On-chain knowledge presentations indicators aren’t having a look excellent for Bitcoin because the NVT ratio is indicating that the crypto continues to be puffed up at the moment.

Bitcoin NVT Ratio Continues To Be At Top Values

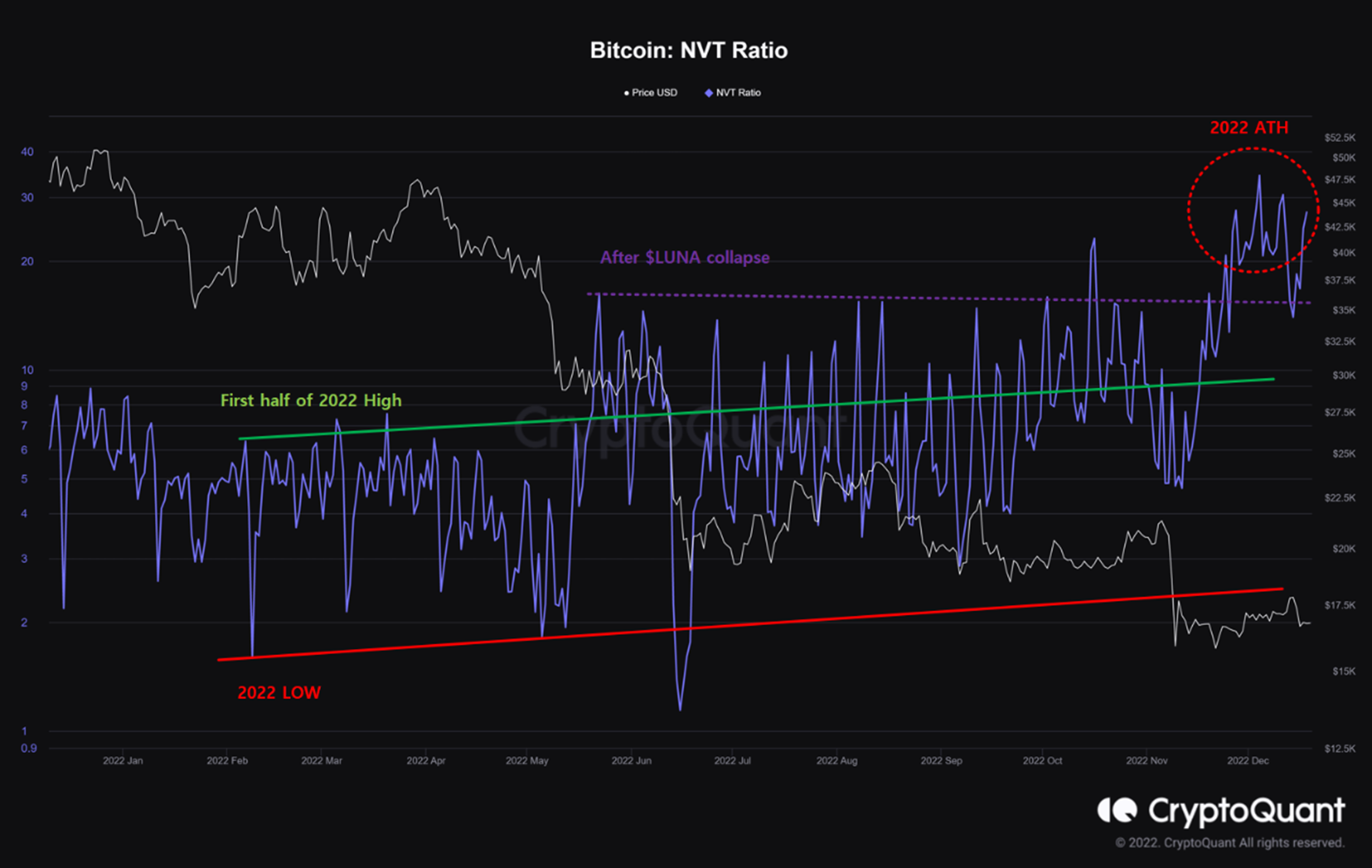

As identified by way of an analyst in a CryptoQuant post, BTC is lately puffed up from an on-chain viewpoint. The “Network Value to Transactions (NVT) ratio” is a trademark that measures the ratio between the marketplace cap of Bitcoin and its transaction quantity (each in USD).

This ratio judges whether or not the present worth of Bitcoin (this is, the marketplace cap) is honest or no longer, by way of evaluating it in opposition to the community’s talent to transact cash at the moment (the transaction quantity). When the metric has a prime worth, it method the cost of BTC is prime in comparison to the amount, and thus the coin may well be within a bubble at the present time. Then again, low values counsel BTC could also be undervalued because the chain has a prime talent to transact cash (compared to the marketplace cap) at the moment.

Here’s a chart that presentations the fad within the Bitcoin NVT ratio during the last 12 months:

Seems like the metric's worth has been beautiful prime all over fresh weeks | Supply: CryptoQuant

Because the above graph highlights, the Bitcoin NVT ratio jumped up following the LUNA collapse again in Would possibly of this 12 months and has since most commonly stayed at an identical or upper ranges. Which means regardless of the associated fee looking at a couple of crashes within the duration, the coin’s worth nonetheless become increasingly more puffed up as volumes around the marketplace sharply dropped.

Even after the FTX crash, which has delivered every other forged blow to the crypto’s marketplace cap, the metric has simplest climbed upper because it has registered a brand new prime for the 12 months lately. BTC has simplest been getting increasingly more overpriced because the endure has gotten deeper, suggesting the dire state of the marketplace when it comes to buying and selling volumes.

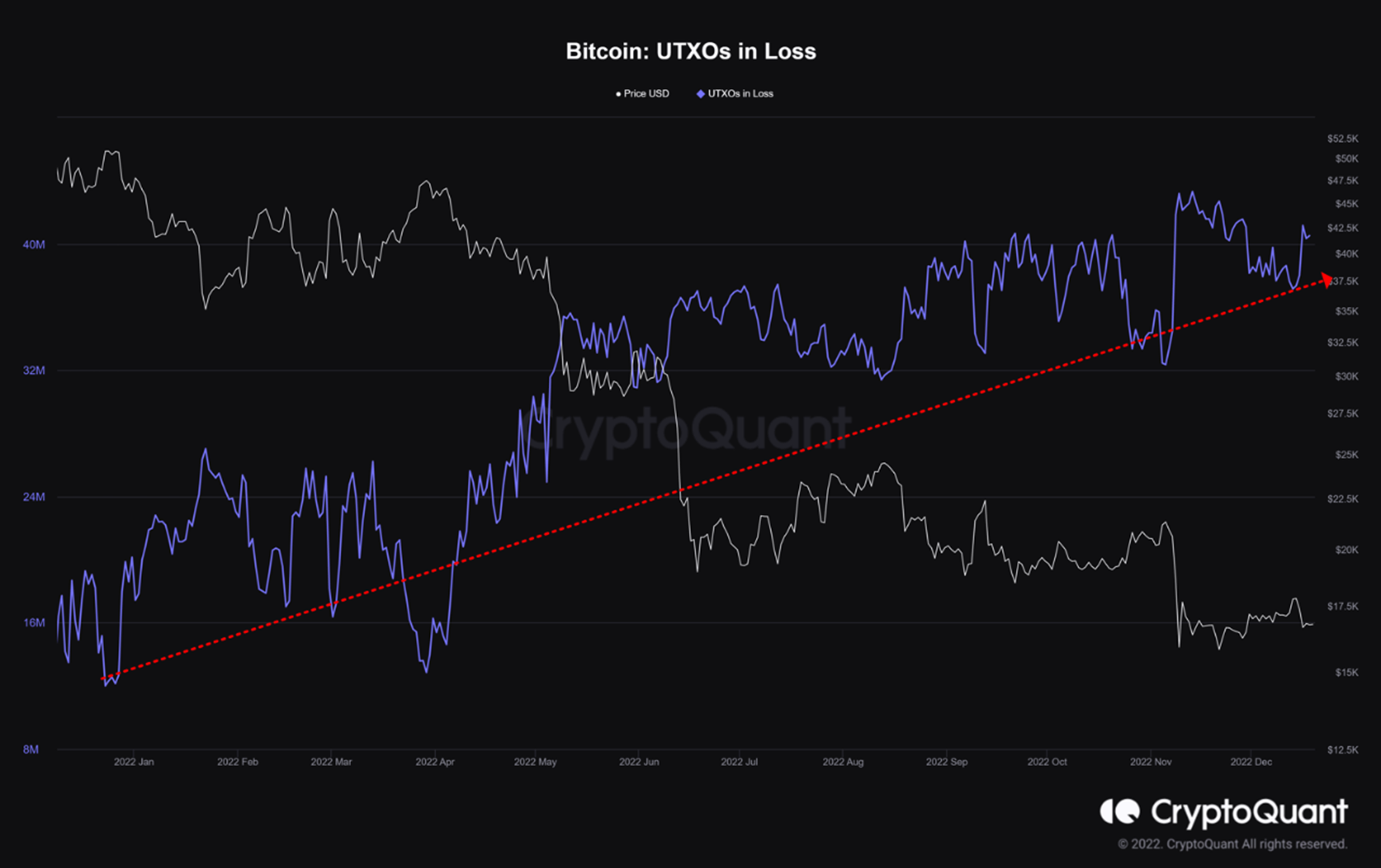

The quant additionally notes that the choice of UTXOs in loss (mainly the quantity of wallets/traders in loss), has been constantly emerging during the endure.

The metric continues to journey on a relentless uptrend | Supply: CryptoQuant

Each those indicators are under no circumstances within the desire of Bitcoin and might suggest there’s additional ache forward for traders. “A extra prolonged endure marketplace may well be noticed as a possible chance that might upload promoting power,” explains the analyst.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $16,800, down 5% within the final week.

The associated fee motion within the asset turns out to had been stale in the previous few days | Supply: BTCUSD on TradingView

Featured symbol from Maxim Hopman on Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)