BTC added 2.5% on information of a BlackRock spot ETF submitting. BNB faces necessary help. TWT is supported for chilly wallets. SUI was a gainer.

BTC

The value of Bitcoin was 2.5% greater after asset administration large BlackRock filed an utility for a Bitcoin ETF.

BlackRock’s iShares unit filed paperwork with the SEC on Thursday in search of the creation of an exchange-traded fund that might use spot market pricing and custody from Coinbase.

There was some hesitation from merchants because the SEC has rejected spot ETFs earlier than and is at present in a court docket battle with Grayscale over its try and create its personal spot ETF.

In early court docket hearings over the matter, the SEC had mentioned that the futures market is a greater possibility as a consequence of its regulated nature and skill to cease market manipulation.

If the BalckRock ETF did get authorised it may open the door to new buying and selling volumes and adoption for BTC. The corporate is the world’s largest asset supervisor and the prospectus states that the ETF can be absolutely backed by BTC.

The value of Bitcoin discovered help on the $25,200 degree not too long ago and is shifting inside a channel. A breakout above the $27,000 degree may see additional features forward.

BNB

The value of Binance Coin (BNB) ought to catch the attention of crypto traders with a key help degree in play.

A latest hunch on the again of authorized issues has seen the coin drop to $243.60 however the important thing help is $210. If the value of BNB went beneath that degree, which marked the lows of June 2022, it may have an effect on the profitability of the alternate. The spark for the demise of the FTX alternate was weak point in its FTT token, which had been used excessively as leverage within the platform.

The issues have been piling up for Binance in latest weeks, with the lawsuit towards the corporate from U.S. regulators. Final week noticed France beginning a cash laundering investigation towards the agency, whereas the corporate withdrew from enterprise operations within the Netherlands. Binance additionally withdrew an utility for registration in the UK.

The corporate’s U.S. enterprise, Binance.US noticed a court docket order to permit customers to withdraw funds however managed to keep away from a full asset freeze in alternate for restrictions.

“The SEC’s request would have successfully shuttered our enterprise, which is in keeping with the company’s continued makes an attempt to kill the crypto business by any means, even by making allegations that aren’t supported by the info,” Binance.US mentioned in a tweet.

The SEC requested funds be repatriated and segregated from enterprise operations to make sure U.S. traders may withdraw their funds from the alternate. The SEC filed a complete of 13 expenses towards Binance.US, Binance, and its CEO Changpeng Zhao on June 5.

Merchants ought to regulate the value of BNB over the approaching weeks because it may drag the sector decrease.

TWT

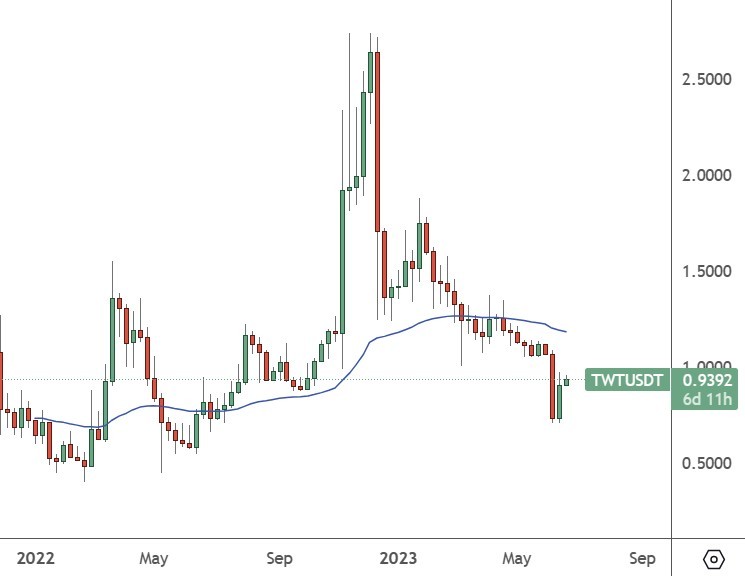

The value of Belief Pockets (TWT) was 28% greater this week as latest alternate points have seen customers transfer belongings to chilly wallets.

The identical dynamic boosted the value of TWT in early-2023 after the collapse of the FTX alternate in November. The latest lawsuits from the Securities and Alternate Fee (SEC) have rattled traders with some shifting belongings from scorching wallets to offline storage. The Belief Pockets platform boasts over 60 million customers. Merchants should buy and promote crypto within the pockets and in addition see their NFTs in a single place. There may be additionally an Earn perform, the place customers can stake cash for as much as 11% APY.

Bitcoin’s latest unfavourable value motion added to promoting stress on 97% of altcoins within the high 100. Knowledge from CoinGlass confirmed market liquidations of $162.7 million in complete liquidations for a 24-hour interval earlier than BTC mustered help at $25k. The value of Belief Pockets token will come into focus once more if the issues worsen for Binance.

The value of TWT has risen on the week to $0.9380 and traders may see a transfer above $1.00 this week with the potential for bigger features because the regulatory image develops.

SUI

The value of SUI was greater by 16% with the undertaking shifting to quantity 76 within the record of cash.

SUI is a Layer 1 blockchain that was launched in Might 2023 and presents scalability and low latency. The community is designed to be user-friendly for builders and supply a low-cost blockchain for decentralized functions.

The platform is written in Rust and helps good contracts by way of its Sui Transfer, nevertheless, it’s slower than many competitor blockchains with 137 transactions per second.

The SUI platform additionally consists of the MIST native token which can be utilized to pay gasoline charges, and community transactions, akin to minting NFTs or shopping for and promoting tokens. The SUI token is already listed on main exchanges akin to Coinbase, Binance, and Gemini.

SUI at present trades at $0.76 with a market capitalization of $462 million.

Disclaimer: data contained herein is supplied with out contemplating your private circumstances, due to this fact shouldn’t be construed as monetary recommendation, funding suggestion or a proposal of, or solicitation for, any transactions in cryptocurrencies.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)