That is an opinion editorial by means of Matthew Mezinskis, writer of the “Crypto Voices” podcast and Porkopolis Economics.

Take a second to replicate on how lengthy you’ve been in Bitcoin. Now take every other to invite your self what number of articles on cash you’ve learn alongside the best way; And now not simply the ones medium-of-exchange or store-of-value items. Consider the philosophizing diatribes which purport to spot the mysterious meanings of what “cash” is. After which without equal twist, how does Bitcoin are compatible in? Many phrases were written by means of Bitcoiners, many by means of its detractors. From the “social contract idea” and “one thing all of us agree on,” to the “transactional foreign money” and that ever-important “cup of espresso” metaphor, everybody at all times has one thing to mention about cash, and thus why or why now not Bitcoin.

What about its funding implications? What about transporting the productive price of your hard work — your financial savings — throughout spacetime? Occasionally other folks write about just right cash, on occasion they write about unhealthy cash. And lest we fail to remember the fan favourite — by no means a dearth of chatter in this, how the cash printer is going “brrrr” and what it way for our economic system. There are extra articles musing on cash each and every 12 months than Christmas markets in Vienna.

This piece is referenced from the writer’s personal financial analysis, published quarterly, which tracks the availability and enlargement of base cash on the planet.

I’ll attempt to carry you one thing other right here. Let’s opt for it immediately. The sphere of economics already has a class, a systemized classification, for what form of “cash” Bitcoin is. I will be able to inform you presently what it’s, however you will have to perceive, the backstory this is hundreds of years previous.

In a position? They name it “high-powered cash” within the West. It’s known as “reserve cash” within the East. Traditionally, it’s regularly referred to as “base cash.” Within the world monetary gadget lately, we name it the “financial base.”

There it’s. That’s what form of cash Bitcoin is, and that’s what form of agreement happens when bitcoin trades arms, when UTXOs are destroyed and created anew. That’s the financial label that absolutely encompasses what the Bitcoin community is and what it does.

Elementary cash is certainly a most often permitted medium of substitute. Positive. However once more, that’s a distinct form of article. What elementary cash in point of fact is and why it issues is the tale I need to inform you right here.

What Base Cash Is No longer

This research will if truth be told be means more straightforward if we begin from the opposite aspect. We’ll get to what it’s. However to begin let’s have a look at the whole lot within the monetary gadget that isn’t base cash.

What isn’t base cash? Elementary money isn’t any medium of substitute this is managed or issued by means of a 3rd occasion. If there’s an middleman concerned — a financial institution or monetary establishment — then you’ll be moderately positive the belongings you’re taking part in with isn’t base cash.1 Otherwise to resolve that is when you have an “account” with somebody. Somebody. Any monetary services and products supplier. Do you grasp an account with a financial institution? Then no matter is in it isn’t elementary money.

Proper, some examples: The British and American methods have lengthy been fanatics of paper exams. And I already know what you’re considering. But even so being an utility for fraud (, together with your complete identify, cope with, and account quantity punched correct on them), why will have to I even care about exams lately? Smartly, I’m telling a tale about cash and banking right here, so simply know that exams as soon as served an important serve as in bills, and had been instrumental within the enlargement of western economies, when there used to be 0 or unfastened central financial institution oversight. Assessments are if truth be told means, far more profound than they seem, relating to inventions in moneyness. Anyway, again to what the article is. Consider it. What else is written on a take a look at? The payee’s identify? Positive. However what else nonetheless? Who issued that take a look at? Who if truth be told got here up with the article? Is there an establishment concerned?

It’s your financial institution, after all.

However inform me nonetheless. Whose concept used to be it to provide you with the ones exams? Does it topic how large the checkbooks are? Who makes a decision what the take a look at looks as if? Will have to there be particular amounts of exams that each and every financial institution provides its shoppers? Is there a take a look at commissar sitting in each municipality, along the mayor, protecting a working tally of exams that procedure their means in the course of the town? I imply we’re nonetheless speaking about cash right here, and exams were used for centuries … so these things essentially will have to be run via the federal government, correct?

Nope.

Precisely 0 other folks advised the bankers what number of exams they may or will have to factor, and nobody is aware of the (exact) solution to this in combination. All of that is nonetheless controlled because it used to be 200 years in the past, in a loose marketplace, the place shoppers consider their banks (their intermediaries) to transparent exams between one every other, to ensure that everybody to make bills and facilitate financial enlargement.

In order that’s a take a look at. Surely now not elementary cash.

What about debit playing cards? I’m going to come up with, pricey reader, the good thing about the doubt by means of this 2nd instance, that you’ve got already guessed that those financial tools are once more, now not base cash. All over again issued by means of a financial institution, these items are it seems that cool for some people; inns like them they usually’ve been round because the 1950s and the daybreak of digital banking … however they’re principally plastic exams which are reusable, and transparent sooner. And yeah, nobody advised the banks what number of shoppers, or what sort of shoppers, to supply them to. The method has been reasonably decentralized, for many years.

(Word, bank cards are if truth be told an overly other beast than debit playing cards, and in a very powerful financial means in relation to moneyness, however no time for that right here. Nonetheless, bank cards aren’t base cash.)

What subsequent? What else do you employ to pay for stuff? It’s almost definitely time to discuss cell apps and on-line banking. Perhaps the truth that these items are digitally local—then they may classify as base cash? Take into account how one can inform — the secret’s whether or not a 3rd occasion is working the display for this product.

One instance of the use of apps for purchases is Apple Pay. So it’s … Apple, correct? Goldman Sachs, if truth be told (ha-ha). Both means, a third-party establishment is providing you that product, so it’s without a doubt now not base cash. Identical is going for PayPal, Venmo, Skrill, Revolut, Sensible, Paysera and all of the different online-only banking apps and accounts. And evidently, you don’t desire a checking account to make use of these kinds of services and products. Despite the fact that it’s only a fee processing corporate, that’s nonetheless a 3rd occasion issuing the ones accounts. It way all the ones virtual fee choices are nonetheless now not base cash.

In order that’s the principle stuff, after we call to mind bills (stablecoins — we’ll get there!). Chances are you’ll keep in mind that, but even so the true exams and playing cards themselves, but even so the tools, all of that is on the finish of day related again on your bank account or deposit account. Once more, let’s depart bank cards apart for now. They’re much more far away “cash.” However we additionally produce other kinds of “accounts” within the monetary gadget that no person understands.

One is the financial savings account. This used to if truth be told be a factor. Financial savings accounts used to (and in some international locations nonetheless do) have extra withdrawal restrictions than checking accounts. In go back for this you’d obtain a better rate of interest for your cash deposited there. No longer so lately.

We even have time deposit accounts, which haven’t begun additional withdrawal restrictions and pay even upper curiosity than financial savings. Once more, any base cash in there? Nope.

We now have different oldschool tools like cash marketplace price range. Those are in most cases now not insured by means of the federal government, will have to pay a better curiosity than checking deposits and industry extra like a inventory (one proportion will have to be round one local foreign money unit) if you wish to get them. Base cash? Once more, without a doubt, no.

So let’s rehash, and please observe this is applicable irrespective of retail or institutional nature:

- Assessments, debit playing cards and cell apps related to deposit accounts aren’t base cash.

- Bank cards are without a doubt now not base cash.

- Financial savings, time deposits, cash marketplace, and different interest-bearing accounts also are now not base cash.

Alright, expectantly that used to be a semi-productive workout in hashing via all of the financial tools that aren’t elementary cash however are nonetheless used for bills. And for some time now you could have been asking, “So, what are those rattling issues if truth be told referred to as then?!”

Resolution: Fiduciary media.

That is a very powerful time period. It’s the most important. And essentially the most logical of names. I’m now not asking you to turn out to be an economist right here — please don’t — however what I’m hoping you do notice is that all of the standard stuff we take into accounts and use as “cash” in our present monetary gadget is economically known as fiduciary media.

It’s a declare. It’s an IOU. It’s a token.

It’s cash in a “moneyness” sense, nevertheless it’s now not cash in a “base cash” sense.

“Once more, what?”

It way precisely what now we have been speaking about. Fiduciary media is solely now not elementary cash, and should you personal this kind of declare, you don’t personal any elementary cash! But whilst you grasp this declare, you don’t grasp “not anything.” This fiduciary media can and does flow into freely and is used for bills.

Bitcoin, In short

If I requested you presently, is bitcoin base cash, what would you are saying? It’s now not a trick query. Don’t assume an excessive amount of.

I’m hoping you responded sure. Bitcoin isn’t issued by means of 0.33 events. To procure it, to carry it, I don’t desire a 0.33 occasion in any respect. I may mine it. The local unit bitcoin, equaling any choice of UTXOs, haven’t any reliance on any fiduciary in any respect. This can be a base asset that you’ll achieve and grasp on your own, Requiring no permission, no middleman. What in regards to the large miners? Miners do supply a carrier in generating blocks, and their prices within the combination are dear lately, however this expensiveness shouldn’t be regarded as “required” by means of the gadget. If all miners left, issue would alter, and acquiring new bitcoin can be a much less “dear” proposition than it’s lately.

However crucially, as opposed to bitcoin, the whole lot else within the monetary global described above is fiduciary media. It’s wonderful to name it cash, however if you wish to know precisely what it’s in an financial sense, it’s merely referred to as fiduciary media. In the event you’re ready for your wage to be direct-deposited into your checking account, otherwise you’re ready on a take a look at to transparent out of your account on your payee’s (in point of fact, you continue to are?), then you definately’re ready on a monetary middleman to behave for your behalf. You’re the use of fiduciary media to settle money owed and make bills.

“So brass tacks: Are you pronouncing fiduciary media is unhealthy?”

Nope.

“Are you pronouncing it’s a fraud?”

Nope.

“Are you pronouncing it reasons unhealthy macro issues to occur economically?”

Nope.

“However nonetheless you’re pronouncing fiduciary media is a kind of cash?”

Yep.

“And most significantly, fiduciary media isn’t elementary cash?”

Sure.

In all my speeches on cash, I in finding the above issues are toughest to grok. I am getting it. To your day by day regimen all you in point of fact care about is how the cardboard, take a look at or banking app seems to be and behaves. You wish to have it to paintings. Wonderful. However the primary questions I’d such as you to invite your self after studying this are ones like, “Who issued your card?” “Who issued your account?” “Who processed that fee for your behalf?” “Who’s your fiduciary?” If you’ll take into accounts those tools in those phrases, then you definately’ve gained the fight, and extra about cash than maximum economists. It’s in point of fact now not extra difficult than this in relation to what fiduciary media is and base cash isn’t.

As to the “why” of fiduciary media, this will have to be self-evident. The aim of fiduciary media is that this: Establishments have issued those claims all through the centuries (and nonetheless achieve this lately) so as to facilitate bills, as historically they’re extra environment friendly in doing so than base cash.

“Hang on although, are you positive fiduciary media doesn’t purpose unhealthy issues to occur within the economic system?”

Sure I’m positive, however as at all times, the large asterisk is that this: So long as central banks aren’t concerned. We will be able to come again to this.

The primary takeaways for now are that fiduciary media isn’t elementary money, fiduciary media is just right for bills, and it’s additionally now not inherently unhealthy, nor fraudulent.

Base Cash

So should you’re the use of a take a look at or plastic or their virtual equivalents for your telephone, issued and controlled by means of a non-public financial institution, then you might be the use of fiduciary media. You aren’t the use of elementary cash. In the end that, I’ll attempt to stay this brief as to what base cash is.

In the event you merely intuited that base cash will be the reverse of fiduciary media, this assumption gets you lovely shut. What kinds of cash do we’ve got available on the market that aren’t controlled by means of a (monopolized) 0.33 occasion? What kinds of cash are belongings of final agreement, the place you don’t need to depend on any individual else to settle? What type of cash is provided by means of the marketplace, because of its call for to be held as a shop of price and medium of substitute?

Historical past has solely illustrated two long-lasting kinds of elementary cash. One is silver, and the opposite is gold. Those aren’t the one two. Sure shells (particularly cowrie shells and wampum) got here shut in sure instances and puts, however didn’t make it international, nor turn out long-lasting. Nick Szabo has written wonderfully in regards to the historical past of beads and shells as primitive cash, highlighting the primary position those collectibles performed for millennia.

Gold and silver are the private, maximum balanced, and maximum documented cases of base cash that completed international adoption. So far as coinage is going, silver has lengthy been traditionally documented as the primary mover from earlier period, and gold rose to prominence later, more or less from medieval instances.

However Why Base Cash?

My studying of historical past as to the “why” for elementary money is twofold. Each causes carried out all through the centuries and each nonetheless do lately. Alternatively, relying on the place you reside (most likely a Western nation should you’re nonetheless bothering to learn this English), those two causes may not be glaring.

The primary explanation why base cash is wanted is right through a “non-local” industry scenario. You, as one occasion to the deal, might by no means see your counterparty once more, and you wish to have the money earlier than shifting on. Take a Ecu spice dealer within the East Indies or a rum dealer within the West. When the deal is completed, he’s getting again on his boat to Europe, and at absolute best he doesn’t see those other folks once more till subsequent season, if ever. He must settle the deal earlier than he leaves port. Input gold and silver. An international medium of substitute that works out of the country, and works at house. Clearly, all of the deal doesn’t want to be accomplished 100% in gold; it may well be 80% in items, after which 20% settled in gold or silver at the margin. An early episode on our podcast with Dr. George Selgin covers this phenomenon neatly.

The second one elementary explanation why for elementary cash is the shop of price serve as. However now not simply shop of price within the generic sense; quite, in an overly particular and private one: the heirloom. Heirlooms permit for the transporting of your existence’s financial savings on your youngsters. Sure, as humanity develops, we’ve been in a position to switch on different items but even so cash to our heirs, corresponding to wonderful artwork, assets or perhaps a portfolio of shares; alternatively, the ones examples in most cases depend on a felony gadget, and (right here’s that phrase once more) a fiduciary. This explanation why for elementary money alludes again to the Szabo article on the whole lot from shells to heirlooms and collectibles with deep and likely price switch. Gold, jewellery and silverware nonetheless satisfy this position lately. Dowries and inheritances are large within the growing global, particularly India and China.

That’s the “why” for elementary money. Now, let’s start to take a troublesome have a look at what it if truth be told is.

Gold And Silver

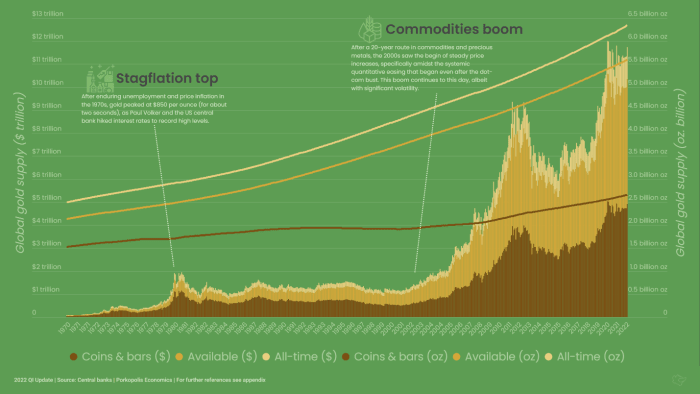

Even a kid is aware of that gold and silver have one thing to do with cash. Whether or not it’s from video video games or fairy stories, it’s ingrained in our DNA that those metals are valuable. I’m going to turn you their provide curves presently. Right here’s gold, over the past 50 years:

Sadly, this image isn’t part of our most elementary monetary schooling. It will have to be. You’ll be able to check my numbers from many trade and mining publications, although discovering the precise layout and figures will probably be tricky as once more, for some explanation why these things isn’t defined merely. Word there’s going to be a margin of error in what you notice modeled above, as opposed to truth (or different analysis). No person is aware of precisely how a lot gold has been produced, however those are my figures and I’m sticking to them.

Any other factor is that the trade in most cases quotes gold devices mined in metric tonnes, which is a terrible factor to do. They will have to at all times be displayed within the local devices that {the marketplace} quotes for value, which is “in line with troy ounce.” Why will have to we do it another means? As with many stuff in existence, don’t let CNBC or Bloomberg confuse you on what’s related. Within the chart above, the right-hand aspect measures mined gold in billions of troy oz., and the left-hand aspect presentations the volume of mined gold expressed within the present world unit of account: the U.S. buck.

All over all of humanity, we’ve pulled 6.Three billion oz. of gold out of the bottom. At present costs that’s more or less $11.Three trillion in price. Does it imply that if all of the global sells its gold presently, they might and may get $11.Three trillion (in the event that they desired)? Clearly now not, however we’ll get to that.

6.Three billion oz. is if truth be told 60% greater than 50 years in the past, that means that almost two-thirds of all gold all through historical past has been mined since 1970.

However now not all of that gold comes within the shape that we in most cases call to mind from fairy stories; particularly, in bullion shape, in cash and bars. 12% of that is deemed to be “misplaced or ate up” by means of trade, from the place it isn’t simply recovered. Of the gold that continues to be, about 50% of it’s in jewellery shape, and 50% of it within the type of cash and bars.

However, we will be able to call to mind all jewellery and bullion as gold this is liquid and world. Keeping apart once more the price that’s misplaced to trade, we get about 5.6 billion oz., or $10 trillion similar, at present costs.

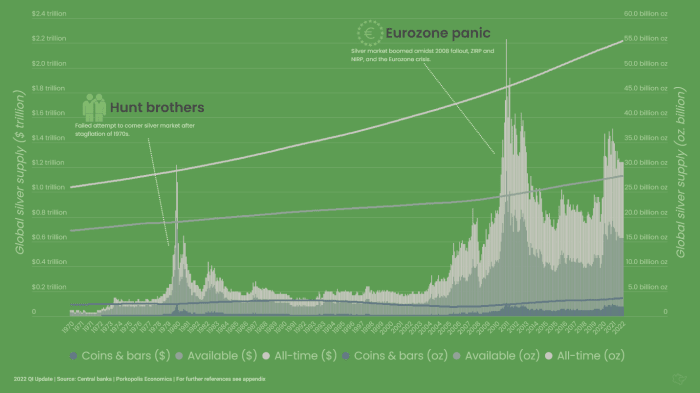

Here’s the very same form of graph, but now for silver. Some 55.Three billion oz. of silver were mined all through humanity. Very similar to gold, the bulk (53%) of all silver above flooring has been dug up since 1970:

Regardless that silver preceded gold prior to now as a most commonly financial (coinage) asset, lately it’s a distinct animal on a macro stage. A miles better chew of its mined provide has long past into trade and deemed now not simply recoverable. 27 billion oz. sturdy if truth be told, or $600 billion in similar price, is misplaced. This silver sits in technological gadgets, in conduits, in equipment, and in constructions. The call for drivers for silver lately are a lot more business, and far much less financial and decorative than gold.

Now of the non-industrial silver above flooring, it’s much more other from gold in that just a small fraction of it’s in bullion shape (cash and bars), solely about 3.6 billion oz., or $80 billion value. However although we referred to as that silver “financial” silver, we will have to nonetheless believe all of the different wealth-transferring, liquid silver above flooring. There’s about 24.6 billion oz. of that stuff, $550 billion value at lately’s costs. And a big portion of that comes with now not solely jewellery, however your grandmother’s fancy silverware.

Now with out getting a lot additional into the weeds right here, let’s ask ourselves some questions on this gold and silver stuff this is liquid, decorative and fiscal:

- Gold: 5.6 billion oz. ($10 trillion similar)

- Silver: 28.2 billion oz. ($610 billion similar)

If I grasp a few of this in my view, in my house, is it without a doubt “mine?” Sure. Would it not classify as an “asset” by myself non-public stability sheet? Sure. Can I shipping this wealth into the longer term by means of passing it right down to my heirs? Sure. Did any corporate “deem” those metals into life? No.

The solutions to the above questions, along the most obvious demand-tendencies for them all through human historical past, in addition to their exchange-medium serve as, can solely lead us to 1 financial conclusion. The chemicals of aurum and argentum are elementary money. They’re classifiable as elementary cash.

Final The Loop

The honor that issues is that of elementary money, as opposed to fiduciary media. Sooner than you get to the advantages of one, as opposed to the hazards of the opposite, now not solely does it lend a hand to grasp the mechanics, but additionally to grasp that we in point of fact can zoom out sufficiently and have a look at how each of this stuff interaction within the world monetary gadget.

Thus far, we’ve checked out what fiduciary media if truth be told is within the trendy monetary gadget, and why it issues. We’ve taken a just right gander at historic elementary cash, which is gold and silver. We’ve mentioned why that issues. We’ve in brief checked out why bitcoin additionally classifies as elementary money, with equivalent (albeit awesome) qualities to these of gold and silver.

In Phase 2 we’ll shut it out. We’ll seek advice from the ones goldsmiths and cash investors within the previous days of the gold and silver industry. We’ll see how fiduciary media advanced right here, and started to constitute the call for for gold and silver. This will likely carry us into trendy banking. Alongside the best way we’ll without a doubt want to scan the inevitable succeed in of the sovereign, of the state, round all this. Take into account, as the fantastic Ron Paul simply observed, “Cash is one-half of each transaction.” It’s unattainable that the state would now not ogle after which transfer in at the cash marketplace.

I’ll additionally put a little bit extra colour in this time period “moneyness.” Cash is a phrase that straddles “elementary money,” “foreign money,” and “fiduciary media,” regularly with no 2nd concept by means of its speaker, so we want to perform a little paintings there.

The upward thrust of the fashionable central financial institution will probably be unattainable to forget about as neatly. I at all times say I’m now not positive which is the husband, and which one is the spouse, however it’s simple that essentially the most successful marriage of all time is that between a geographical region’s treasury, and its central financial institution.

And that can carry us to the fashionable, fiat financial base. And not at all only a passing description of the lazy economist, I’ll display you precisely what it way, and precisely what it looks as if.

After which after all we’ll see how all roads result in Bitcoin. Why bitcoin is elementary money like that of yore, and why this time, it can be other.

This can be a visitor put up by means of Matthew Mezinskis. Reviews expressed are totally their very own and don’t essentially replicate the ones of BTC, Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)