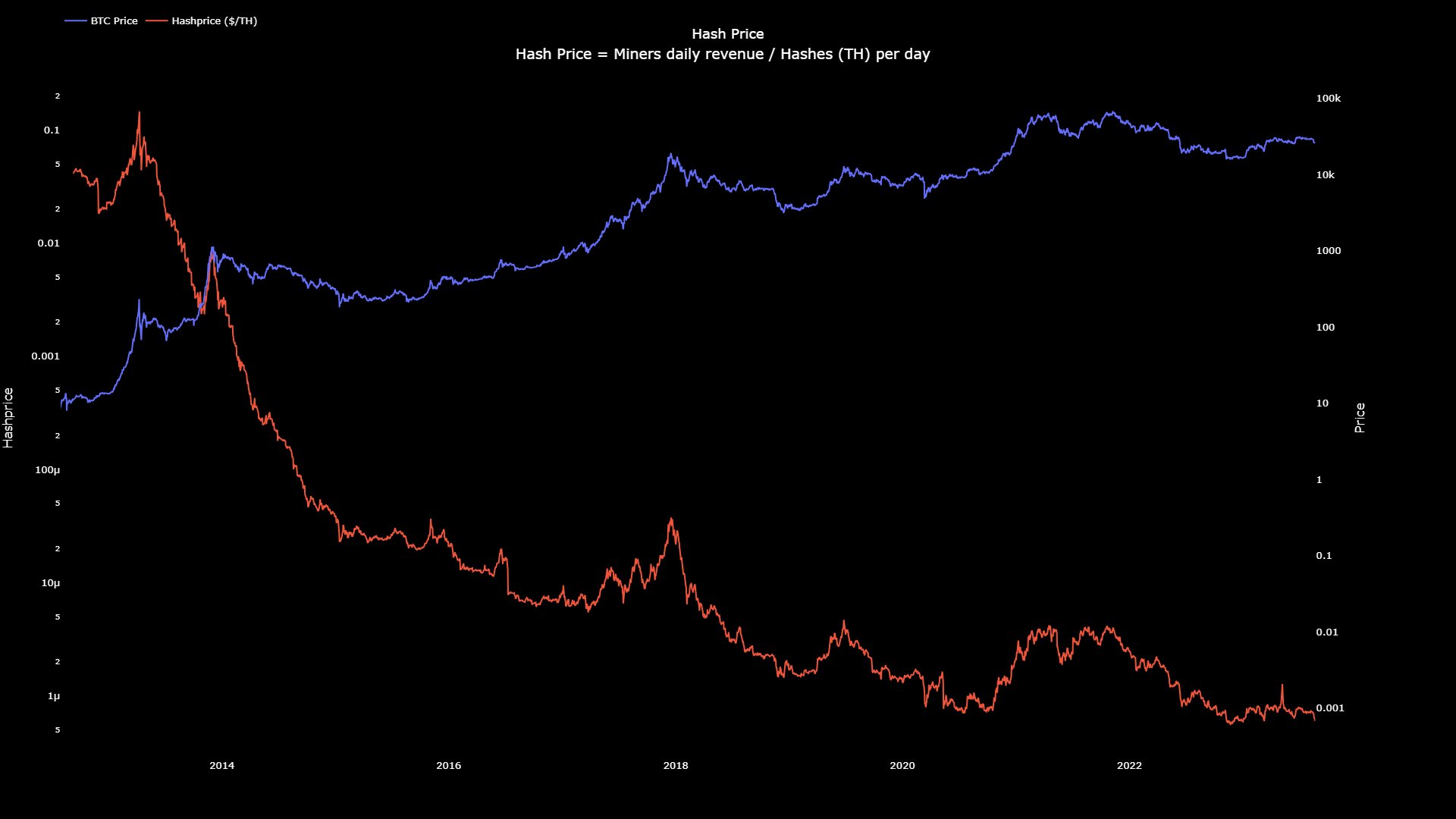

The “hashprice” right here refers back to the quantity of every day income the miners make corresponding to each hash they deal with. From the graph, it’s obvious that the indicator’s worth has been on a perpetual downtrend all through the asset’s historical past, a consequence of the hashrate trending up throughout this identical interval.

Block rewards (that’s, the compensation that the miners obtain for fixing blocks) on the community stay practically fixed, so whatever the quantity of hashrate related to the community, the miners’ whole revenues gained’t budge, however relatively their shares can be affected.

Subsequently, as extra hashrate has been coming on-line as a result of rising competitors within the area, the hashprice has continuously decreased. The metric does present native deviations sometimes, although, and these often correspond to rallies and crashes.

The metric is measured in {dollars}, so it is sensible that the BTC worth going up or down would additionally have an effect on the indicator’s worth. Lately, as Bitcoin has crashed, so has the hashprice, and the metric’s worth is now round an all-time low.

Regardless of miners making traditionally low revenues per hash now, they haven’t but considerably disconnected energy from the community. It’s unsure whether or not this may stay the identical within the coming days, but when it does, it could possibly be an indication that the miners are hopeful in regards to the long-term end result of the cryptocurrency, so that they don’t see a lot motive to disconnect simply but.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $26,100, up 1% within the final week.

BTC has stagnated because the crash | Supply: BTCUSD on TradingView

Featured picture from Dmitry Demidko on Unsplash.com, charts from TradingView.com, CryptoQuant.com, Blockchain.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)