Bitcoin positive factors as undergo marketplace force eases. COMP surges 75% on DeFi information. Bentley and whales lend a hand MATIC to 64% achieve. SAND needs to be Ny.

BTC

The cost of Bitcoin used to be 8% upper this week because the cryptocurrency marketplace tried to mount a restoration.

Contemporary promoting force has receded with a deal for BlockFi and hopes for an orderly repair to 3 Arrows Capital. It’s not all easy crusing for BlockFi as hedge fund Morgan Creek used to be looking to block the new bailout. Morgan Creek needs to boost $250 million for an fairness providing after FTX’s announcement that it will lengthen a $250 million credit score line to BlockFi.

The crypto lender has been suffering to stick afloat and BlockFi’s shareholders, which incorporates Morgan Creek, are having a look to give protection to their funding.

“I’ve been making calls all day,” Morgan Creek spouse Mark Yusko stated on a leaked transcript.

The leaked transcript additionally stated that BlockFi’s deal gave FTX an choice to shop for up BlockFi “at necessarily 0 value” and that may wipe out earlier buyers.

The 3 Arrows Capital hedge fund on the middle of the new issues used to be additionally set to be served a default realize if it does no longer pay up on loans. Voyager has publicity to 3 Arrows Capital of 15,250 bitcoin (just about $310 million) and $350 million USD Coin (USDC).

The cryptocurrency marketplace has stabilized for now and Ethereum outperformed BTC because of the compelled promoting that had passed off within the Ethereum by-product cash.

Bitcoin trades at $21,300 because the lengthy trail to restoration starts for the sector’s greatest cryptocurrency. The primary actual line within the sand is at $30,000 for a bigger restoration.

COMP

Compound Finance used to be the best-performing coin this week with a achieve of 75% for the DeFi venture.

Decentralized finance used to be one of the most hardest-hit sectors within the fresh downturn and we will be able to quickly see what urge for food stays for the crypto lenders.

Crypto lender Celsius Community gave compound a spice up after it repaid Compound $10 million value of the DAI stablecoin. The cost will soothe insolvency fears at Celsius after the new suspension of withdrawals, swaps, and transfers. Compound currently has $2.89bn of overall worth locked (TVL) at the chain and that’s a lot not up to remaining 12 months’s highs at $12bn.

Compound has rallied above the $50 stage and can try to recuperate however the cost has cratered from the highs remaining 12 months at $900 and that might not be simple to score. Institutional buyers have been getting enthusiastic about DeFi however upper rates of interest make bonds extra interesting and Would possibly noticed file call for for presidency bonds.

MATIC

Polygon’s MATIC noticed a robust rebound this week with positive factors of round 65%.

Polygon used to be helped by way of the inside track that Bentley Motors can be shedding a ‘one-off’ NFT at the Polygon chain. Bentley made some extent of the use of Polygon on account of its internet 0 commitments and that might display buyers that corporates are positioning for the use of carbon-neutral blockchains sooner or later.

In a Twitter put up, Bentley Motors said:

“These days, we announce our first project into the NFT market with a one-time NFT drop at the carbon-neutral Polygon community, scheduled for September 2022 and restricted to simply 208 items.”

Polygon lately attained carbon-neutral standing and has pledged to move carbon detrimental by way of the tip of 2022. In consequence, all Bentley NFTs shall be solely carbon-neutral.

“With a dedication to attaining end-to-end carbon neutrality by way of 2030, the similar 12 months when all Bentley cars shall be totally battery electrical, it used to be important that Bentley’s first project into Web3 used to be in a sustainable manner.”

This may well be the way forward for blockchain with energy-intensive blockchains drifting away.

There used to be an additional spice up for MATIC with information of accumulation from ETH ‘whale’ buyers. ETH whales have added over $36 million value of Polygon tokens within the area of 48 hours.

MATIC trades above $0.50 and can search for additional catalysts to succeed in the $3.00 stage once more.

SAND

The Sandbox additionally produced positive factors of over 50% as buyers place for additional metaverse positive factors.

Founding father of The Sandbox, Mathieu Nouzareth, stated in a contemporary interview that he needs the venture to be the Ny of the metaverse.

The Sandbox hasn’t in reality been impacted, and the rationale I feel is as a result of we’re a sport, and video games are much less impacted by way of a macroeconomic atmosphere. Other people come as it’s in reality a ton of amusing, any individual can revel in it.

He additionally shrugged off the new undergo marketplace, pronouncing:

“I’ve observed 5 of those [downturns]. However if you happen to stay your head down and concentrate on construction, in two, 3 years, we will be able to see some large, wonderful corporations that may emerge after this.”

The Sandbox’s CEO stated the userbase at the digital universe had no longer diminished. He believes that the suitable form of customers will input the marketplace since they aren’t enthusiastic about a get-rich-quick scheme.

Explaining his imaginative and prescient for The Sandbox, the CEO stated:

It isn’t like ‘Able Participant One,’ a dystopian nightmare. We need to be the Ny of the metaverse, a focus of thrilling manufacturers and artists — however our imaginative and prescient isn’t to switch fact.

In separate analysis at the metaverse, McKinsey & Co. said that they be expecting the metaverse to generate as much as $five trillion by way of the 12 months 2030.

The corporate’s ‘Worth Introduction within the Metaverse’ document stated that $120bn has already flowed into the digital international area.

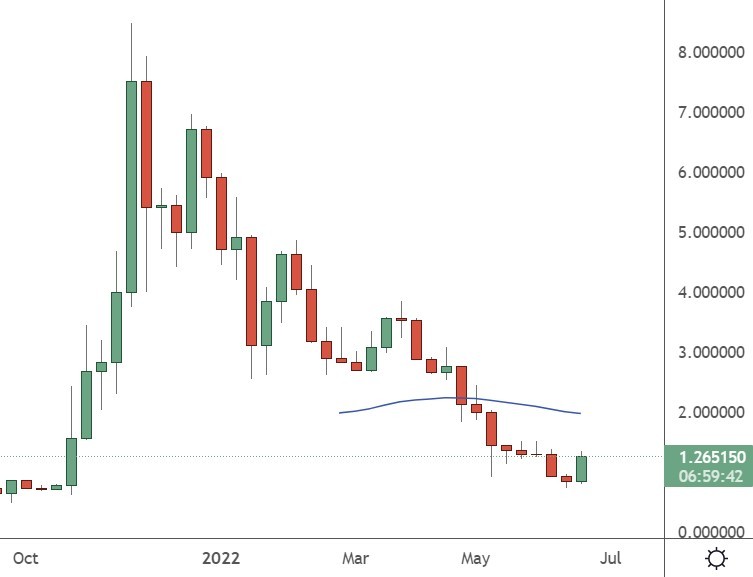

SAND recently trades round $1.25 after the new rebound and buyers may well be stepping into early for the run to $five trillion revenues if McKinsey is proper.

Disclaimer: knowledge contained herein is supplied with out bearing in mind your individual cases, subsequently must no longer be construed as monetary recommendation, funding advice or an be offering of, or solicitation for, any transactions in cryptocurrencies.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)