On-chain information reveals Bitcoin and the opposite high property are observing a excessive quantity of loss-taking presently. Right here’s what this might imply.

Buyers Of Bitcoin & Different High Cash Are Capitulating Presently

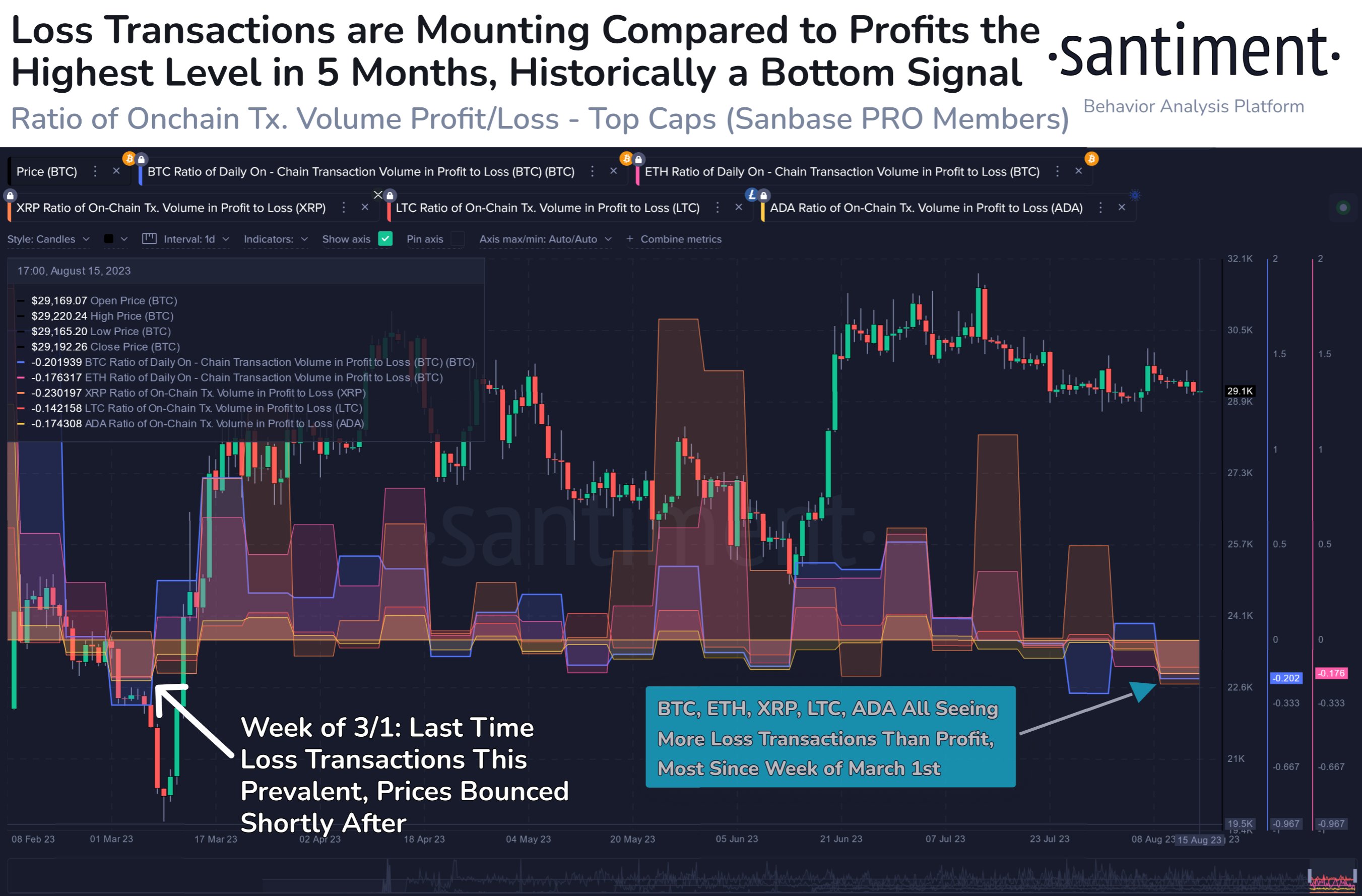

In keeping with information from the on-chain analytics agency Santiment, the present dealer capitulation that the most important property available in the market are seeing could also be a backside sign.

The indicator of curiosity right here is the “ratio of every day on-chain transaction quantity in revenue to loss,” which, as its title already implies, tells us how the profit-taking quantity for any given coin compares with its loss-taking quantity proper now.

When this metric has a constructive worth, it signifies that the profit-taking quantity is larger than the loss-taking quantity presently. Thus, such a development implies that the market as a complete is harvesting income for the time being.

Then again, the indicator having unfavorable values suggests loss taking is the dominant conduct among the many merchants of the cryptocurrency in query proper now.

Within the context of the present dialogue, the property of relevance are Bitcoin (BTC), Ethereum (ETH), XRP (XRP), Litecoin (LTC), and Cardano (ADA).

Here’s a chart that reveals the development within the ratio of transaction quantity in revenue to loss for these property over the previous few months:

Appears to be like like the worth of the metric has been unfavorable for all these property in current days | Supply: Santiment on X

As displayed within the above graph, the indicator’s worth for all these high property has dipped contained in the unfavorable territory not too long ago. This excessive loss realization from the traders has come because the market as a complete has been unable to amass collectively any important rally.

From the chart, it’s seen that these property have seen the traders capitulate at completely different factors all year long, however the present capitulation occasion has an fascinating characteristic that was lacking from these earlier situations: the loss-taking is presently taking place for all these giant cryptocurrencies.

It will seem that merchants as a complete have lastly began to surrender in the marketplace after experiencing infinite consolidation, as they’re able to take losses with a purpose to make their exit.

The dimensions of the loss-taking itself can be extraordinary, as the one different time this 12 months that the loss quantity overtook the revenue quantity to this diploma was approach again in March.

Traditionally, capitulation from traders has made bottoms extra possible to kind. And from the above chart, it’s seen that the March capitulation additionally results in Bitcoin hitting a backside.

The possible cause behind this sample is that the traders who exit in losses are usually the weak arms, who had a low conviction within the asset, to start with. In capitulation occasions, the cash that they promote at losses are picked up by the extra resolute traders, and therefore, the market beneficial properties a stronger basis for increase rallies.

It’s doable that the excessive loss taking that Bitcoin and the others are experiencing presently may additionally result in a backside, if the historic priority is something to think about.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $29,100, down 2% within the final week.

BTC continues to maneuver inside a slim vary | Supply: BTCUSD on TradingView

Featured picture from Artwork Rachen on Unsplash.com, charts from TradingView.com, Santiment.internet

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)